FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

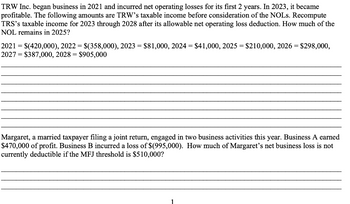

Transcribed Image Text:TRW Inc. began business in 2021 and incurred net operating losses for its first 2 years. In 2023, it became

profitable. The following amounts are TRW's taxable income before consideration of the NOLs. Recompute

TRS's taxable income for 2023 through 2028 after allowable net operating loss deduction. How much of the

NOL remains in 2025?

2021 = $(420,000), 2022 = $(358,000), 2023 = $81,000, 2024 = $41,000, 2025 = $210,000, 2026 = $298,000,

2027 = $387,000, 2028 = $905,000

Margaret, a married taxpayer filing a joint return, engaged in two business activities this year. Business A earned

$470,000 of profit. Business B incurred a loss of $(995,000). How much of Margaret's net business loss is not

currently deductible if the MFJ threshold is $510,000?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At the beginning of 2019, Norris Company l1ad a deferred tax liability of $6,400, because of the use of MACRS depreciation for income tax purposes and units-of-production depreciation for financial reporting. The income tax rate is 30% for 2018 and 2019, but in 2018 Congress enacted a 40% tax rate for 2020 and future years. Norris’s accounting records show the following pretax items of finacial income for 2019: income from continuing operations, $120,000 (revenues of $352,000 and expenses of $232,000); gain On disposal of Division F, $23,000; loss from operations of discontinued Division F, $10,000;and prior period adjustment, $15,000, due to an error that understated revenue in 2018. All of these items are taxable; however, financial depreciation for 2019 on assets related to continuing operations exceeds tax depreciatio11 by $5,000. Norris had a retained earnings balance of $161,000 on January 1, 2019, and declared and paid casl1 dividends of $32,000 during 2019. 1. Prepare Norris’s…arrow_forwardPrior to 2019, the accounting income and taxable income for Sheffield Corporation were the same. On January 1, 2019, the company purchased equipment at a cost of $1,116,000. For accounting purposes, the equipment was to be depreciated over six years using the straight-line method and no residual value. For income tax purposes, the equipment was subject to a CCA rate of 30% (half-year rule applies for 2019). Sheffield's income before tax for accounting purposes for 2020 was $13,000,000. The company was subject to a 20% income tax rate for all applicable years and anticipated profitable years for the foreseeable future. Sheffield follows IFRS. Calculate taxable income and taxes payable for 2020. Taxable income Income taxes payable $ eTextbook and Media List of Accounts %24 %24arrow_forwardOriole Co. at the end of 2021, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows: Pretax financial income $ 690,000 Estimated warranty expenses deductible for taxes when paid 1,140,000 (1,632,000) $ 198,000 Extra depreciation Taxable income Estimated warranty expense of $830,000 will be deductible in 2022, $240,000 in 2023, and $70,000 in 2024. The use of the depreciable assets will result in taxable amounts of $544,000 in each of the next three years. Prepare a table of future taxable and deductible amounts. 2022 Future taxable(deductible) amounts Warranties Excess Depreciation Date 2023 Account Titles 2024 Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2021. Assuming an income tax rate of 30% for all years. TOTAL Debit Creditarrow_forward

- i need the answer quicklyarrow_forwardWhyRU Company usually depreciates its equipment using straight line method for accounting purposes, but for tax purposes its sum-of-the-years method. WhyRU Company acquired the equipment through purchase amounting to P2,400,000 on January 1,2018. Assume a tax rate of 30%. Useful life is 4 years. WhyRU Company made the following income in its income tax return available through reports for 2018 – P800,000; 2019 – P890,0000; 2020 – P1,200,000; 2021 – P1,500,000 There is no other differences between WhyRU's accounting income and taxable income for years 2018, 2019, 2020 and 2021 other than for the difference in depreciation for the equipment described.arrow_forwardIn 2019, Bluebird Corporation had net income from operations of $100,000. Further, Bluebird recognized a long-term capital gain of $30,000 and a short-term capital loss of $45,000. Which of the following statements is correct? Question 22 options: Bluebird will have taxable income in 2019 of $100,000 and will have a net capital loss of $15,000 that can be carried back 3 years and forward 5 years. Blue Corporation may use the capital loss to offset the capital gain and must carry the net capital loss of $15,000 forward five years as a short-term capital loss. Bluebird Corporation may deduct $33,000 of the capital loss in 2019 and may carry forward the remainder of the loss indefinitely to offset capital gains Bluebird Corporation will have taxable income in 2019 of $85,000. None of the above.arrow_forward

- The following information is available for Metlock Inc. for 2024: Excess of tax depreciation over book depreciation, $77,200. This $77,200 difference will reverse equally over the next 4 years. 1. 2 3. (a) Deferral, for book purposes, of $26,000 of subscription income received in advance. The subscription income will be earned in 2025. Pretax financial income, $206,000. Tax rate for all years, 20%. Your answer is correct. Compute taxable income for 2024. (b) Taxable income 154800 Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2024. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. List all debit entries before credit entries.) Account Titles and Explanation deprecation Debit Creditarrow_forwardWCC Corporation has a $115,000 net operating loss carryover to 2023 from a previous year. Assume that it reported $78,000 of taxable income in 2023 (before the net operating loss deduction) and $45,000 of taxable income in 2024 (before the net operating loss deduction). Note: Leave no answer blank. Enter zero if applicable. b. What is WCC's taxable income in 2023 and 2024 (after the net operating loss deduction), assuming the $115,000 NOL carryover originated in 2020 and WCC elected to forgo the NOL carry back option? Year 2023 2024 Taxable Incomearrow_forwardAs of June 30, 2023, Alpha Ltd disclosed the following details regarding its assets and liabilities from its balance sheet: Assets ($000): Computer equipment at purchase price: 300 Accumulated depreciation: (60) Accounts receivable: 100 Allowance for doubtful accounts: (10) Liabilities: Warranty cost provision: 30 Provision for long service leave benefits: 20 Alpha Ltd depreciates its computer equipment over five years for accounting purposes but over three years for tax purposes, using the straight-line depreciation method. No payments were made for long service leave or warranty claims during the fiscal year. Determine the value of each temporary difference for Alpha Ltd as of June 30, 2023. Calculate the carrying amount and tax base, and specify whether each temporary difference is deductible or taxable.arrow_forward

- Hanshabenarrow_forwardAt the end of 2021, Schrutte Inc. in its first year of operations, had pretax financial income of $650,000. The company had extra depreciation taken for tax purposes in the amount of $975,000. Estimated expenses that were deducted for financial income but not yet paid amounted to $425,000. It is estimated that the expenses will be paid in 2022. The tax rate for all years is 25% In the journal entry at the end of the year that records income tax expense, deferred taxes and income taxes payable, what is the entry to the Income Tax Payable account? Question 19 options: a) credit Income Tax Payable account by $162,500 b) credit Income Tax Payable account by $300,000. c) credit to Income Tax Payable account by $25,000. d) credit Income Tax Payable account by $512,500.arrow_forwardWCC Corporation has a $115,000 net operating loss carryover to 2023 from a previous year. Assume that it reported $78,000 of taxable income in 2023 (before the net operating loss deduction) and $45,000 of taxable income in 2024 (before the net operating loss deduction). Note: Leave no answer blank. Enter zero if applicable. a. What is WCC's taxable income in 2023 and 2024 (after the net operating loss deduction), assuming the $115,000 NOL carryover originated in 2017?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education