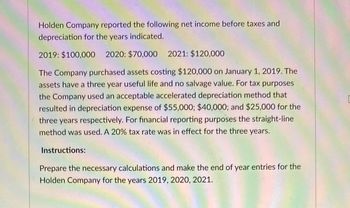

Holden Company reported the following net income before taxes and

2019: $100,000 2020: $70,000 2021: $120,000

The Company purchased assets costing $120,000 on January 1, 2019. The

assets have a three year useful life and no salvage value. For tax purposes

the Company used an acceptable accelerated depreciation method that

resulted in depreciation expense of $55,000; $40,000; and $25,000 for the

three years respectively. For financial reporting purposes the straight-line

method was used. A 20% tax rate was in effect for the three years.

Instructions:

Prepare the necessary calculations and make the end of year entries for the

Holden Company for the years 2019, 2020, 2021.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- Doug Smith Industries purchased warehouses for $165 million (no residual value) at the beginning of 2018. The warehouses were being depreciated over a 10-year life using the sum-of-the-years'-digits method. At the beginning of 2021, management decided to change to straight-line. Ignoring taxes, the 2021 adjusting entry will include a debit to depreciation expense of:arrow_forwardOn January 1, 2019, Nobel Corporation acquired machinery at a cost of $1,600,000. Nobel adopted the straight-line method of depreciation for this machine and had been recording depreciation over an estimated life of ten years, with no residual value. At the beginning of 2022, a decision was made to change to the double-declining balance method of depreciation for this machine.Assuming a 20% tax rate, the cumulative effect of this accounting change on beginning retained earnings, is a. $300,800. b. $0. c. $240,640. d. $179,200.arrow_forwardHarley Davis Inc. started its unicycle manufacturing business in 2019 and acquired $600,000 of equipment at the beginning of 2019. It decided to use the double-declining balance (DDB) depreciation on its equipment with no residual value and a 10-year useful life. In 2020 it changed to the straight-line depreciation method. Depreciation computed for 2019-2020 is presented below: Year DDB 2019 $120,000 2020 96,000 In 2021, what would Harley Davis report for depreciation expense? (Show me your work)arrow_forward

- In 2025, the controller of Green Company discovered that 2024 depreciation expense was overstated by $40,000, a material amount. Assuming an income tax rate of 25%, the prior period adjustment to 2025 beginning retained would be:arrow_forwardHadley Zavis Inc. started its unicycle manufacturing business in 2020 and acquired $600,000 of equipment at the beginning of 2020. It decided to use the double-declining balance (DDB) depreciation on its equipment with no residual value and a 10-year useful life. In 2022 it changed to the straight-line depreciation method. Depreciation computed for 2020-2021 is presented below: Year DDB 2020 $120,000 2021 96,000 In 2022, what would Harley Davis report for depreciation expense?arrow_forwardThe Canliss Milling Company purchased machinery on January 2, 2019, for $800,000. A five-year life was estimated and no residual value was anticipated. Canliss decided to use the straight-line depreciation method and recorded $160,000 in depreciation in 2019 and 2020. Early in 2021, the company changed its depreciation method to the sum-of-the-years’-digits (SYD) method. Required:2. Prepare any 2021 journal entry related to the change. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Record the adjusting entry for depreciation in 2021.arrow_forward

- Thor, Inc reported depreciation on the income statement by the straight-line method on an asset with a four-year useful life. MACRS is used for the tax return. Income statement: $5 million each year. Tax Return: 2020 $7 million; 2021 $6 million; 2022 $4 million; 2023 $3 million. The income tax rate is 20% for all years. The current year is 2022. Which of the following statements is true regarding the differences between accounting and tax depreciation? The 2022 beginning balance in the deferred tax liability is $.6M, the 2022 difference is originating, and the desired ending balance in the 2022 deferred tax liability is $.4M. The 2022 beginning balance in the deferred tax liability is $.6M, the 2022 difference is reversing, and the desired ending balance in the 2022 deferred tax liability is $.4M. The 2022 beginning balance in the deferred tax liability is $.4M, the 2022 difference is reversing, and the desired ending balance in the 2022 deferred tax liability is $.6M. The 2022…arrow_forwardThe Collins Corporation purchased office equipment at the beginning of 2022 and capitalized a cost of $2,092,000. This cost included the following expenditures: $ 1,900,000 Purchase price Freight charges Installation charges 36,000 26,000 Annual maintenance charge 130,000 Total $ 2,092,000 The company estimated an eight-year useful life for the equipment. No residual value is anticipated. The double-declining-balance method was used to determine depreciation expense for 2022 and 2023. In 2024, after the 2023 financial statements were issued, the company decided to switch to the straight-line depreciation method for this equipment. At that time, the company's controller discovered that the original cost of the equipment incorrectly included one year of annual maintenance charges for the equipment.arrow_forwardSINCO Ltd. purchased a piece of equipment in the year 2018 for the sum of $ 200,000. The company is subject to a tax depreciation rate of 25%. According to the following table, what is the depreciation allowance that this company can claim in 2020? (in the following picture : Année is year)arrow_forward

- On January 1, 2018, Ameen Company purchased major pieces of manufacturing equipment for a total of $36 million. Ameen uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting. At December 31, 2020, the book value of the equipment was $30 million and its tax basis was $20 million. At December 31, 2021, the book value of the equipment was $28 million and its tax basis was $12 million. There were no other temporary differences and no permanent differences. Pretax accounting income for 2021 was $50 million. Required: 1. Prepare the appropriate journal entry to record Ameen's 2021 income taxes. Assume an income tax rate of 25%. 2. What is Ameen's 2021 net income?arrow_forwardKk120.arrow_forwardOriole Company purchased equipment that cost $2595000 on January 1, 2020. The entire cost was recorded as an expense. The equipment had a 9-year life and a $103800 residual value. Oriole uses the straight-line method to account for depreciation expense. The error was discovered on December 10, 2022. Oriole is subject to a 30% tax rate. Oriole’s net income for the year ended December 31, 2020, was understated by $2595000. $2318200. $1816500. $1622740.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education