FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

N3.

Account

please answer asap

drop down options are: meets or does not meet

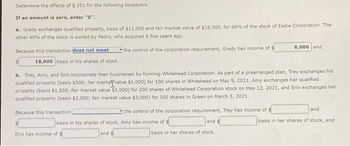

Transcribed Image Text:Determine the effects of § 351 for the following taxpayers.

If an amount is zero, enter "0".

a. Grady exchanges qualified property, basis of $12,000 and fair market value of $18,000, for 60% of the stock of Eadie Corporation. The

other 40% of the stock is owned by Pedro, who acquired it five years ago.

the control of the corporation requirement, Grady has income of $

Because this transaction does not meet

18,000 basis in his shares of stock.

b. Trey, Amy, and Erin incorporate their businesses by forming Whitehead Corporation. As part of a prearranged plan, Trey exchanges his

qualified property (basis $500; fair market value $1,000) for 100 shares in Whitehead on May 9, 2021. Amy exchanges her qualified

property (basis $1,800; fair market value $2,000) for 200 shares of Whitehead Corporation stock on May 12, 2021, and Erin exchanges her

qualified property (basis $2,000; fair market value $3,000) for 300 shares in Green on March 5, 2021.

the control of the corporation requirement, Trey has income of $

and $

basis in her shares of stock.

Because this transaction

basis in his shares of stock, Amy has income of $

and

6,000 and

Erin has income of $

and

basis in her shares of stock, and

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the following to answer questions 16 - 19 For each transaction indicate whether it should: A. increase, B. decrease, or C. no effect. Credit sales transaction cycle Asskiabilitstockholders’ equRtøvenespenses 16. Provide services on account 17. Estimate uncollectible accounts 18. Write off accounts as uncollectible 19. Collect on account previously written offarrow_forwardDo not give answer in imagearrow_forwardTo calculate the withdrawal amount from an account in which you want to decrease the balance, you use the __________________ formulaarrow_forward

- Blossom Company purchases various types of beach toys for sale to consumers. Listed below are the transactions for the month of June. Blossom uses a perpetual inventory system. June 1 Purchased 25 water tubes for $260 each terms n/30 FOB destination. 8 Returned 4 tubes purchased on June 1 due to defects. Received a full refund for the defective tubes. 10 Freight charges of $100 for the June 1 transaction are paid by the responsible party. 11 Made a complaint about competitive pricing. Received a $400 credit for the water tubes purchased on June 1. 15 Purchased 110 water tubes for $235 each on account, terms 2/10 n/30. 18 Made payment for the amount owing for the June 1 transaction. 20 Made payment for the amount owing for the June 15 transaction.arrow_forwardHow would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forwardPresented below is information related to the purchases of common stock by Carla Company during 2020. Cost Fair Value (at purchase date) (at December 31) Investment in Arroyo Company stock $107,000 $88,000 Investment in Lee Corporation stock 230,000 278,000 Investment in Woods Inc. stock 190,000 200,000 Total $527,000 $566,000 (Assume a zero balance for any Fair Value Adjustment account.) (a) What entry would Carla make at December 31, 2020, to record the investment in Arroyo Company stock if it chooses to report this security using the fair value option? (b) What entry would Carla make at December 31, 2020, to record the investments in the Lee and Woods corporations, assuming that Carla did not select the fair value option for these investments?arrow_forward

- Please help me. Thankyou.arrow_forwardssignments x signment/assignmentOverview.do?filterMode=all&studentCourseSelector=199635 9 Cookie Graces Sady Teels Final Which of the following has the steps of the accounting cycle in the proper sequence? (Some Score steps may be missing.) Attempt a. analyze and record transactions, post transaction to the ledger prepare a trial balance, prepare financial statements, journalize closing entries, analyze adjustment data and prepare adjusting Score entries b. prepare financial statements, journalize closing entries and post to the ledger, analyze and record transactions, post transactions to the ledger, prepare a trial balance, analyze adjustment data, prepare adjusting entries C. prepare a trial balance, analyze adjustment data, prepare adjusting entries, prepare financial statements, journalize closing entries and post to the ledger analyze and record transactions, post transactions to the ledger Commen d. analyze and record transactions, post transactions to the ledger, prepare a…arrow_forwardSubject - account Please help me. Thankyou.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education