FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

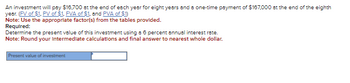

Transcribed Image Text:An investment will pay $16,700 at the end of each year for eight years and a one-time payment of $167,000 at the end of the eighth

year. (FV of $1, PV of $1. FVA of $1, and PVA of $1)

Note: Use the appropriate factor(s) from the tables provided.

Required:

Determine the present value of this investment using a 6 percent annual interest rate.

Note: Round your Intermediate calculations and final answer to nearest whole dollar.

Present value of investment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Your investment advisor has offered you an investment that will provide you with a single cash flow of $ 10,000 at the end of 20 years if you pay premiums of $ 200 per year in the interim period. Speciifcally, the annual premiums will begin immediately and extend through the end of year 19. You will then receive the $ 10,000 at the end of year 20. Find the IRR for this investment a. 8.00% b. 7.10% c. 8.10% d. 9.10%arrow_forwardPlease show working Please answer a , b and c a. An investment will pay $50 at the end of each of the next 3 years, $200 at the end of Year 4, $350 at the end of Year 5, and $500 at the end of Year 6. If other investments of equal risk earn 9% annually, what is its present value? Its future value? Do not round intermediate calculations. Round your answers to the nearest cent. Present value: $ __________ Future value: $ ___________ b. Your parents will retire in 20 years. They currently have $340,000 saved, and they think they will need $1,250,000 at retirement. What annual interest rate must they earn to reach their goal, assuming they don't save any additional funds? Round your answer to two decimal places. ___________ % c. If you deposit $2,000 in a bank account that pays 8% interest annually, how much will be in your account after 5 years? Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forwardYou are quoted an interest rate of 6% on an investment of $10 million. What is the value of your investment after four years if interest is compounded as follows? Note: Enter your answers in dollars, not millions of dollars. Do not round intermediate calculations. Round your answers to the nearest whole dollar amount. a. Annually b. Monthly c. Continuously a. Future value b. Future value c. Future valuearrow_forward

- You are evaluating a growing perpetuity investment from a large financial services firm. The investment promises an initial payment of $20,100 at the end of this year and subsequent payments that will grow at a rate of 3.4 percent annually. If you use a 9 percent discount rate for investments like this, what is the present value of this growing perpetuity? (Round answer to 2 decimal places, e.g. 15.25.)arrow_forwardFind the present value of an investment that will pay $9,000 at the end of Years 10, 11, and 12. Use a discount rate of 10 percent.arrow_forwardWhich of the given interest rates and compounding periods would provide the best investment? (a) 8 percent per year, compounded semiannually; (b) 8 percent per year, compounded quarterly; (c) 8 percent per year, compounded continuously. Your answer is (input a, b, or c)arrow_forward

- If you invest $9,400 per period for the following number of periods, how much would you have received at the end? ( Use a Financial calculator to arrive at the answers. Round the final answers to the nearest whole dollar.) a. 12 years at 6 percent. Future value $ b. 18 years at 8 percent. Future value $ c. 25 periods at 16 percent. Future value $arrow_forwardProvided are links to the present and future value tables: (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your answer to the nearest whole dollar.) a. How much would you have to deposit today if you wanted to have $55,000 in three years? Annual interest rate is 10%. b. Assume that you are saving up for a trip around the world when you graduate in three years. If you can earn 6% on your investments, how much would you have to deposit today to have $15,000 when you graduate? (Round your answer to 2 decimal places.) c-1. Calculate the future value of an investment of $666 for ten years earning an interest of 9%. (Round your answer to 2 decimal places.) c-2. Would you rather have $666 now or $1,800 ten years from now? d. Assume that a college parking sticker today costs $80. If the cost of parking is increasing at the rate of 6% per year, how much will the college parking sticker cost in seven years? (Round your answer to 2 decimal…arrow_forwardYou are evaluating a growing perpetuity investment from a large financial services firm. The investment promises an initial payment of $15,000 at the end of this year and subsequent payments that will grow at a rate of 2.0 percent annually. If you use a 9 percent discount rate for investments like this, what is the present value of this growing perpetuity? (Round answer to 2 decimal places, e.g. 15.25.) Present value $arrow_forward

- An investment offers $3,850 per year for 15 years, with the first payment occurring one year from now. a. If the required return is 6 percent, what is the value of the investment? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What would the value be if the payments occurred for 40 years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What would the value be if the payments occurred for 75 years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) d. What would the value be if the payments occurred forever? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Present value of 15 annual payments b. Present value of 40 annual payments c. Present value of 75 annual payments d. Present value of annual payments foreverarrow_forwardAn investor is considering two investment projects. Project A requires an initial payment of £11,000. In return, the investor will receive a payment of £15,200 after one year. Project B requires an initial payment of £10,000. In return, the investor will receive a payment of £1,120 at the end of every month for one year. Calculate the cross-over rate of the projects Enter a percentage correct to 1 decimal place. What is the payback period of each project? Project A: months Project B: monthsarrow_forwardCalculate the future value of an investment of $1, 000 at an interest rate of 5% after 5 years. ( USE EXCEL PLEASE)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education