Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Determine the FW of the following engineering project when the MARR is 13% per year. Is the project acceptable?

Proposal A

Investment cost

$10,000

Expected life

Market (salvage) value

6 years

- 51,200

Annual receipts

S7,000

Annual expenses

$4.000

A negative market value means that there is a net cost to dispose of an asset.

Click the icon to view the interest and annuity table for discrete compounding when the MARR is 13% per year.

The FW of the following engineering project is S

(Round to the nearest dollar.)

According to the FW Decision Rule the project

v acceptable.

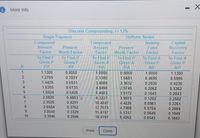

Transcribed Image Text:i More Info

Discrete Compounding; i=13%

Unifonm Series

Siriking,

Fund

Factor

To Find A

Given F

Single Payment

Compound

Amount

Capital

Recovery

Factor

To Find A

Given P

A/P

Compound

Amount

Factor

Present

Worth Factor

To Find P

Given F

PIF

Preserit

Worth Factor

To Find P

Given 4

PIA

Factor

To Find F

Given 4

FIA

To Find F

Given P

FIP

1.1300

0.8850

1.0000

0.8850

1.6681

2.3612

1.0000

1.1300

1.2769

0.7831

2.1300

0.4695

0.5995

1.4429

0.6931

3.4069

0.2935

0.4235

1.6305

0.6133

4.8498

6,4803

8.3227

2.9745

0.2062

0.3362

1.8424

0.5428

3.5172

3.9975

4.4226

0.1543

0.2843

2.0820

0.4803

0.1202

0.2502

2.3526

0.4251

10.4047

0.0961

0.2261

8

2.6584

0.3762

12.7573

47988

0.0784

0.2084

3.0040

0.3329

15.4157

5.1317

5.4262

0.0649

0.1949

10

3.3946

0.2946

18.4197

0.0543

0.1843

Print

Done

Z12 3456 709

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A small company wants to invest in Project A or B. The cash flows for both are shown below. Determine the payback period for each project assuming a MARR of 5% and suggest which project should be selected based on discounted payback period analysis.arrow_forwardConsider the three small mutually exclusive investment alternatives in the table below. The feasible alternative chosen must provide service for a 10-year period. The MARR is 12% per year, and the market value of each is 0 at the end of useful life. State all assumptions (repeatablity/co-terminated at 5 year study period) you make in your analysis. Which alternative should be chosen? A B Capital Investment PhP 2,000 PhP 8,000 PhP 20,000 Use IRR (FW equation) analysis. Annual revenues less expenses 600 2,200 3,600 Useful life (years) 5 5 10 ANSWER: IRRA = 15.24% ; IRRB = 11.65% ; IRRC = Blank 3% ; Choose alternative Blank 4 %3D %3D Do not use comma and any unit of measure. Use two decimal places in the Final answer.arrow_forwardAn investment project costs $12,600 and has annual cash flows of $3,100 for six years Required: (a) What is the discounted payback period if the discount rate is zero percent? (Click to select) (b) What is the discounted payback period if the discount rate is 3 percent? (Click to select) (c) What is the discounted payback period if the discount rate is 20 percent? (Click to select) eBook & Resources eBook: 9.3. The Discounted Paybackarrow_forward

- The cash flow of an energy management opportunity is estimated as follows: Initial cost:$12,000 Energy saving:$2,700/year for 12 years Maintenance cost:$1,200/year for 12 years Salvage value:$2,500@the end of 12 years If the interest rate is 10%, 1) What is the simple payback period (SPP) (in years)? (a)5.2 (b)4.2 (c)4.6 (d)8.02) With an annual discount rate is 10%, what is the discounted payback period (in years)? (a)9.5 b) 15.1 (c)8.1 (d) 16.9 (e) 6.53)With an annual discount rate is 10%, what is the benefit-cost ratio (BCR)? (Hint: Benefit = Annual saving-Maintenance; Cost= Initial investment - Salvage)(a) 1.04(b) 0.80(c) 1.25(d) 1.12(e) 1.43arrow_forwardPlease show complete steps all parts or skip itarrow_forwardFocarrow_forward

- Two mutually exclusive alternatives have the estimates shown below. Use annual worth analysis to determine which should be selected at an interest rate of 10% per year. Q $-44,000 R $-84,000 First Cost AOC per Year Salvage Value $-10,000 $-5,000 in year 1, increasing by $1,000 per year thereafter $4,000 $5,000 Life 2 years 4 years Alternative (Click to select) should be selected.arrow_forwardNet present value—unequal lives Project 1 requires an original investment of $375,000. The project will yield cash flows of $90,000 per year for 8 years. Project 2 has a computed net present value of $50,000 over a 6-year life. Project 1 could be sold at the end of 6 years for a price of $40,000. Use the Present Value of $1 at Compound Interest and the Present Value of an Annuity of $1 at Compound Interest tables shown below. Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 5 0.747 0.621 0.567 0.497 0.402 6 0.705 0.564 0.507 0.432 0.335 7 0.665 0.513 0.452 0.376 0.279 8 0.627 0.467 0.404 0.327 0.233 9 0.592 0.424 0.361 0.284 0.194 10 0.558 0.386 0.322 0.247 0.162 Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3…arrow_forwardCompute the discounted payback statistic for Project C if the appropriate cost of capital is 8 percent and the maximum allowable discounted payback period is three years. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Project C Time: 1 3 4 Cash flow: -$1,900 $840 $750 $790 $480 $280 Discounted payback period years Should the project be accepted or rejected?arrow_forward

- Net Present Value—Unequal Lives Project 1 requires an original investment of $63,800. The project will yield cash flows of $13,000 per year for five years. Project 2 has a calculated net present value of $15,600 over a three-year life. Project 1 could be sold at the end of three years for a price of $56,000. Use the Present Value of $1 at Compound Interest and the Present Value of an Annuity of $1 at Compound Interest tables shown below. Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 5 0.747 0.621 0.567 0.497 0.402 6 0.705 0.564 0.507 0.432 0.335 7 0.665 0.513 0.452 0.376 0.279 8 0.627 0.467 0.404 0.327 0.233 9 0.592 0.424 0.361 0.284 0.194 10 0.558 0.386 0.322 0.247 0.162 Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690…arrow_forwardCalculate Net Present Value of minitor that costs $ 35,000.00 Amortization period 5 years with savings of 8000 per year with a hurdle rate of 12%, 5%. Which investment is more attractive?arrow_forwardSolve c) What is the payback period (PB) for this project?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education