FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

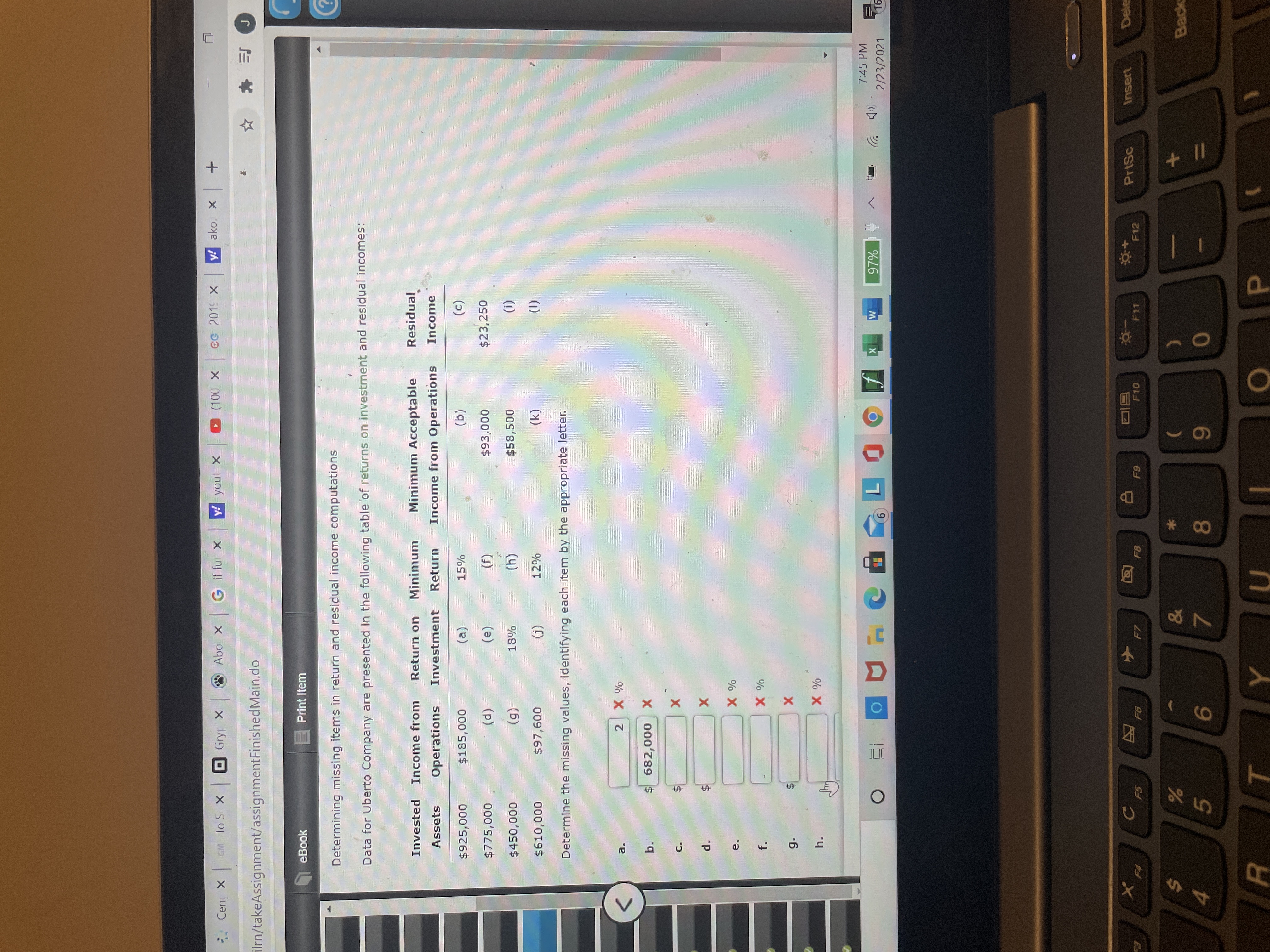

Transcribed Image Text:Determining missing items in return and residual income computations

Data for Uberto Company are presented in the following table 'of returns on investment and residual incomes:

Invested Income from

Return on

Minimum

Minimum Acceptable

Residual

Operations

Investment

Return

Income from Operations

Income

Assets

$925,000

$185,000

(a)

15%

(b)

(c)

$775,000

(d)

(e)

(f)

$93,000

$23,250

$450,000

(g)

18%

(h)

$58,500

(i)

$610,000

$97,600

(j)

12%

(k)

(1)

