FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Note:-

- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.

- Answer completely.

- You will get up vote for sure.

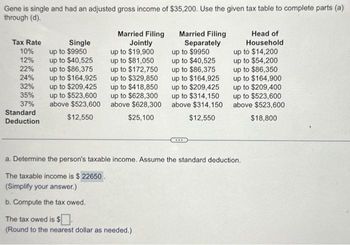

Transcribed Image Text:Gene is single and had an adjusted gross income of $35,200. Use the given tax table to complete parts (a)

through (d).

Tax Rate

10%

12%

22%

24%

32%

35%

37%

Standard

Deduction

Single

up to $9950

up to $40,525

up to $86,375

up to $164,925

up to $209,425

up to $523,600

above $523,600

$12,550

Married Filing

Jointly

up to $19,900

up to $81,050

up to $172,750

up to $329,850

up to $418,850

up to $628,300

above $628,300

$25,100

Married Filing

Separately

up to $9950

up to $40,525

up to $86,375

up to $164,925

up to $209,425

up to $314,150

above $314,150

$12,550

Head of

Household

up to $14,200

up to $54,200

up to $86,350

up to $164,900

up to $209,400

up to $523,600

above $523,600

$18,800

a. Determine the person's taxable income. Assume the standard deduction.

The taxable income is $ 22650.

(Simplify your answer.)

b. Compute the tax owed.

The tax owed is $.

(Round to the nearest dollar as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Some accountants argue that the receiving department should be eliminated. Discuss the objective of eliminating the receiving function. What accounting/audit problems need to be resolved.arrow_forwardIt says they answers are wrong from your example.arrow_forwardSelect the best answer for each of the follwing items and give reasons for your choice. a. Which of the following best describes the relationship between assurance services and attest services? (1) While attest services involved financial data, assurance services involve nonfinancial data (2) While attest services require objectivity, assurance services do not require objectivity (3) All attest services require independence. (4) Attest and assurance services are different terms referring to the same types of servicesarrow_forward

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education