FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Financial Statements from the End-of-Period Spreadsheet

Demo Consulting is a consulting firm owned and operated by Jesse Flatt. The following end-of-period spreadsheet was prepared for the year ended August 31, 20Y9:

| Demo Consulting | ||||||||

| End-of-Period Spreadsheet | ||||||||

| For the Year Ended August 31, 20Y9 | ||||||||

| Unadjusted | Adjusted | |||||||

| Adjustments | Trial Balance | |||||||

| Account Title | Dr. | Cr. | Dr. | Cr. | Dr. | Cr. | ||

| Cash | 12,470 | 12,470 | ||||||

| 29,690 | 29,690 | |||||||

| Supplies | 3,150 | 2,640 | 510 | |||||

| Land | 25,240 | 25,240 | ||||||

| Office Equipment | 23,750 | 23,750 | ||||||

| 3,300 | 1,570 | 4,870 | ||||||

| Accounts Payable | 8,020 | 8,020 | ||||||

| Salaries Payable | 390 | 390 | ||||||

| Common Stock | 10,000 | 10,000 | ||||||

| 20,280 | 20,280 | |||||||

| Dividends | 3,860 | 3,860 | ||||||

| Fees Earned | 80,610 | 80,610 | ||||||

| Salary Expense | 21,670 | 390 | 22,060 | |||||

| Supplies Expense | 2,640 | 2,640 | ||||||

| Depreciation Expense | 1,570 | 1,570 | ||||||

| Miscellaneous Expense | 2,380 | 2,380 | ||||||

| 122,210 | 122,210 | 4,600 | 4,600 | 124,170 | 124,170 |

Question Content Area

Based on the preceding spreadsheet, prepare an income statement for Demo Consulting.

Transcribed Image Text:Based on the preceding spreadsheet, prepare an income statement for Demo Consulting.

Demo Consulting

Income Statement

For the Year Ended August 31, 20Y9

Fees earned

Expenses:

Salary expense

Supplies expense

Depreciation expense

Miscellaneous expense

Total expenses

Net income

Feedback

19,460 X

2,270 X

1,350 X

2,040 X

72,460 X

25,120 X

45,650 X

Check My Work

Revenue and expense accounts flow into the income statement.

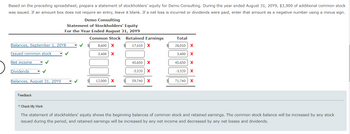

Based on the preceding spreadsheet, prepare a statement of stockholders' equity for Demo Consulting. During the year ended August 31, 20Y9, $3,900 of additional common stock

was issued. If an amount box does not require an entry, leave it blank. If a net loss is incurred or dividends were paid, enter that amount as a negative number using a minus sign.

Transcribed Image Text:Based on the preceding spreadsheet, prepare a statement of stockholders' equity for Demo Consulting. During the year ended August 31, 20Y9, $3,900 of additional common stock

was issued. If an amount box does not require an entry, leave it blank. If a net loss is incurred or dividends were paid, enter that amount as a negative number using a minus sign.

Balances, September 1, 20Y8

Issued common stock

✓

Net income

Dividends

Balances, August 31, 20Y9

Demo Consulting

Statement of Stockholders' Equity

For the Year Ended August 31, 20Y9

Common Stock

8,600 X

3,400 X

Feedback

12,000 X

Retained Earnings

17,410 X

$

45,650 X

-3,320 X

59,740 X

Total

26,010 X

3,400 X

45,650 X

-3,320 X

71,740

X

▼ Check My Work

The statement of stockholders' equity shows the beginning balances of common stock and retained earnings. The common stock balance will be increased by any stock