Determine the missing values, identifying each item by the appropriate letter.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject: acountingarrow_forwardRequired information [The following information applies to the questions displayed below] Westerville Company reported the following results from last year's operations: Sales Variable expenses Contribution margin Fixed expenses Net operating income Average operating assets ROI At the beginning of this year, the company has a $300,000 investment opportunity with the following cost and revenue characteristics: Sales $ 1,800,000 435,000 1,365,000 1,005,000 $360,000 $ 1,200,000 $360,000 $ 216,000 The company's minimum required rate of return is 10% Contribution margin ratio Fixed expenses 70 of sales. 6. What is the ROI related to this year's investment opportunity?arrow_forwardDetermining missing items in return and residual income computations Data for Uberto Company are presented in the following table of returns on investment and residual incomes: Invested Assets Income from Operations Return on Investment Minimum Return Minimum Acceptable Income from Operations Residual Income $890,000 $231,400 (a) 15% (b) (c) $460,000 (d) (e) (f) $50,600 $23,000 $310,000 (g) 14% (h) $31,000 (i) $230,000 $48,300 (j) 12% (k) (l) Determine the missing values, identified by the letters above. For all amounts, round to the nearest whole number. a. % b. c. d. e. % f. % g. h. % i. j. % k. l.arrow_forward

- Data for Uberto Company are presented in the following table of rates of return on investment and residual incomes: Invested Assets Income from Operations Return on Investment Minimum Return Minimum Acceptable Income from Operations Residual Income $780,000 $187,200 (a) 13% (b) (c) $620,000 (d) (e) (f) $74,400 $24,800 $330,000 (g) 14% (h) $36,300 (i) $250,000 $50,000 (j) 12% (k) (l) Determine the missing values, identified by the letters above. For all amounts, round to the nearest whole number. a. fill in the blank % b. $ fill in the blank c. $ fill in the blank d. $ fill in the blank e. fill in the blank % f. fill in the blank % g. $ fill in the blank h. fill in the blank % i. $ fill in the blank j. fill in the blank % k. $ fill in the blank l. $ fill in the blankarrow_forwardOne item is omitted from each of the following computations of the return on investment: Rate of Return on Investment = Profit Margin x Investment Turnover 17 % = 10 % x (a) (b) = 28 % x 0.75 18 % = (c) x 1.5 10 % = 20 % x (d) (e) = 15 % x 1.2 Determine the missing items identified by the letters as shown above. If required, round your answers to two decimal places. (a) fill in the blank (b) fill in the blank % (c) fill in the blank % (d) fill in the blank (e) fill in the blank %arrow_forwardRequired Supply the missing information in the following table for Rooney Company. (Do not round intermediate calculations. Round "ROI" answer to 2 decimal places. (i.e., 0.2345 should be entered as 23.45).)arrow_forward

- What is the Residual Income for Stevenson Corporation, given the following info: Invested Assets = $550,000 Sales = $660,000 Income from Operations = $99,000 Desired minimum rate of return = 15.0% O $16,500 O $17,280 O $14,850 O $0arrow_forwardAssume a company had net operating income of $300,000, sales of $1,500,000, average operating assets of $1,000,000, and a minimum required rate of return on average operating assets of 10.00%. The company's residual income is closest to: Multiple Choice $100,000. $200,000. $150,000. $250,000.arrow_forwardThe Marine Division of Pacific Corporation has average invested assets of $110,000,000. Sales revenue of $50,280,000 results in net operating income of $9,972,000. The hurdle rate is 7%. Required a. Calculate the return on investment. b. Calculate the profit margin. c. Calculate the investment turnover. d. Calculate the residual income. Complete this question by entering your answers in the tabs below. Required A Required B Required C Calculate the return on investment. Note: Round percentage to 2 decimals. Return on Investment Required D %arrow_forward

- Determining missing items in return on investment computation One item is omitted from each of the following computations of the return on investment: Return on Investment = Profit Margin x Investment Turnover 27 % = 10 % x (a) (b) = 16 % x 0.75 24 % = (c) x 1.5 14 % = 20 % x (d) (e) = 15 % x 1.8 Determine the missing items identified by the letters as shown above. If required, round your answers to two decimal places. (a) fill in the blank 1 (b) fill in the blank 2 % (c) fill in the blank 3 % (d) fill in the blank 4 (e) fill in the blank 5 %arrow_forwardDetermining Missing Items in Return Computation One item is omitted from each of the following computations of the return on investment: Rate of Return on Investment = Profit Margin x Investment Turnover 19 % 10 % (a) (b) 16 % 0.75 33 % (c) X 1.5 12 % 20 % (d) (e) 15 % 1.8 Determine the missing items identified by the letters as shown above. If required, round your answers to two decimal places. (a) (b) % (c) (d) (e) %arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education