FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

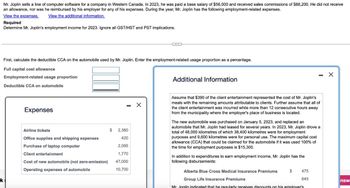

Transcribed Image Text:Mr. Joplin sells a line of computer software for a company in Western Canada. In 2023, he was paid a base salary of $56,000 and received sales commissions of $88,200. He did not receive

an allowance, nor was he reimbursed by his employer for any of his expenses. During the year, Mr. Joplin has the following employment-related expenses.

View the expenses. View the additional information.

Required

Determine Mr. Joplin's employment income for 2023. Ignore all GST/HST and PST implications.

k

First, calculate the deductible CCA on the automobile used by Mr. Joplin. Enter the employment-related usage proportion as a percentage.

Full capital cost allowance

Employment-related usage proportion

Deductible CCA on automobile

Expenses

Airline tickets

Office supplies and shipping expenses

Purchase of laptop computer

Client entertainment

Cost of new automobile (not zero-emission)

Operating expenses of automobile

$ 2,380

420

2,095

1,770

47,000

10,700

C

X

Additional Information

Assume that $390 of the client entertainment represented the cost of Mr. Joplin's

meals with the remaining amounts attributable to clients. Further assume that all of

the client entertainment was incurred while more than 12 consecutive hours away

from the municipality where the employer's place of business is located.

The new automobile was purchased on January 5, 2023, and replaced an

automobile that Mr. Joplin had leased for several years. In 2023, Mr. Joplin drove a

total of 48,000 kilometres of which 38,400 kilometres were for employment

purposes and 9,600 kilometres were for personal use. The maximum capital cost

allowance (CCA) that could be claimed for the automobile if it was used 100% of

the time for employment purposes is $15,300.

In addition to expenditures to earn employment income, Mr. Joplin has the

following disbursements:

$

475

645

Alberta Blue Cross Medical Insurance Premiums

Group Life Insurance Premiums

Mr. Joplin indicated that he regularly receives discounts on his emplover's

X

nsw

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Similar questions

- Kyle, a single taxpayer, worked as a freelance software engineer for the first three months of 2023. During that time, he earned $86,000 of self-employment income. On April 1, 2023, Kyle took a job as a full-time software engineer with one of his former clients, Hoogle Incorporated From April through the end of the year, Kyle earned $206,000 in salary. What amount of FICA taxes (self-employment and employment related) does Kyle owe for the year? Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. Answer is complete but not entirely correct. S 15,711 Self-employment/FICA taxarrow_forwardChristie sued her former employer for a back injury she suffered on the job in 2021. As a result of the injury, she was partially disabled. In 2022, she received $240,000 for her loss of future income, $160,000 in punitive damages because of the employer's flagrant disregard for the employee's safety, and $15,000 for the reimbursement of medical expenses. What's Christie's gross income in 2021? Please explain.arrow_forwardKyle, a single taxpayer, worked as a freelance software engineer for the first three months of 2023. During that time, he earned $72,000 of self-employment income. On April 1, 2023, Kyle took a job as a full-time software engineer with one of his former clients, Hoogle Incorporated From April through the end of the year, Kyle earned $220,000 in salary. What amount of FICA taxes (self-employment and employment related) does Kyle owe for the year?arrow_forward

- Rodney, a resident taxpayer is employed by subiaco function center as a marketing manager. during the 2023 income year, Rodney used his private car for wpork related travel to meetings. he maintained fuel receipts amounting to $4000 and noted that he had travelled a total of 6000n work related kilometers during the year. rodney has not maintained a logbook. From the above information, calculate the maximum deduction available to Rodney for car expenses in respect of the 2023 income year. a)$3900 b) $4000 c) $4680 d) $0arrow_forwardDuring the year, Mr. A incurred $526 to purchase airline tickets for travel to client sites on behalf of ABC co. He claimed this amount to abc by presenting his receipt and received a reimbusement for the full amount. Indicate the effect on Mr. A's net employment income. An inclusion in employment income should be entered in the box as a number (e.g., 100, do not use any other signs). A deduction from employment income should be entered in the box as a negative number (e.g, -100, do not use any other signs/brackets). If the item would have no effect on the calculation of employment income, enter the number 0 in the box (e.g., do not use any other signs/words)arrow_forwardMichelle was paid a retiring allowance of $72,000.00 when her employment was terminated in February 2021. Michelle started with the organization in June 1978 and joined the company pension plan in June 1980. She was fully vested when her employment was terminated. Calculate the portion of Michelle's retiring allowance that will be reported as non- eligible on her T4 information slip.arrow_forward

- On February 2, 2019, Alexandra purchases a personal computer. The computer cost $1,800. Alexandra uses the computer 85% of the time in her accounting business, and the remaining 15% of the time for various personal uses. Calculate Alexandra's maximum depreciation deduction for 2019 for the computer, assuming half-year convention and she does not use bonus depreciation or make the election to expenses.arrow_forwardKyle, a single taxpayer, worked as a freelance software engineer for the first three months of 2023. During that time, he earned $90,000 of self-employment income. On April 1, 2023, Kyle took a job as a full-time software engineer with one of his former clients, Hoogle Incorporated From April through the end of the year, Kyle earned $198,000 in salary. What amount of FICA taxes (self-employment and employment related) does Kyle owe for the year? Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. Self-employment/FICA taxarrow_forwardBeam Hines is a translator who works for a consulting firm in Mississauga. Her 2020 salary is $73,500, from which her employer, a Canadian controlled private company, deducts maximum CPP and EI contributions. Also deducted is an RPP contribution of $2,600. The employer makes a matching contribution ($2,600). Her employment compensation does not include any commission income. Other Information:1. To reward Beam for her outstanding work, and as an incentive to stay with the company, her employer has awarded her a bonus of $10,000 that will be paid in August 2021. 2. Beam received options to purchase 200 shares of her employer’s stock at a price of $72 per share last year. At the time the options were granted, the fair market value of the shares was $74 per share. During May 2020, when the shares had a fair market value of $90 per share, Beam exercises all of these options. She is still holding these shares at the end of the year. (Note: please mention the result of stock options benefit…arrow_forward

- Gen is a new sole proprietor. By the end of January 2022, she needs to issue what document to any independent contractors to whom she paid $600 or more to do project work for her business? Form 1099-K, Payment Card and Third-Party Network Transactions. Form 1099-MISC, Miscellaneous Income. Form 1099-NEC, Nonemployee Compensation. Form W-2, Wage and Tax Statement.arrow_forwardKyle, a single taxpayer, worked as a freelance software engineer for the first three months of 2022. During that time, he earned $54,000 of self-employment income. On April 1, 2022, Kyle took a job as a full-time software engineer with one of his former clients, Hoogle Incorporated From April through the end of the year, Kyle earned $200,000 in salary. What amount of FICA taxes (self-employment and employment related) does Kyle owe for the year? Note: Round your intermediate calculations to the nearest whole dollar amount. Self Employment/FICA taxes= ???arrow_forwardDuring 2021, Harry, a self-employed accountant, travels from Kansas City to Miami for a seven-day business trip. While in Miami, Harry decides to stay for an additional 5 days of vacation. Harry pays $600 for airfare, $200 for restaurant meals, and $500 for lodging while on business. The cost of meals and lodging while on vacation was $300 and $500, respectively. How much may Harry deduct as travel expenses for the trip?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education