FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

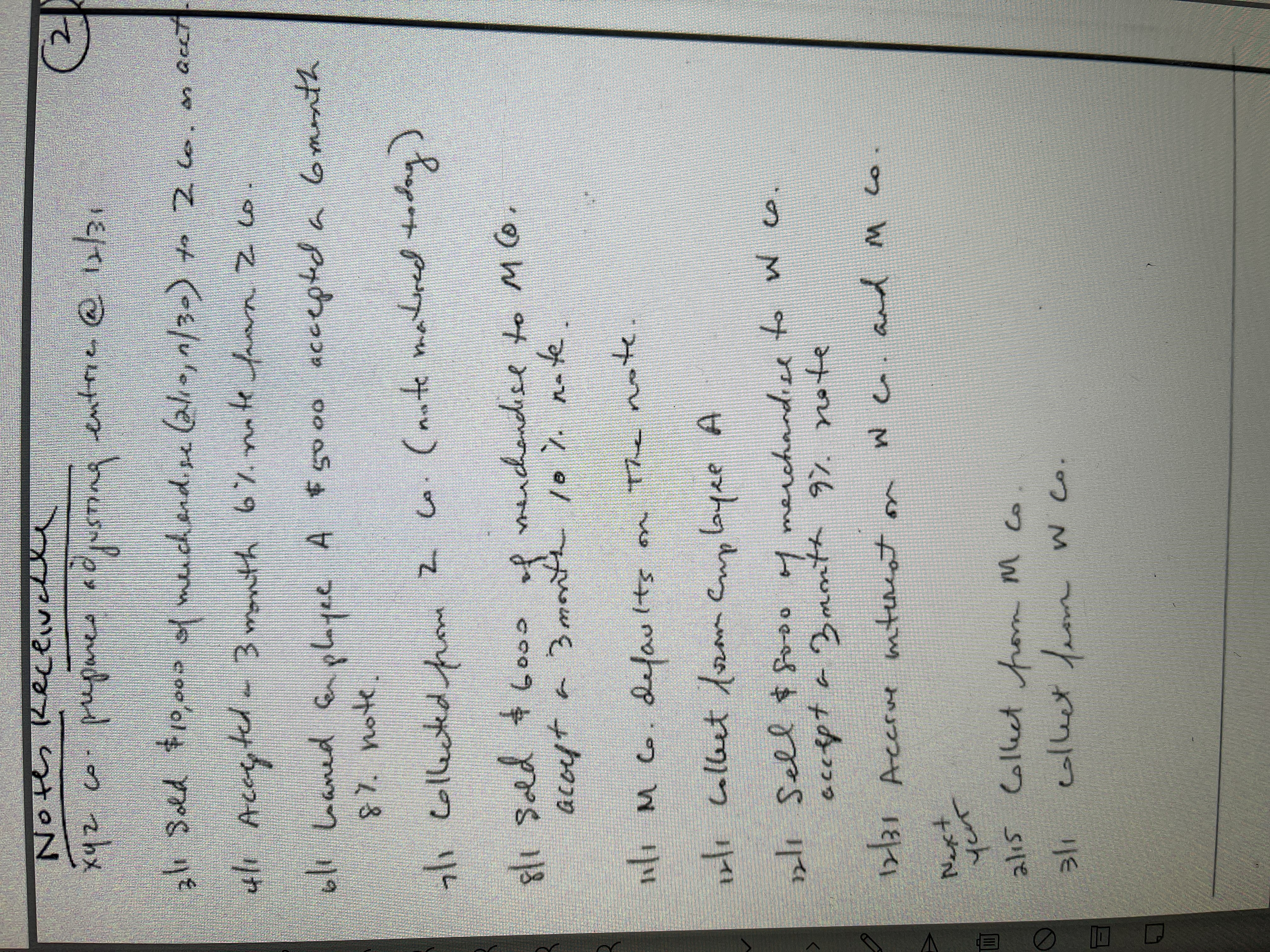

N/R

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Karanarrow_forwardWildhorse Corporation sells rock-climbing products and also operates an indoor climbing facility for climbing enthusiasts. During the last part of 2025. Wildhorse had the following transactions related to notes payable Sept. 1 Sept. 30 Oct. 1 Oct. 31 Nov. 1 Nov. 30 Dec. 1 Dec. 31 Issued a $13,200 note to Pippen to purchase inventory. The 3-month note payable bears interest of 9% and is due December 1. (Wildhorse uses a perpetual inventory system) Recorded accrued interest for the Pippen note. Issued a $22,800, 9%, 4-month note to Prime Bank to finance the purchase of a new climbing wall for advanced climbers. The note is due February 1. Recorded accrued interest for the Pippen note and the Prime Bank note. Issued a $24,000 note and paid $7,600 cash to purchase a vehicle to transport clients to nearby climbing sites as part of a new series of climbing classes. This note bears interest of 6% and matures in 12 months. Recorded accrued interest for the Pippen note, the Prime Bank note, and…arrow_forwardSweet Company provides the following information about its defined benefit pension plan for the year 2020. Service cost $91,000 Contribution to the plan 106,400 Prior service cost amortization 10,800 Actual and expected return on plan assets 65,200 Benefits paid 40,500 Plan assets at January 1, 2020 633,900 Projected benefit obligation at January 1, 2020 701,600 Accumulated OCI (PSC) at January 1, 2020 149,900 Interest/discount (settlement) rate 9 %arrow_forward

- When writing off a customer's account using the allowance method: A. Bad Debts Expense is increased with a debit B. The customer's account is decreased with a debit C. The Allowance for Bad Debts account is decreased with a debit D. Bad Debts Expense is increased with a creditarrow_forwardUsing the imformation already about the schedule of accounts recievable help fill in the balance. -use the image to show the context also journalize the adjusting entry for bad debt expensearrow_forwardPresented below is information related to the purchases of common stock by Carla Company during 2020. Cost Fair Value (at purchase date) (at December 31) Investment in Arroyo Company stock $107,000 $88,000 Investment in Lee Corporation stock 230,000 278,000 Investment in Woods Inc. stock 190,000 200,000 Total $527,000 $566,000 (Assume a zero balance for any Fair Value Adjustment account.) (a) What entry would Carla make at December 31, 2020, to record the investment in Arroyo Company stock if it chooses to report this security using the fair value option? (b) What entry would Carla make at December 31, 2020, to record the investments in the Lee and Woods corporations, assuming that Carla did not select the fair value option for these investments?arrow_forward

