FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

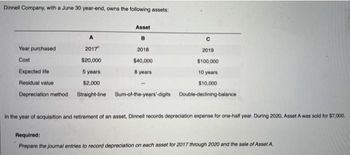

Transcribed Image Text:Dinnell Company, with a June 30 year-end, owns the following assets:

A

с

2017"

2019

$20,000

$100,000

5 years

10 years

$2,000

$10,000

Depreciation method Straight-line Sum-of-the-years-digits Double-declining-balance

Year purchased

Cost

Asset

B

Expected life

Residual value

2018

$40,000

8 years

In the year of acquisition and retirement of an asset, Dinnell records depreciation expense for one-half year. During 2020, Asset A was sold t

$7,000.

Required:

Prepare the journal entries to record depreciation on each asset for 2017 through 2020 and the sale of Asset A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- An asset is placed in service on May 15, 2020 and has a depreciable basis of $40,000. The asset is in the 7-year recovery class and the half-year convention applies. What is the maximum depreciation deduction that may be claimed for 2020, assuming no election to expense and no bonus depreciation? a. $5,144 b. $5,716 c. $25,000 d. $2,572 e. None of these choices are correct.arrow_forwardThe T-accounts for Equipment and the related Accumulated Depreciation—Equipment for Luo Company at the end of 2020 are shown here. Equipment Beg. bal. 80,600 Disposals 23,800 Acquisitions 40,000 End. bal. 96,800 Accumulated Depreciation—Equipment Disposals 8,700 Beg. bal. 47,800 Depr. exp. 13,300 End. bal. 52,400 In addition, Luo’s income statement reported a loss on the disposal of plant assets of $6,100. What amount was reported on the statement of cash flows as “cash flow from sale of equipment”? (Show amount that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) Cash flow from sale of equipment $arrow_forwardJaen Advertising Inc. reported the following on its December 31, 2020, balance sheet: Equipment, P500,000 Accumulated depreciation-equipment, P135,000 In a footnote, Jaen indicates that it uses straight-line depreciation over 10 years and estimates salvage value as 10% of cost. What is the average age of the equipment owned by Jaen? O 7.3 years ОТ years О 2.7 years З yearsarrow_forward

- Harris Co. takes a full year's depreciation expense in the year of an asset's acquisition and no depreciation expense in the year of disposition. Data relating to one of Harris's depreciable assets at December 31, 2021 are as follows: Acquisition year 2019 Cost $280,000 Residual value 40,000 Accumulated depreciation 192,000 Estimated useful life 5 years Using the same depreciation method as used in 2019, 2020, and 2021, how much depreciation expense should Harris record in 2022 for this asset? (You need to use the info given to determine which depreciation method is used and then calculate depreciation for 2022.)arrow_forwardABC Company acquired an equipment on January 1, 2020 forP5,000,000. Depreciation is computed using the straight-line method.The estimated useful life of the equipment is five years with no residualvalue. A specific price index applicable to the equipment was 150 onJanuary 1, 2020 and 225 on December 31, 2020. What is the unrealizedholding gain on the equipment to be reported in 2020? A. 1,250,000B. 1,500,000C. 2,000,000D. 2,500,000arrow_forwardQui Corporation takes a full year's depreciation expense in the year of an asset's acquisition, and no depreciation expense in the year of disposition. Data relating to one of Qui's depreciable assets at December 31, 2018 are as follows; Acquisition year- 2016; Estimated useful life- 5 years; Cost- P110,000; Residual value- P20,000; Accumulated depreciation - P72,000. Using the same depreciation method as used in 2016, 2017, and 2018, how much depreciation expense should Qui Corporation record in 2019 for this asset?arrow_forward

- Recording partial-year depreciation and sale of an asset On January 2, 2016, Pet Spa purchased fixtures for $37,800 cash, expecting the fixtures to remain in service for six years. Pet Spa has depreciated the fixtures on a straight-line basis, with $9,000 residual value. On May 31, 2018, Pet Spa sold the fixtures for $24,200 cash. Record both depreciation expense for 2018 and sale of the fixtures on May 31, 2018.arrow_forwardAsanco Corporation acquired and placed in service the following assets during the year: Asset Date Acquired Cost Basis Building 12/4 $350,000 Computer Equipment 3/2 $40,000 Furniture 4/15 $38,000 Assume that Asanco does not elect §179 expensing and elects not to use bonus depreciation. Answer the following questions. What is Asanco’s first year cost recovery for each asset? Use the format below. Asset Acquisition Date Quarter Recovery Period Original Basis Rate Depreciation Expense What is Asanco’s year 3 cost recovery for each asset if it sells all of these assets on January 10th of year 3? Use the format below. Asset Original Basis Recovery Period Rate Portion of Year Depreciation Expensearrow_forwardAn asset's book value is $36,000 on January 1, Year 6. The asset is being depreciated $500 per month using the straight-line method. Assuming the asset is sold on July 1, Year 7 for $25,000, the company should record: Multiple Choice O O O Neither a gain or loss is recognized on this type of transaction. A gain on sale of $2,000. A loss on sale of $1,000. A gain on sale of $1,000. A loss on sale of $2,000.arrow_forward

- an entity acquired furniture and fittings on 1 July 2021 for $42 000. The estimated useful life of the furniture and fittings at acquisition date was 8 years and the residual value was $2000. The company sold all the furniture and fittings on 1 January 2027 for $18 000. The journal entry to reflect the sale is:arrow_forwardSalem Company buys a building for $1,000,000 on 1st January 2019. Its estimated useful life in the business is 20 years, after which it will be sold for an estimated residual value of $200,000. Under the Straight-line method of depreciation, Accumulated depreciation at December 31, 2020 will be Multiple Choice O $40,000 $80,000 $200,000arrow_forwardA company sells a long-lived asset that originally cost $200,000 for $50,000 on December 31, 2018. The accumulated depreciation account had a balance of $110,000 after the current year's depreciation of $45,000 had been recorded. The company should recognize a: Multiple Choice $100,000 loss on disposal. $40,000 loss on disposal. $40,000 gain on disposal. $25,000 loss on disposal.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education