Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

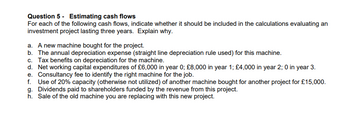

Transcribed Image Text:Question 5 - Estimating cash flows

For each of the following cash flows, indicate whether it should be included in the calculations evaluating an

investment project lasting three years. Explain why.

a. A new machine bought for the project.

b. The annual depreciation expense (straight line depreciation rule used) for this machine.

c. Tax benefits on depreciation for the machine.

d. Net working capital expenditures of £6,000 in year 0; £8,000 in year 1; £4,000 in year 2; 0 in year 3.

e. Consultancy fee to identify the right machine for the job.

f. Use of 20% capacity (otherwise not utilized) of another machine bought for another project for £15,000.

g. Dividends paid to shareholders funded by the revenue from this project.

h. Sale of the old machine you are replacing with this new project.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- helparrow_forwardA company is evaluating three possible investments. The following information is provided by the company: Project A Project B Project C Investment $238,000 $54,000 $238,000 Residual value 0 30,000 40,000 Net cash inflows: Year 1 70,000 30,000 100,000 Year 2 70,000 21,000 70,000 Year 3 70,000 17,000 80,000 Year 4 70,000 14,000 40,000 Year 5 70,000 0 0 What is the payback period for Project A? (Assume that the company uses the straight−line depreciation method.) (Round your answer to two decimal places.) A. 1.8 years B. 2.4 years C. 5.00 years D. 3.4 yearsarrow_forwardMemanarrow_forward

- Question content area top Part 1 (IRR calculation) Determine the IRR on the following projects: a. An initial outlay of $13,000 resulting in a single free cash flow of $17,165 after 9 years b. An initial outlay of $13,000 resulting in a single free cash flow of $46,394 after 15 years c. An initial outlay of $13,000 resulting in a single free cash flow of $105,001after 25 years d. An initial outlay of $13,000 resulting in a single free cash flow of $13,653 after 4 yearsarrow_forwardBaghibenarrow_forwardc. A company is planning to invest in a project over a 5-year period, but wants to know its financial implications. It expects the cash in-flow return on the investment to steadily increase over the 5 years. Using the information below, help determine the Total Net Cash Flows, the Net Present Value and the estimated Payback Period. Note: Estimate the payback period to the nearest year. Discount Rate 12% Investment Project Cash Flow Total Net Cash Flow Initial Investment $ (5,000) ? Year 1 $ 800 ? Year 2 $ 900 ? Year 3 $ 1,500 ? Year 4 $ 1,800 ? Year 5 $ 3,200 ? NPV of investment ? Estimated Payback Periodarrow_forward

- An organisation is considering a capital investment in new equipment . • The estimateed cash flows are as follows: • Year Cash flow • $ •0 ( $240000) •1 80000 •2 32000 •3 80000 •4 40000 •5 24000 •Calculate the IRR of the project to assess whether it should be undertaken.arrow_forward2. Calculating Project NPV The Fleming Company is considering a new investment. Financial projections for the investment are tabulated below. The corporate tax rate is 22 percent. Assume all sales revenue is received in cash, all operating costs and income taxes are paid in cash, and all cash flows occur at the end of the year. All net working capital is recovered at the end of the project. Investment Sales revenue Operating costs Depreciation Net working capital spending Year 0 $32,800 450 Year 1 Year 2 Year 3 Year 4 $14,200 2,100 8,200 175 $15,900 $15,700 2,100 2,100 8,200 8,200 250 275 $12,900 2,100 8,200 ? a. Compute the incremental net income of the investment for each year. b. Compute the incremental cash flows of the investment for each year. c. Suppose the appropriate discount rate is 12 percent. What is the NPV of the project?arrow_forwardCompany Express S. A. asks you to construct cash flows for following three (3) investment projects, containing following information:PROJECT 1a. Sales (in ThCh$):- Year 1: 90,000- Year 2: 55,000- Year 3: 75,000- Year 4: 190,000b. Cost of sales is estimated at 53% of sales.c. Depreciation for year is ThCh$ 15,000 per period (period 1 to 3). In year 4 there is a sale of machinery that results in a gain on sale of non-current assets of ThCh$ 9,800. Total depreciation for year 4 is ThCh$ 12,500.d. Administrative expenses are equivalent to 17% of sales.e. In period 0 there is an investment of ThCh$ 58,000.f. There is credit financing of ThCh$ 32,000 which is amortized in equal parts of ThCh$ 8,000 per period with a financial expense of ThCh$ 3,700 per period.g. There is an investment in working capital of ThCh$ 24,000 in period 0, which is recovered in period 4.h. In period 4 there is an investment in land of ThCh$ 40,000.i. Income tax rate is 17%. Calculate: cash flow per period. Please…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education