FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

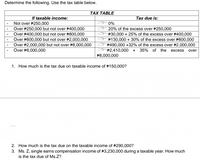

Transcribed Image Text:Determine the following. Use the tax table below.

ТАХ ТАBLE

If taxable income:

Tax due is:

I 0%

Not over P250,000

Over P250,000 but not over P400,000

Over P400,000 but not over P800,000

Over P800,000 but not over P2,000,000

Over P2,000,000 but not over P8,000,000

20% of the excess over P250,000

P30,000 + 25% of the excess over #400,000

P130,000 + 30% of the excess over P800,000

$490,000 +32% of the excess over P2,000,000

P2,410,000 +

P8,000,000

Over P8,000,000

35% of the

excess

over

1. How much is the tax due on taxable income of P150,000?

2. How much is the tax due on the taxable income of 290,000?

3. Ms. Z, single earns compensation income of P3,230,000 during a taxable year. How much

is the tax due of Ms.Z?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. What is the tax due and payable amount in fiscal year 20x1? Fiscal year June 20, 20x1 (5th year) 20x2 Sales 80,000,000 75,000,000 Cost of Sales 50,000,000 46,875,000 Allowable Deductions excluding NOLCO 32,000,000 25,000,000 2. Using the information above, how much is tax due in fiscal year 20x2?arrow_forwardPlease do not give solution in image format thankuarrow_forwardharrow_forward

- Rr.12. 1.) Calculate taxable income for 20X2 answer: 139,000 2.) Calculate taxes payable for 20X2 answer: 20,850 3.) Determine the current deferred tax liability at 12/31/X2 answer: 37200 4.) calculate total income tax expense for 20X2 answer: 58,050 5.) Compute net income after taxes for 20X2 answer: 328,950 6.) Calculate taxable income for 20X3 answer: 213,027 7.) The entry required at the end of 20X3 requires answer: debit DTL for 26,040 8.) Compute net income after taxes for 20X3 answer: ??? 9.) Calculate taxable income for 20X4 answer: 196,800 10.) Compute net income after taxes for 20X4 answer: ??? Using the information above, solve for parts 8 and 10arrow_forwardGiven the following tax structure: Taxpayer Mae Salary $ 44,500 Pedro $ 68,500 Total Tax $ 3,738 ??? Required: a. What is the minimum tax that Pedro should pay to make the tax structure vertically equitable with respect to the amount of tax p b. This would result in what type of tax rate structure? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B What is the minimum tax that Pedro should pay to make the tax structure vertically equitable with respect to the amount of tax paid? Minimum tax $5,754 X mirod Required Parrow_forwardA customer makes a taxable purchase of 44,000. Assuming the applicable sales tax rate is 8.75%, how much will the customer owe? Please round your answer to the nearest whole dollar. Do not include dollar signs. O 47,454 O 44,000 48,750 none of the abovearrow_forward

- Please do not give solution in image format ?arrow_forwardMa3.arrow_forwardName: Activity Worksheet #4 (Chapter 4) TRUE/FALSE Personal income taxes are paid only on your taxable income. 1. The key to reducing one's tax liability is to reduce taxable income rather than gross 2. income. MULTIPLE CHOICE 3. Which of the following would be considered smart financial planning? a. Turn all your income tax planning over to someone else b. Withhold too much income in order to receive a refund next year. c. Ignore the impact of income taxes in your personal financial planning d. Contribute to your employer-sponsored 401(k) retirement plan at least up to the amount of the employer's matching contribution taxes are based on one's ability to pay a. Progressive b. Regressive c. Marginal d. All of these 5. Dave Scott's total income is $42,000, but his taxable income is only $34,050. Therefore, his tax percent liability (what he owes in taxes) is 4,694. Dave's average tax rate is approximately С. 15 а. 11 b. 14 d. 25 6. Jeff is trying to decide whether to sell his baseball…arrow_forward

- Assume that the Kelso Company operates in an industry for which NOL carryback is allowed. The Kelso Company had the following operating results: O $22,800. Year 2019 2020 2021 25% What is the income tax refund receivable? O $24,300 O $28,800. Income (loss) 54,000 57,000 (72,000) O 23,550. Tax rate 35% 30% Income tax 18,900first year of operations 17,100 0arrow_forwardD Exercise 5-7A (Static) Which of the following statements are true about state and local income taxes? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) W S X F2 ? All states tax employee earnings. ? Some localities levy income tax on employees. State tax rates on employee earnings vary among states. ? Certain states have no personal income tax deduction. # 3 E JUL 7 80 F3 $ 4 R Q F4 % 5 U * 00 8 DII F8 I ( 9 J K CVBNM A F9 0 < ) 0 F10 L W P 4 F11 { [ = F12 ?arrow_forwardPlease show all workarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education