ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

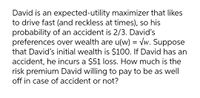

Transcribed Image Text:David is an expected-utility maximizer that likes

to drive fast (and reckless at times), so his

probability of an accident is 2/3. David's

preferences over wealth are u(w) = vw. Suppose

that David's initial wealth is $100. If David has an

accident, he incurs a $51 loss. How much is the

risk premium David willing to pay to be as well

off in case of accident or not?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Johnny owns a house that is worth $100,000. There is a O.1% chance that the house will be completely destroyed by fire, leaving Johnny with $0. Johnny's utility function is u(x) = vx, where x represents final wealth. Assuming that Johnny has no other wealth, what's the maximum amount that he would be willing to pay for an insurance policy that completely replaces his house if destroyed by fire? Make sure to answer with the dollar sign and then the number, i.e. $532.17. Be accurate up to the second decimal. You should not need to round. Hint: The hundredths place should be 0. Enter your answer herearrow_forwardYou have a house worth 300,000. A fire will burn everything to the ground and leave $0 in value. Assume full coverage in the case of a fıre. In every given year, there is a 5% probability that your home burns. If your Utility function is U=Wealth/2 what is the actuarily fair insurance premium? 512 10,000 15,000 520.33arrow_forwardSuppose every driver faces a 1.5% probability of an automobile accident every year, and on an average an accident will cost each driver $10,000. Suppose there are two types of individuals: those with $50,000 and those with $6,000 in the bank. Assume that individuals with $6,000 in the bank declare bankruptcy if they get in an accident. In the bankruptcy, creditors receive only what individuals have in the bank. What is the expected loss from an accident for individuals with $6,000 in the bank if they don’t buy comprehensive insurance coverage? a. $50,000.00 b. $6,000.00 c. $150.00 d. $90.00arrow_forward

- . Bob le Flambeur is offered a raffle ticket. With probability p, the raffle ticket wins, and pays 5 dollars. With probability 1-p, the ticket loses and pays nothing. One ticket costs 1 dollar. (a) If Bob has von Neumann-Morgenstern utility u(x)=³ over change in wealth z, what is the certainty equivalent for Bob of buying one ticket (as a function of p)? What is the risk premium? Solution: If Bob buys a raffle ticket, then with probability p he gains 4 dollars (5 dollars minus the price of the ticket), and with probability 1-p he loses 1 dollar. His expected utility is therefore 64p-(1-p) = 65p-1. The certainty equivalent is therefore CE(p) = 365p-1. The expected value of the lottery is 4p- (1 − p) = 5p - 1, giving a risk premium of R(p)=5p-1-65p - I. (b) Now suppose that, instead of the utility function above, Bob is risk-neutral. An un- scrupulous raffle saleswoman makes Bob the following offer. For 50 cents, she will tell him whether the ticket for sale will win or lose before Bob…arrow_forwardPLEASE CHECK THIS HOW TO SOLVEarrow_forward!arrow_forward

- Consider a person with the following utility function over wealth: u(w) = ew, where e is the exponential function (approximately equal to 2.7183) and w = wealth in hundreds of thousands of dollars. Suppose that this person has a 40% chance of wealth of $100,000 and a 60% chance of wealth of $2,000,000 as summarized by P(0.40, $100,000, $2,000,000). a. What is the expected value of wealth? b. Construct a graph of this utility function . c. Is this person risk averse, risk neutral, or a risk seeker? d. What is this person’s certainty equivalent for the prospect?arrow_forwardQuestion 2 A person has a wealth of $20,000 but faces an accident that results in a loss of S12,000 with probability, p. Suppose that Bermoulli utility is given by u(x) = -1/x. 1. Determine the maximum amount of money the person is willing to pay for complete coverage (as a function of p). 2. Now suppose that an insurance company offers an insurance contract with a deductible of $2,000. Again, determine the maximum amount of money a person is willing to pay for this insurance contract.arrow_forwardYou take a position with a large real estate development company as your first job after graduation. Your first big assignment is to sell an office building – you have been informed the company’s cost into the building (and the bottom line price it is willing to accept) is $400,000. You have identified a likely buyer and you assess that his top price is either $500,000 with a probability of .3, $600,000 with a probability of .5, or $1,000,000 with a probability of .2. You have to commit to a posted price – what price will maximize your profitability?arrow_forward

- An investor has a power utility function with a coefficient of relative risk aversion of 3. Compare the utility that the investor would receive from a certain income of £2 with that generated by a lottery having equally likely outcomes of £1 and £3. Calculate the certain level of income which, for an investor with preferences as above, would generate identical expected utility to the lottery described. How much of the original certain income of £2 the investor would be willing to pay to avoid the lottery? Detail the calculations and carefully explain your answer.arrow_forwardSuppose that a person's utility function is the square root of wealth. Suppose the person earns $100,000 per year. He or she has an illness with a probability of 0.2, and the cost of the treatment is $30,000. Would the person pay $6,000 for insurance? Why or why not? What is the most this person would pay to be insured (hint: equate expected utility to utility with certainty)? Suppose their utility function changed to wealth squared (hint: are they now risk averse?). Would they pay $6,000 for insurance? Why or why not?arrow_forwardQ.No.4. If you are supposed to a 40/60 chance of gaining or losing Rs.400 and insurance that removes the risk costs Rs.150; at what level of wealth will you be indifferent relative to taking the gamble or paying the insurance? That is, what is your certainty equivalent wealth? Assuming your utility function is U(W)= In(W).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education