Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

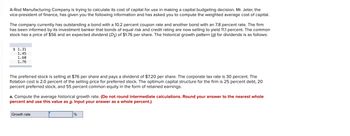

Transcribed Image Text:A-Rod Manufacturing Company is trying to calculate its cost of capital for use in making a capital budgeting decision. Mr. Jeter, the

vice-president of finance, has given you the following information and has asked you to compute the weighted average cost of capital.

The company currently has outstanding a bond with a 10.2 percent coupon rate and another bond with an 7.8 percent rate. The firm

has been informed by its investment banker that bonds of equal risk and credit rating are now selling to yield 11.1 percent. The common

stock has a price of $56 and an expected dividend (D₁) of $1.76 per share. The historical growth pattern (g) for dividends is as follows:

$ 1.31

T

1.45

1.60

1.76

The preferred stock is selling at $76 per share and pays a dividend of $7.20 per share. The corporate tax rate is 30 percent. The

flotation cost is 2.0 percent of the selling price for preferred stock. The optimum capital structure for the firm is 25 percent debt, 20

percent preferred stock, and 55 percent common equity in the form of retained earnings.

a. Compute the average historical growth rate. (Do not round intermediate calculations. Round your answer to the nearest whole

percent and use this value as g. Input your answer as a whole percent.)

Growth rate

%

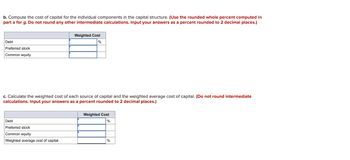

Transcribed Image Text:b. Compute the cost of capital for the individual components in the capital structure. (Use the rounded whole percent computed in

part a for g. Do not round any other intermediate calculations. Input your answers as a percent rounded to 2 decimal places.)

Debt

Preferred stock

Common equity

Weighted Cost

%

c. Calculate the weighted cost of each source of capital and the weighted average cost of capital. (Do not round intermediate

calculations. Input your answers as a percent rounded to 2 decimal places.)

Debt

Preferred stock

Common equity

Weighted average cost of capital

Weighted Cost

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The Knowles/Armitage (KA) group at Merrill Lynch advises clients on how to create a diversified investment portfolio. One of the investment alternatives they make available to clients is the All World Fund composed of global stocks with good dividend yields. One of their clients is interested in a portfolio consisting of Investment in the All World Fund and a treasury bond fund. The expected percent return of an investment in the All World Fund is 9.80% with a standard deviation of 15.00%. The expected percent return of an investment in a treasury bond fund is 5.70% and the standard deviation is 4.00%. The covariance of an investment in the All World Fund with an investment in a treasury bond fund is -12. a. Which of the funds would be considered the more risky? Select your answer: Why? It has a - Select your answer- b. If KA recommends that the client invest 75% in the All World Fund and 25% in the treasury bond fund, what is the expected percent return and standard deviation for such…arrow_forwardA firm is evaluating a project which requires Rs.10 million in investments. The Firm's financial manager is proposing two options to finance the project. First, all equity financing; second, Rs. 5 million through 15% debentures are issued at par, and Rs. 5 million of ordinary equity. The managers expect three possible EBITS for this project, i.e., 1.5, 2, and 2.8 million. You have to determine when the manager would use the first and second financing optionsarrow_forwardYou are an analyst for a large public pension fund and you have been assigned the task of evaluating two different external portfolio managers (Yellen and Zagami) who (actively) manage two funds which are considering. Your associates have assembled the following historical average return, standard deviation, and CAPM beta estimates for these two fund managers over the past five years. In addition, you have estimated that the risk premium for the market portfolio is 5.12% and the risk-free rate is currently 4.14%. What is Ms. Yellen's average "alpha" for the period. Report your answer in percentage format rounded to three decimal places. (For example.1234 should be entered as "12.3"). Fund Manager Actual Avg. Return Standard Deviation Ms. Yellen 11% Mr. Zagami 8.24% Answer: 11.07 8.75% Beta 1.18 0.9arrow_forward

- You became a fund manager in UAlbany Bank. After research, you pulled up two potential assets to invest. The assets' anticipated gains per share next year are: Asset 1, 324 Asset 2,324 Asset 1, 14 Probability Which asset is riskier and what is its variance per share? Asset 2, 14 0.40 0.40 0.20 Asset 1 -$10 $20 $35 Asset 2 $10 $15 $5arrow_forwardThe treasurer of a large corporation wants to invest $23 million in excess short-term cash in a particular money market investment. The prospectus quotes the instrument at a true yield of 3.42 percent; that is, the EAR for this investment is 3.42 percent. However, the treasurer wants to know the money market yield on this instrument to make it comparable to the T-bills and CDs she has already bought. If the term of the instrument is 122 days, what are the bond equivalent and discount yields on this investment? Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 3 decimal places. Bond equivalent yield Discount yield % %arrow_forwardFrank Meyers, CFA, is a fixed-income portfolio manager for a large pension fund. A member of the Investment Committee, Fred Spice, is very interested in learning about the management of fixed-income portfolios. Spice has approached Meyers with several questions.Meyers decides to illustrate fixed-income trading strategies to Spice using a fixed-rate bond and note. Both bonds have semiannual coupon periods. Unless otherwise stated, all interest rate changes are parallel. The characteristics of these securities are shown in the following table. He also considers a 9-year floating-rate bond (floater) that pays a floating rate semiannually and is currently yielding 5%. Characteristics of Fixed-Rate Bond and Fixed-Rate Note Fixed-Rate Bond Fixed-Rate Note Price 107.18 100.00 Yield to maturity 5.00% 5.00% Time to maturity (years) 18 8 Modified duration (years) 6.9848 3.5851 Spice asks Meyers to quantify price changes from changes in interest rates. To illustrate, Meyers…arrow_forward

