FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

1. The comparative

|

Year 2

|

Year 1

|

|

| Cash |

$ 72,000

|

$42,500

|

|

61,000

|

70,200

|

|

| Inventories |

121,000

|

105,000

|

| Investments |

-

|

100,000

|

| Equipment |

515,000

|

425,000

|

|

(153,000)

|

(175,000)

|

|

|

$616,000

|

$567,700

|

|

|

|

||

| Accounts Payable |

$ 59,750

|

$47,250

|

| Bonds Payable |

-

|

75,000

|

| Common Stock, $20 par |

375,000

|

325,000

|

| Premium on Common Stock |

50,000

|

25,000

|

|

131,250

|

95,450

|

|

|

$616,000

|

$567,700

|

Additional data for the current year are as follows:

| (a) |

Net income, $75,800.

|

|

| (b) | Depreciation reported on income statement, $38,000. | |

| (c) | Fully |

|

| (d) | Bonds payable for $75,000 were retired by payment at their face amount. | |

| (e) | 2,500 shares of common stock were issued at $30 for cash. | |

| (f) | Cash dividends declared and paid, $40,000. | |

| (g) | Investments of $100,000 were sold for $125,000. |

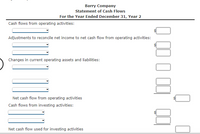

Prepare a statement of

Barry Company

Statement of Cash Flows

For the Year Ended December 31, Year 2

Transcribed Image Text:Barry Company

Statement of Cash Flows

For the Year Ended December 31, Year 2

Cash flows from operating activities:

Adjustments to reconcile net income to net cash flow from operating activities:

Changes in current operating assets and liabilities:

Net cash flow from operating activities

Cash flows from investing activities:

Net cash flow used for investing activities

Transcribed Image Text:Net cash flow from operating activities

Cash flows from investing activities:

Net cash flow used for investing activities

Cash flows from financing activities:

Net cash flow used for financing activities

Cash at the beginning of the year

Cash at the end of the year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Determine the net

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Determine the net

Solution

by Bartleby Expert

Knowledge Booster

Similar questions

- The following information is from Lacy's Inc. $ millions Prior Fiscal Year Current Fiscal Year Net Year-End Assets Revenue Income $21,330 14,403 $18,955 $1,070 a. Compute the asset turnover ratio for the current fiscal year. b. Compute the return on assets ratio for the current fiscal year. Numerator a. Asset Turnover Ratio $ Check b. Return on Assets Ratio $ Numerator Denominator / $ Denominator / $ || Result Resultarrow_forwardSelected data from the Carmen Company at year-end are as follows: Total assets Average total assets Net income Sales Average common stockholders' equity Net cash provided by operating activities Shares of common stock outstanding Long-term investments $2,000,000 $2,200,000 $250,000 $1,300,000 $1,000,000 $275,000 10,000 $400,000 Required: Compute the (a) asset turnover, (b) return on total assets, (c) return on common stockholders' equity, and (d) earnings per share on common stock. Assume the company had no preferred stock or interest expense. Round dol values to the nearest cent and other final answers to one decimal place. a. Asset turnover ratio b. Return on total assets c. Return on common stockholders' equity d. Earnings per share on common stock 1000 % % per share Karrow_forwardAssume a company had net income of $79,000 that included a gain on the sale of equipment of $4,000. It provided the following excerpts from its balance sheet: This Year Last Year Current assets: Accounts receivable $ 40,000 $ 46,000 Inventory $ 53,000 $ 50,000 Prepaid expenses $ 13,000 $ 11,000 Current liabilities: Accounts payable $ 38,000 $ 44,000 Accrued liabilities $ 18,000 $ 15,000 Income taxes payable $ 13,000 $ 10,000 If the credits to the company’s accumulated depreciation account were $21,000, then based solely on the information provided, the company’s net cash provided by (used in) operating activities would be: Multiple Choice $63,000. $55,000. $105,000. $97,000.arrow_forward