- Journalize the following transactions, using the direct write-off method of accounting for uncollectible receivables. Mar. 17: Received $3,190 from Paula Spitler and wrote off the remainder owed of $5,900 as uncollectible. If an amount box does not require an entry, leave it blank. Mar. 17 fill in the blank e83d81f48fed021_2 fill in the blank e83d81f48fed021_3 fill in the blank e83d81f48fed021_5 fill in the blank e83d81f48fed021_6 fill in the blank e83d81f48fed021_8 fill in the blank e83d81f48fed021_9 July 29: Reinstated the account of Paula Spitler and received $5,900 cash in full payment. July 29 fill in the blank cf28d0043fd3fb7_2 fill in the blank cf28d0043fd3fb7_3 fill in the blank cf28d0043fd3fb7_5 fill in the blank cf28d0043fd3fb7_6 July 29 fill in the blank cf28d0043fd3fb7_8 fill in the blank cf28d0043fd3fb7_9 fill in the blank cf28d0043fd3fb7_11 fill in the blank cf28d0043fd3fb7_12arrow_forwardShow a journal entry writing off an account using both the allowance method and the direct write-off method. NOTE: YOU CAN INCLUDE ANY AMOUNTS AS LONG AS THEY MAKE SENSE, BUT DO NOT FORGET TO INCLUDE ACTUAL NUMBERS FOR THIS JOURNAL SHOWING BOTH METHODS AS STATED ABOVE. THIS CAN BE MADE UP BUT DO NOT FORGET THE NUMBERS.arrow_forwardPlease help me. Thankyou.arrow_forward

- Fill in the blanks to complete sentence. 9.The loan guarantee is issued at the request of the __________ in favor of __________arrow_forwardCeradyne Limited accepts a three-month, 7%, $43,600 note receivable in settlement of an account receivable on April 1, 2018. Interest is due at maturity. Prepare the journal entries required by Ceradyne Limited to record the issue of the note on April 1, and the settlement of the note on July 1, assuming the note is honoured and that no interest has previously been accrued. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) te Account Titles and Explanation < Debit C Prepare the journal entries required by Ceradyne Limited to record the issue of the note on April 1, and the settlement of the note on July 1, assuming that the note is dishonoured, but eventual collection is expected. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account…arrow_forwardFOR YOU AND THE CLASS: What is the journal entry to record Bad debts expense under the allowance method. In other words ....what account would be debited and what account would be credited? Replyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education