- As a junior investment manager, your boss instructs you to help a client to invest $100,000for the next year. Particularly, you are asked to form an investment portfolio for the clientby investing in risk-free assets like 90-day bank bill and two stocks: A and B. Stock A hasa beta value of 0.8, an expected return of 7% and a standard deviation of 10%; and stockB has a beta value of 1.2, an expected return of 12% and a standard deviation of 15%.The correlation coefficient between the returns for the two stocks is 0. The risk-free rate is2%.(a) What is the expected return of the risky portfolio with the two stocks that has theleast amount of risk?(b) Suppose that the optimal risky portfolio with the two stocks has a weight of 53% inA and 47% in B, and has the expected return of 9.4% and standard deviation of8.8%. If this client is willing to take a risk measured by standard deviation of 5% forhis overall investment portfolio, how much would you recommend to the client toinvest in the…arrow_forwardFormulate but do not solve the problem. A private investment club has $450,000 earmarked for investment in stocks. To arrive at an acceptable overall level of risk, the stocks that management is considering have been classified into three categories: high-risk, medium-risk, and low-risk. Management estimates that high-risk stocks will have a return rate of 15%; medium-risk stocks, 11%; and low-risk stocks, 5%. The members have decided that the investment in low-risk stocks should be equal to the sum of the investments in the stocks of the other two categories. Determine how much the club should invest in each type of stock if the investment goal is to have a return of $45,000 on the total investment. (Assume that all the money available for investment is invested. Let x, y, and z denote the amount, in dollars, invested in high-, medium-, and low-risk stocks, respectively.) =450,000 =z =45,000arrow_forwardFormulate but do not solve the problem.The management of a private investment club has a fund of $200,000 earmarked for investment in stocks. To arrive at an acceptable overall level of risk, the stocks that management is considering have been classified into three categories: high-risk, medium-risk, and low-risk. Management estimates that high-risk stocks will have a rate of return of 16%/year; medium-risk stocks, 10%/year; and low-risk stocks, 6%/year. The investment in low-risk stocks is to be twice the sum of the investments in stocks of the other two categories. If the investment goal is to have an average rate of return of 9%/year on the total investment, determine how much the club should invest in each type of stock. (Assume that all the money available for investment is invested. Let x, y, and z denote the amount, in dollars, invested in high-, medium-, and low-risk stocks, respectively.) = 200,000 = z = .09(200,000)arrow_forward

- A firm's financial managers are evaluating two potential investments with a cost of $10,000 each. They forecast returns of $3,000 per year for 5 years for Investment A and $4,000 per year for 5 years for Investment B. The returns are more uncertain for B than for A. Which of the following is true? Investment A is better than B according to shareholder wealth maximization criterion. Investment B is better than A according to shareholder wealth maximization criterion. Investment A is better than B according to the profit maximization criterion. Investment B is better than A according to the profit maximization criterion.arrow_forwardAn investor has $80,000 to invest in Certificates of Deposit (CD) and a mutual fund. The CD yields 7% and the mutual fund yields 8%. The mutual fund requires a minimum investment of $8,000 and the investor requires at least twice as much should be invested in CDs as in the mutual fund. How much should be invested in each to maximize the return? What is the maximum return? Show your work and explanations setting this problem up. Variables should clearly be defined. Show all your work.arrow_forwardAs the chief investment officer for a money management firm specializing in taxable individual investors, you are trying to establish a strategic asset allocation for two different clients. You have established that Ms. A has a risk-tolerance factor of 8, while Mr. B has a risk-tolerance factor of 27. The characteristics for four model portfolios follow: ASSET MIX Portfolio Stock Bond ER σ2 1 6 % 94 % 9 % 6 % 2 25 75 10 10 3 67 33 11 14 4 88 12 12 24 Calculate the expected utility of each prospective portfolio for each of the two clients. Do not round intermediate calculations. Round your answers to two decimal places. Portfolio Ms. A Mr. B 1 2 3 4 Which portfolio represents the optimal strategic allocation for Ms. A? Which portfolio is optimal for Mr. B? Portfolio represents the optimal strategic allocation for Ms. A. Portfolio is the optimal allocation for Mr. B. For Ms. A, what level of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education