ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

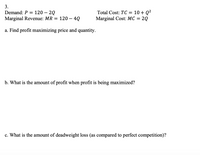

Transcribed Image Text:**Question 3**

**Demand:** \( P = 120 - 2Q \)

**Total Cost:** \( TC = 10 + Q^2 \)

**Marginal Revenue:** \( MR = 120 - 4Q \)

**Marginal Cost:** \( MC = 2Q \)

a. Find the profit-maximizing price and quantity.

b. What is the amount of profit when profit is being maximized?

c. What is the amount of deadweight loss (as compared to perfect competition)?

**Note:** There are no graphs or diagrams included in the image.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Due to an increase in the price of a competitor's product, the demand for a firm's product increases sharply. How is this most likely to affect the firm's marginal revenue and marginal cost? OA. Both marginal revenue and marginal cost will increase. OB. Marginal revenue will increase but marginal cost will decrease. OC. Marginal revenue will increase but marginal cost will not change. OD. Both marginal revenue and marginal cost will not be affected. OE Marginal revenue will not change but marginal cost will increase.arrow_forwardThe marginal cost to produce one bottle of developer is $5. There is no fixed cost. Note that this is a market demand, not a firm's individual demand schedule. 1)Calculate total revenue, total cost, marginal revenue and total profit. Quantity Demanded : 0, 10, 20, 30, 40, 50, 60, 70, 80 Price: 40, 35, 30, 25, 20, 15, 10, 5, 0 2) If the market for developer is perfectly competitive, what quantity will be produced? What price will be charged? What will the firm’s profit be? Write a sentence explaining how you determined each of those three answers.arrow_forwardAssume the following regarding a firm in Perfect Competition: Market Demand = Qd 460-3P Market Supply = Qs = 9 P Each identical firm has: MC=4q ATC = 14 1. What price will the firm charge? Number 2. What is the firm's equilibrium quantity? Number 3. What is the firm's total cost? Number 4. What is the firm's total revenue? Number 5. What is the firm's profit or loss? (use a negative sign to indicate a loss) Number 6. Is the firm in a short-run or long-run situation? Click for Listarrow_forward

- 1. Suppose a perfectly competitive firm has a cost function described by TC = 200Q+Q² +225 Each firm's marginal revenue is $240. a. Find the profit maximizing level of output. b. Is this a short-run or long-run situation? How do you know? c. Assuming that this firm's total cost curve is the same as all other producers, find the long-run price for this good.arrow_forwardWhich of the following is NOT an expected outcome for a firm in a market where sellers have market power? Select one: a. An inefficiently small output b. Lower costs c. Higher prices d. Larger economic profitsarrow_forward67. In a perfectly competitive market, industry demand is given by Q = 1000 – 20P. The typical firm’s average cost is TC = 300 + Q2 /3, and marginal cost by MC = (2/3)Q. Suppose there are 10 identical firms in the market. What is the market supply? A. 30Q B. 40Q C. 15Q D. 5Qarrow_forward

- Which of the following statements applies to a purely competitive producer? a. it will not advertise its product b. in long-run equilibrium, it will earn an economic profit c. its product will have a brand name that elicits customer loyalty d. its product is slightly different from those of its competitors [ don't give chatgpt answer]arrow_forwardPrice MC ATC MRDARP Quantity 12. According to ACDC, what does MR DARP stand for? Marginal Revenue, Demand Average Revenue, Price 13. According to the graph above, is the company making a profit, breaking even, or a loss? How do you know? 14. What happens if the ATC is below the MR line? Draw what this would look like. 15. What happens if the ATC is above the MR line? Draw what this would look like.arrow_forwardPerfect Competition MC - Marginal Cost MR - Marginal Revenue ATC - Average Total Cost Refer to the figure above. If this firm is producing the profit-maximizing quantity and selling it at the profit-maximizing price, the firm's total revenue will be: $240 $90 $60 $180arrow_forward

- Why does a firm in perfect competition produce the quantity at which marginal cost equals price? In a perfectly competitive market, the price of a handsaw is $25. When a firm maximizes its profit, it produces 6 handsaws a day. Draw the marginal revenue curve. Label it. Draw the marginal cost curve that illustrates the profit-maximizing output. Label it. Draw a point at the profit-maximizing output and price. A firm produces the quantity at which marginal cost equals price because when marginal cost is greater than price, the firm O A. can increase economic profit by producing 1 less handsaw O B. is maximizing economic profit OC. is at its shutdown point O D. can increase economic profit by producing 1 more handsaw 50- 45- 40- 35 30- 25- 20- 15- 10- 5 0- 0 Price (dollars per handsaw) 10 Quantity (handsaws per day) >>> Draw only the objects specified in the question.arrow_forwardPrice or Cost(dollars per unit) Pc MR Later C2 MR B MC Demand QE QC QB QA Later ATC Demand Quantity (units per period) 3. Refer to the graph above. Identify each of the following market outcomes: a. Short-run equilibrium output in perfect competition. b. Long-run equilibrium output in perfect competition. c. Long-run equilibrium price in perfect competition. d. Long-run equilibrium output in monopoly. e. Long-run equilibrium output in monopolistic competition.arrow_forwardA firm that has as its objective the maximization of revenues rather than profits would produce an output level for which: Select one: a. marginal revenue is equal to zero b. total revenue is equal to total cost c. marginal revenue is equal to average cost d. marginal revenue is equal to price In the short run, a firm should continue to operate, even if it is incurring losses, provided: Select one: a. the firm can cover its variable costs b. the firm can cover its fixed costs c. none of the above d. the firm can cover the sum of its variable and fixed costsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education