- Inc. reported the following data for last year: Inc. Balance Sheet Beginning Balance Ending Balance Assets Cash $ 126,000 $ 131,000 Accounts receivable 332,000 488,000 Inventory 576,000 476,000 Plant and equipment, net 896,000 875,000 Investment in Tesla Inc. 396,000 427,000 Land (undeveloped) 253,000 246,000 Total assets $ 2,579,000 $ 2,643,000 Liabilities and Stockholders' Equity Accounts payable Long-term debt $ 380,000 1,013,000 1,186,000 $ 340,000 1,013,000 1,290,000 Stockholders' equity Total liabilities and stockholders' equity $ 2,579,000 $ 2,643,000 Inc. Income Statement Sales $ 5,265,000 4,317,300 947,700 Operating expenses Net operating income Interest and taxes: Interest expense Tax expense Net income $ 123,000 210,000 333,000 $ 614,700 Inc. paid dividends of $510,700 last year. The "Investment in Tesla Inc." item on the balance sheet represents an investment in the stock of another company. The company's minimum required rate of return is 15%. What was the company's…arrow_forwardSubject-Acountingarrow_forwardThe comparative balance sheet of Merrick Equipment Co. for December 31, 20Y9 and 20Y8, is as follows: Dec. 31, 20Y9 Dec. 31, 20Y8 Assets Cash $246,670 $230,250 Accounts receivable (net) 89,360 82,700 Inventories 252,250 244,840 Investments 0 94,860 Land 129,390 0 Equipment 278,320 216,470 Accumulated depreciation—equipment (65,160) (58,370) Total assets $930,830 $810,750 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) $168,480 $159,720 Accrued expenses payable (operating expenses) 16,750 21,080 Dividends payable 9,310 7,300 Common stock, $10 par 50,260 39,730 Paid-in capital in excess of par—common stock 188,960 110,260 Retained earnings 497,070 472,660 Total liabilities and stockholders’ equity $930,830 $810,750 Additional data obtained from an examination of the accounts in the ledger for 20Y9 are as follows: Equipment and land were…arrow_forward

- Financial data for Joel de Paris, Inc., for last year follow: Joel de Paris, Inc.Balance Sheet BeginningBalance EndingBalance Assets Cash $ 129,000 $ 137,000 Accounts receivable 336,000 477,000 Inventory 580,000 488,000 Plant and equipment, net 875,000 858,000 Investment in Buisson, S.A. 406,000 431,000 Land (undeveloped) 252,000 251,000 Total assets $ 2,578,000 $ 2,642,000 Liabilities and Stockholders' Equity Accounts payable $ 387,000 $ 331,000 Long-term debt 1,039,000 1,039,000 Stockholders' equity 1,152,000 1,272,000 Total liabilities and stockholders' equity $ 2,578,000 $ 2,642,000 Joel de Paris, Inc.Income Statement Sales $ 4,850,000 Operating expenses 4,122,500 Net operating income 727,500 Interest and taxes: Interest expense $ 121,000 Tax expense 208,000 329,000 Net income…arrow_forwardSelected financial data for Wilmington Corporation is presented below. WILMINGTON CORPORATION Balance Sheet As of December 31 Year 7 Year 6 Current Assets Cash and cash equivalents $ 634,527 $ 335,597 Marketable securities 166,106 187,064 Accounts receivable (net) 284,226 318,010 Inventories 466,942 430,249 Prepaid expenses 60,906 28,060 Other current assets 83,053 85,029 Total Current Assets 1,695,760 1,384,009 Property, plant and equipment 1,384,217 625,421 Long-term investment 568,003 425,000 Total Assets $3,647,980 $2,434,430 Current Liabilities Short-term borrowings $ 306,376 $ 170,419 Current portion of long-term debt 155,000 168,000 Accounts payable 279,522 314,883 Accrued liabilities 301,024 183,681 Income taxes payable 107,509 196,802 Total Current Liabilities 1,149,431…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education