Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:A flood control project with a life of 14 years will require an investment of $57,000 and annual maintenance costs of $4,000. The project will provide no benefits for the first three years but will save $22,000 per year in flood damage starting in the fourth year. The appropriate MARR is 11% per year. What is the modifie

B-C ratio for the flood control project?

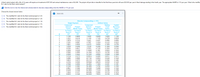

Click the icon to view the interest and annuity table for discrete compounding when the MARR is 11% per year.

Choose the closest answer below.

i More Info

O A. The modified B-C ratio for the flood control project is 3.43.

O B. The modified B-C ratio for the flood control project is 1.26.

O C. The modified B-C ratio for the flood control project is 1.18.

Discrete Compounding; i= 11%

Uniform Series

Single Payment

Compound

Amount

O D. The modified B-C ratio for the flood control project is 1.75.

Compound

Amount

Sinking

Fund

Factor

To Find A

Сaptal

Recovery

Factor

O E. The modified B-C ratio for the flood control project is 1.64.

Present

Worth Factor

Present

Factor

Factor

Worth Factor

To Find P

To Find F

Given A

FIA

To Find F

To Find P

To Find A

Given A

Given F

AIF

Given P

Given F

Given P

FIP

PIF

PIA

AIP

1

1.1100

0.9009

1.0000

0.9009

1.0000

1.1100

2

1.2321

0.8116

2.1100

1.7125

0.4739

0.5839

3

1.3676

0.7312

3.3421

2.4437

0.2992

0.4092

4.7097

6.2278

4

1.5181

0.6587

3.1024

0.2123

0.3223

1.6851

0.5935

3.6959

0.1606

0.2706

6

1.8704

0.5346

7.9129

4.2305

0.1264

0.2364

0.4817

0.4339

7

2.0762

9.7833

4.7122

0.1022

0.2122

8

2.3045

11.8594

5.1461

0.0843

0.1943

9

2.5580

0.3909

14.1640

5.5370

0.0706

0.1806

10

2.8394

0.3522

16.7220

5.8892

0.0598

0.1698

3.1518

3.4985

0.0511

0.0440

0.0382

0.0332

11

0.3173

19.5614

6.2065

0.1611

12

0.2858

22.7132

6.4924

0.1540

13

3.8833

0.2575

26.2116

6.7499

0.1482

14

4.3104

0.2320

30.0949

6.9819

0.1432

15

4.7846

0.2090

34.4054

7.1909

0.0291

0.1391

16

5.3109

0.1883

39.1899

7.3792

0.0255

0.1355

0.0225

0.0198

0.0176

0.1325

0.1298

17

5.8951

6.5436

0.1696

44.5008

7.5488

18

0.1528

50.3959

7.7016

56.9395

64.2028

19

7.2633

0.1377

7.8393

0.1276

20

8.0623

0.1240

7.9633

0.0156

0.1256

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- An investment project costs $21,500 and has annual cash flows of $6,500 for 6 years. If the discount rate is 15 percent, what is the discounted payback period? Select one: a. 5.71 b. 3.91 c. 4.21 d. 4.91 e. 5.91arrow_forwardAn investment project costs $14,100 and has annual cash flows of $3,200 for six years. a. What is the discounted payback period if the discount rate is zero percent? Discounted payback period b. What is the discounted payback period if the discount rate is 3 percent? Discounted payback periódarrow_forwardA project has estimated annual net cash flows of $11,250 for four years and is estimated to cost $37,500. Assume a minimum acceptable rate of return of 12%. Use Present Value of an Annuity of $1 at Compound Interest table below.arrow_forward

- For the following project, compute an EAA: Project A requires you an upfront payment of $212872 and yearly payments of $51728 for 12 years. Your cost of capital is 4.59%arrow_forwardA project has estimated annual net cash flows of $147,000 for 4 years and is estimated to cost $475,500. Assume a minimum acceptable rate of return of 10%. Use the Present Value of an Annuity of $1 at Compound Interest table below. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 Determine (1) the net present value of the project and (2) the present value index. If required, use the minus sign to indicate a negative net present value. Net present value of the project (round to the nearest dollar) $fill in the blank 1 Present value index (rounded to two decimal places) fill in the blank 2 Feedback…arrow_forwardAn investment project costs $12,600 and has annual cash flows of $3,100 for six years Required: (a) What is the discounted payback period if the discount rate is zero percent? (Click to select) (b) What is the discounted payback period if the discount rate is 3 percent? (Click to select) (c) What is the discounted payback period if the discount rate is 20 percent? (Click to select) eBook & Resources eBook: 9.3. The Discounted Paybackarrow_forward

- Consider a project with an initial investment of $300,000, which must befinanced at an interest rate of l2% per year. Assuming that the required repayment period is six years, determine the repayment schedule by identifying the principal as well as the interest payments for each of the following repayment methods:(a) Equal repayment of the principal: $50,000 principal payment each year(b) Equal repayment of the interest: $36,000 interest payment each year(c) Equal annual installments: $72,968 each yeararrow_forwardPlease show complete steps all parts or skip itarrow_forward(Discounted payback period) Gio's Restaurants is considering a project with the following expected cash flows: Year 0 1 2 60 3 100 4 105 (Click on the icon in order to copy its contents into a spreadsheet.) Project Cash Flow (millions) $(180) 100 If the project's appropriate discount rate is 8 percent, what is the project's discounted Davback period? The project's discounted payback period is years. (Round to two decimal places.)arrow_forward

- The conventional B/C ratio for a flood control project along the Mississippi River was calculated to be 1.3. The benefits were $500,000 per year and the maintenance costs were $200,000 per year. What was the initial cost of the project if a discount rate of 7% per year was used and the project was assumed to have a 50-year life?arrow_forwardProject A costs $5,300 and will generate annual after-tax net cash inflows of $1,900 for five years. What is the NPV using 5% as the discount rate? Round your present value factor to three decimal places and final answer to the nearest dollar. (Click here to see present value and future value tables) 2,928 xarrow_forwardPlease help me with show all calculation thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education