SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN: 9780357391266

Author: Nellen

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

General accounting

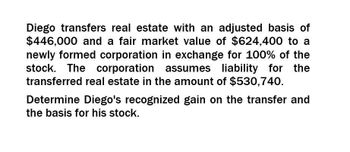

Transcribed Image Text:Diego transfers real estate with an adjusted basis of

$446,000 and a fair market value of $624,400 to a

newly formed corporation in exchange for 100% of the

stock. The corporation assumes liability for the

transferred real estate in the amount of $530,740.

Determine Diego's recognized gain on the transfer and

the basis for his stock.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please help solutionarrow_forwardNeed help with this questionarrow_forwardJohn transfers a property (A/B $10,000, FMV $50,000) to Brown Corp. in exchange for 100% of the Brown stock, which is worth $50,000. The property is subject to a liability of $20,000, which Brown assumes. The transfer is for business purpose. The $20,000 liability is also for business purpose. What is John’s recognized gain? What is John’s stock basis in the Brown corporation What is Brown’s basis in the property?arrow_forward

- Check my answer. Adam transfers property with an adjusted basis of $50,000 (fair market value of $400,000) to Swift Corporation for 90% of the stock. The property is subject to a liability of $60,000, which Swift assumes. What is the basis of the Swift stock to Adam? Section 357 provides when the acquiring corporation a liability is a section 351 transaction, the liability is not treated as a boot received for gain purposes, but is used in determining the basis of the stock received. The basis of the property transferred is $50,000, Liability assumed is $60,000. The basis of the stock received is $0.0 What is the basis of the property to Swift Corporation? The basis of the property received by the corporation is greater than the adjusted basis or the debt assumed. Swifts basis in the property is $60,000arrow_forwardIn 2021, Ruth transfers the following property for an 80% interest in RGB corporation (1,000 shares): Land with a FMV of $100,000 and an adjusted basis of $20,000. The land had a $40,000 mortgage which was assumed by the corporation. Does Ruth recognize gain, loss, or income from the transfer of the assets to RGB Corporation?arrow_forwardJocelyn contributes land with a basis of $56,000 and fair market value of $84,000 and inventory with a basis of $19,000 and fair market value of $28,500 in exchange for 100% of Zion Corporation stock. The land is subject to a $14,000 mortgage. Determine Jocelyn's recognized gain or loss and the basis in the Zion stock received. If an amount is zero, enter "0". The exchange l § 357(a). As a result, Jocelyn has income of $ tax-free under § 351 because the release of a liability and a basis $ treated as boot under in her stock.arrow_forward

- Jocelyn contributes land with a basis of $39,500 and fair market value of $59,250 and inventory with a basis of $19,600 and fair market value of $29,400 in exchange for 100% of Zion Corporation stock. The land is subject to a $9,875 mortgage. Determine Jocelyn's recognized gain or loss and the basis in the Zion stock received. If an amount is zero, enter "0". The exchange ________? tax-free under § 351 because the release of a liability________? treated as boot under§ 357(a). As a result, Jocelyn has income of $fill in the blank _____? and a basis $fill in the blank 4______? in her stock.arrow_forwardTristan transfers property with a tax basis of $1,160 and a falr market value of $1,720 to a corporation In exchange for stock with a falr market value of $1,160 and $390 In cash in a transaction that qualifies for deferral under section 351. The corporation assumed a liability of $170 on the property transferred. What Is the corporation's tax basis In the property recelved In the exchange? Multiple Cholce $1,720 $1,550 $1,330 $1,160arrow_forward2. Santiago transfers real estate with an adjusted basis of $400,000 and fair market value of $550,000 to the newly formed Star Corporation in exchange for 100% of its stock. The corporation assumes the liability on the transferred real estate in the amount of $425,000. What is Santiago's basis for his stock?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT