FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

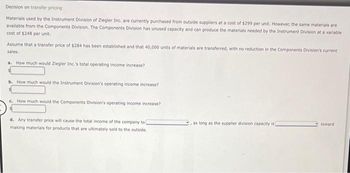

Transcribed Image Text:Decision on transfer pricing

Materials used by the Instrument Division of Ziegler Inc. are currently purchased from outside suppliers at a cost of $299 per unit. However, the same materials are

available from the Components Division. The Components Division has unused capacity and can produce the materials needed by the Instrument Division at a variable

cost of $248 per unit.

Assume that a transfer price of $284 has been established and that 40,000 units of materials are transferred, with no reduction in the Components Division's current

sales.

a. How much would Ziegler Inc.'s total operating income increase?

b. How much would the Instrument Division's operating income increase?

c. How much would the Components Division's operating income increase?

d. Any transfer price will cause the total income of the company to

making materials for products that are ultimately sold to the outside.

as long as the supplier division capacity is

toward

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Determining Market-Based and Negotiated Transfer Prices Carreker, Inc., has a number of divisions, including the Alamosa Division, producer of surgical blades, and the Tavaris Division, a manufacturer of medical instruments. Alamosa Division produces a 2.5 cm steel blade that can be used by Tavaris Division in the production of scalpels. The market price of the blade is $25. Cost information for the blade is: Variable product cost $ 9.40 Fixed cost 5.00 Total product cost $14.40 Tavaris needs 18,000 units of the 2.5 cm blade per year. Alamosa Division is at full capacity (84,000 units of the blade). Required: 1. If Carreker, Inc., has a transfer pricing policy that requires transfer at market price, what would the transfer price be?$ fill in the blank 1per unit Do you suppose that Alamosa and Tavaris divisions would choose to transfer at that price? 2. Now suppose that Carreker, Inc., allows negotiated transfer pricing and that Alamosa Division can avoid $1.50 of selling…arrow_forwardQRC Company is trying to decide which one of two alternatives it will accept. The costs and revenues associated with each alternative are listed below: Alternative A Alternative B Projected revenue $ 125,000 $ 150,000 Unit-level costs 25,000 36,000 Batch-level costs 12,500 24,000 Product-level costs 15,000 17,000 Facility-level costs 10,000 12,500 What is the differential revenue for this decision? Multiple Choice $50,000 $25,000 $125,000 $150,000arrow_forward6. Materials used by the Instrument Division of XPort Industries are currently purchased from outside suppliers at a cost of $220 per unit. However, the same materials are available from the Components Division. The Components Division has unused capacity and can produce the materials needed by the Instrument Division at a variable cost of $165 per unit. a. If a transfer price of $190 per unit is established and 60,000 units of materials are transferred, with no reduction in the Components Division's current sales, how much would XPort Industries' total income from operations increase? b. How much would the Instrument Division's income from operations increase? c. How much would the Components Division's income from operations increase?arrow_forward

- The materials used by Hibiscus Company Division A are currently purchased from outside supplier at $53 per unit. Division B is able to supply Division A with 12,400 units at a variable cost of $47 per unit. The two divisions have recently negotiated a transfer price of $48 per unit for the 12,400 units. (a) By how much will each division's income increase as a result of this transfer? Enter an increase as a positive number and a decrease as a negative number. Division A $fill in the blank 1 Division B $fill in the blank 2 (b) What is the total increase in income for Hibiscus Company? $fill in the blank 3arrow_forwardThe materials used by the North Division of Horton Company are currently purchased from outside suppliers at $29 per unit. These same materials are produced by Horton’s South Division. The South Division can produce the materials needed by the North Division at a variable cost of $14 per unit. The division is currently producing 126,000 units and has capacity of 180,000 units. The two divisions have recently negotiated a transfer price of $20 per unit for 54,000 units. By how much will each division's income increase as a result of this transfer? South Division $ North Division $arrow_forwardDecision on transfer pricing Materials used by the Instrument Division of Ziegler Inc. are currently purchased from outside suppliers at a cost of $447 per unit. However, the same materials are available from the Components Division. The Components Division has unused capacity and can produce the materials needed by the Instrument Division at a variable cost of $371 per unit. Assume that a transfer price of $425 has been established and that 26,500 units of materials are transferred, with no reduction in the Components Division's current sales. a. How much would Ziegler Inc.'s total operating income increase? b. How much would the Instrument Division's operating income increase? C. How much would the Components Division's operating income increase? d. Any transfer price will cause the total income of the company to as long as the supplier division capacity is toward making materials for products that are ultimately sold to the outside.arrow_forward

- Decision on transfer pricing Materials used by the Instrument Division of Ziegler Inc. are currently purchased from outside suppliers at a cost of $316 per unit. However, the same materials are available from the Components Division. The Components Division has unused capacity and can produce the materials needed by the Instrument Division at a variable cost of $262 per unit. a. If a transfer price of $288 per unit is established and 27,900 units of materials are transferred, with no reduction in the Components Division's current sales, how much would Ziegler Inc.'s total operating income increase? b. How much would the Instrument Division's operating income increase? $ C. How much would the Components Division's operating income increase?arrow_forwardDecision on Transfer Pricing Materials used by the Instrument Division of XPort Industries are currently purchased from outside suppliers at a cost of $368 per unit. However, the same materials are available from the Components Division. The Components Division has unused capacity and can produce the materials needed by the Instrument Division at a variable cost of $305 per unit. a. If a transfer price of $335 per unit is established and 41,300 units of materials are transferred, with no reduction in the Components Division's current sales, how much would XPort Industries’ total income from operations increase? b. How much would the Instrument Division’s income from operations increase?$ c. How much would the Components Division's income from operations increase?arrow_forwardFind minimum, maximum and appropriate transfer pricearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education