issued during the period, and retained earnings will be increased by any net income and decreased by any net losses and dividends.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Courses =HCS380 Week 1 Terminology Matching Accounts Receivable Terminology Matching Note Payable Bonds Payable Common Stock Income Statement Balance Sheet Retained Earnings Statement Statement of Cash Flow Basic Accounting Equation multimedia.phoenix.edu Annual Report View Assessment HCS/380: Week 1 - Terminology Matching - Academic Resources Owed to a bank for the money borrowed Bill customer/patient for services HCS Debt securities sold to investors that must be repaid at a particular date in the future A AOL PASSV REQUIRED Enter your password for "kaylakı Accounts. Prepared by corporate management to present financial information, management discussion, notes, and auditor's report Used by creditors to determine if they will be paid Assets Liabilities+Stockholder's Equity Used by creditors and investors to analyze the organization's cash position Used by investors to evaluate the organization's history of paying high dividends The total amount paid in by stockholders for the share…arrow_forwardCurrent Attempt in Progress Kingbird, Inc's trial balance at the end of its first month of operations reported the following accounts and amounts with normal balances: Cash Prepaid insurance Accounts receivable Accounts payable Notes payable Common stock Dividends Revenues Expenses $18240 O $35910 O $37050 O $36480 O $37620 570 2850 2280 3420 5700 570 25080 14250 Total credits on Kingbird, Inc's trial balance arearrow_forwardFrancisco Company has 10 employees, each of whom earns $2,800 per month and is paid on the last day of each month. All 10 have been employed continuously at this amount since January 1. On March 1, the following accounts and balances exist in its general ledger. a. FICA-Social Security Taxes Payable, $3,472; FICA-Medicare Taxes Payable, $812. (The balances of these accounts represent total liabilities for both the employer's and employees' FICA taxes for the February payroll only.) b. Employees' Federal Income Taxes Payable, $7,000 (llability for February only). c. Federal Unemployment Taxes Payable, $336 (liability for January and February together). d. State Unemployment Taxes Payable, $3,024 (lability for January and February together). The company had the following payroll transactions. March 15 Issued check payable to Swift Bank, a federal depository bank authorized to accept employers' payments of FICA taxes and employee income tax withholdings. The $11,284 check is in payment of…arrow_forward

- 23. Prepare closing entries rom the following end-of period spreadsheet. Austin Entergrises Fadof Peried Spreadsheet For the Year Eaded December JI Adnted Trial Balance Credit Income Statement Debt Balance Sheet Deb 26.500 7000 Account Titie Crede Debit Crede 26,500 7,000 1,000 18300 Cash Accounts Receivable Supplies Equipment Accumalated Depr 18.500 5.000 5.000 Accoures Payabie Wages Payable Common Stock Retained arnings Dividends Eees Earmed Wages Eapense Rest Esgeme Depreciation Eapense Toals Net omeLo) 11,000 100 6.000 2.000 1000 1,000 6.000 2.000 2.000 2,000 59.500 59.500 19,000 7.000 3.00 19000 7000 3.300 .500 .500 29,500 20.0 59.500 5.000 25,000 20.000arrow_forwardRequired information [The following information applies to the questions displayed below.] Chase Company posted transactions (a through in the following T-accounts in December, its first month of operations. a. C. Debit Debit Cash 15,600 b. 14,600 e. f. Accounts Payable 4,200 d. Debit Credit Services Revenue C. Credit Credit Prepare its December 31 trial balance. Chase Company Trial Balance 5,200 b. 6,200 d. 4,200 6,300 14,600 e. Debit Debit Debit Supplies 5,200 6,300 Common Stock a. Rent Expense 6,200 Credit Credit Credit 15,600arrow_forwardTop-Value Corporation has 242,000 shares of $30 par common stock outstanding. On September 2, Top-Value Corporation declared a 2% stock dividend to be issued November 30 to stockholders of record on October 3. The market price of the stock was $55 per share on September 2. Required: Journalize the entries required on September 2, October 3, and November 30. If no entry is required, simply skip to the next transaction. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.arrow_forward

- Please do not give solution in image format thankuarrow_forwardQuestion: Journalize the required returns! Include excel formula in your answerarrow_forward27 es The general ledger of Zips Storage at January 1, 2024, Includes the following account balances: Credits Accounts Cash Accounts Receivable Prepaid Insurance Land Accounts Payable Deferred Revenue Common Stock Retained Earnings Totaln Debits $25,300 16,100 13,400 155,000 $7,400 6,500 150,000 45,900 $209,800 $209,800 The following is a summary of the transactions for the year: 1. January 9 2. February 12 3. April 25 4. May 6 5. July 15. 6. September 10 7. October 31 8. November 20 9. December 30 Provide storage services for cash, $141,100, and on account, $55,700. Collect on accounts receivable, $52,200. Receive cash in advance from customers, $13,600. Purchase supplies on account, $10,600. Pay property taxes, $9,200. Pay on accounts payable, $12,100. Pay salaries, $130,600. Issue shares of common stock in exchange for $34,000 cash. Pay $3,500 cash dividends to stockholders. Problem 3-9A (Algo) Part 5 5. Record adjusting entries. Insurance expired during the year is $7,700. Supplies…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education