FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Suppose division A quoted a transfer price of $110 for up to 800 units. What would be the contribution to the company as a whole if a transfer were made? As manager of division B, would you be inclined to buy at $110? Explain.

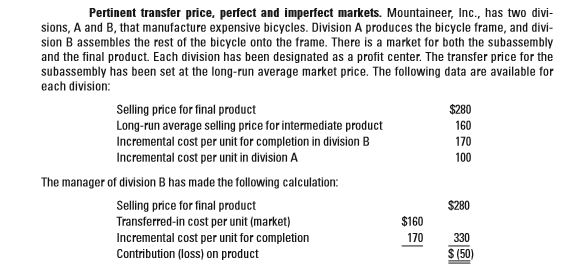

Transcribed Image Text:Pertinent transfer price, perfect and imperfect markets. Mountaineer, Ic., has two divi-

sions, A and B, that manufacture expensive bicycles. Division A produces the bicycle frame, and divi-

sion B assembles the rest of the bicycle onto the frame. There is a market for both the subassembly

and the final product. Each division has been designated as a profit center. The transfer price for the

subassembly has been set at the long-run average market price. The following data are available for

each division:

Selling price for final product

$280

Long-run average selling price for intermediate product

Incremental cost per unit for completion in division B

Incremental cost per unit in division A

160

170

100

The manager of division B has made the following calculation:

$280

Selling price for final product

Transferred-in cost per unit (market)

Incremental cost per unit for completion

Contribution (loss) on product

$160

170

330

S (50)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Weaver Company's predetermined overhead rate is $18.00 per direct labor-hour and its direct labor wage rate is $12.00 per hour. The following information pertains to Job A-200. Direct materials $200 Direct labor $120 What is the total manufacturing cost assigned to Job A-200?arrow_forwardThe materials used by Hibiscus Company Division A are currently purchased from outside supplier at $53 per unit. Division B is able to supply Division A with 12,400 units at a variable cost of $47 per unit. The two divisions have recently negotiated a transfer price of $48 per unit for the 12,400 units. (a) By how much will each division's income increase as a result of this transfer? Enter an increase as a positive number and a decrease as a negative number. Division A $fill in the blank 1 Division B $fill in the blank 2 (b) What is the total increase in income for Hibiscus Company? $fill in the blank 3arrow_forwardAssume you are the department B manager for Marleys manufacturing. Marley’s operates under a cost-based transfer structure. Assume you receive the majority of your raw materials from department A, which sells only to department B (they have no outside sales) Assume the market price for the items your department purchase is 15% below what you are being charged by department A of Marley’s manufacturing. Determine the operating income for department B, assuming department A “sold” department B 1,000 unit during the month and department A reduced the selling price to the market price. Round your percentage answer to one decimal.arrow_forward

- Help me pleasearrow_forwardCarol Components operates a Production Division and a Packaging Division. Both divisions are evaluated as profit centers. Packaging buys components from Production and assembles them for sale. Production sells many components to third parties in addition to Packaging. Selected data from the two operations follow: Capacity (units) Sales price Variable costsb Fixed costs a For Production, this is the price to third parties. b For Packaging, this does not include the transfer price paid to Production. Suppose Production is located in Country A with a tax rate of 30 percent and Distribution in Country B with a tax rate of 10 percent. All other facts remain the same. a. Optimal transfer price b. Transfer price c Transfer price Required: a. Current output in Production is 25,300 units. Packaging requests an additional 5,960 units to produce a special order. What transfer price would you recommend? to search b. Suppose Production is operating at full capacity. What transfer price would you…arrow_forwardAnstell Corporation operates a Manufacturing Division and a Marketing Division. Both divisions are evaluated as profit centers. Marketing buys products from Manufacturing and packages them for sale. Manufacturing sells many components to third parties in addition to Marketing. Selected data from the two operations follow: Capacity (units) Sales price* Variable costs + Fixed costs Manufacturing 250,000 $ 280 $ 112 $ 100,000 a. Transfer price b. Transfer price Marketing 125,000 $910 For Manufacturing, this is the price to third parties. t For Marketing, this does not include the transfer price paid to Manufacturing. per unit per unit $ 336 $ 720,000 Required: a. Current output in Manufacturing is 125,000 units. Marketing requests an additional 25,000 units to produce a special order. What transfer price would you recommend? b. Suppose Manufacturing is operating at full capacity. What transfer price would you recommend? c. Suppose Manufacturing is operating at 230,000 units. What transfer…arrow_forward

- Assume you are the department B manager for Marley's Manufacturing. Marley's operates under a cost-based transfer structure. Assume you receive the majority of your raw materials from department A, which sells only to department B (they have no outside sales). After calculating the operating income in dollars and operating income in percentage, analyze the following financial information to determine costs that may need further investigation.arrow_forwardats Assume a company has three products-A, B, and C-that emerge from a joint process. The joint processing costs that are incurred up to the split-off point equal $1,200,000. The selling prices and outputs for each product at the split-off point are as follows: Product A B С Selling Price $33 per pound $29 per pound $24 per pound Product A B C Each product can be processed further beyond the split-off point. The additional processing costs for each product and their respective selling prices after further processing are as follows: Output 14,000 pounds 18,000 pounds 19,000 pounds Additional Processing Costs $65,000 $72,000 $88,000 Selling Price $37 per pound $34 per pound $30 per pound The company is trying to decide whether to retain or discontinue the entire joint manufacturing process. What is the financial advantage (disadvantage) of continuing to operate the entire joint manufacturing process?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education