FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

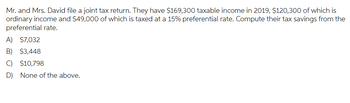

Transcribed Image Text:Mr. and Mrs. David file a joint tax return. They have $169,300 taxable income in 2019, $120,300 of which is

ordinary income and $49,000 of which is taxed at a 15% preferential rate. Compute their tax savings from the

preferential rate.

A) $7,032

B) $3,448

C) $10,798

D) None of the above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- • Aiden and Sophia are married and they have always filed Married Filing Jointly.• Aiden died May 5, 2020 at the age of 58. Sophia, age 56, has not remarried.• Aiden earned $5,000 in wages and Sophia earned $51,000 in wages.• Sophia paid all the cost of keeping up a home and provided all the support for theirtwo children, Mia and Oliver, who lived with them all year.• Mia is 11 years old and Oliver is 15 years old.• Sophia does not have enough deductions to itemize, but she did make a $500 cashcharitable contribution to a qualified charitable organization in tax year 2020.• Aiden, Sophia, Mia, and Oliver are all U.S. citizens with valid Social Securitynumbers. 5. What is most advantageous filing status allowable that Sophia can claim on the taxreturn for tax year 2020?a. Singleb. Head of Householdc. Qualifying Widow(er)d. Married Filing Jointly6. What amount can Sophia deduct as a charitable contribution adjustment?a. $0b. $250c. $300d. $500arrow_forwardam.100.arrow_forwardCora, 79, has an estate that includes her personal residence valued at $120,000 and $18,000 in a bank account that is solely in her name. She would like to arrange her estate so that she maintains exclusive control of the assets during her lifetime, but at her death the assets will pass to her friend, Mabel, outside of probate. Based on Cora's goals and situation, which of the following are correct statements about will substitutes that she could use? She should put her bank account in tenancy in common with Mabel. She should title her personal residence in joint tenancy with her friend, Mabel. She should execute a will that names her friend, Mabel, as the legatee of the bank account and the devisee of the personal residence. She should place the bank funds in a payable on death (POD) account with Mabel as beneficiary. She should change the title on her personal residence to indicate a life estate reserved for her lifetime and a remainder to her friend, Mabel. A)IV and V…arrow_forward

- When did Walt diedarrow_forwardin intestacy, what relative of the deceased generally ranks lowest in the hierarchy for the distribution of the estate assets? A. nieces and nephews B. Parents C. childeren D. spouse or common-law partnerarrow_forwardProblem 19-36 (LO. 7) At the time of her death, Ariana held the following assets. Personal residence (title listed as "Ariana and Peter, tenants by the entirety with right of survivorship") Savings account (listed as "Ariana and Rex, joint tenants with right of survivorship") with funds provided by Rex Certificate of deposit (listed as "Ariana, payable on proof of death to Rex") with funds provided by Ariana Unimproved real estate (title listed as "Ariana and Rex, equal tenants in common") Insurance policy on Ariana's life, issued by Lavender Company (Ariana's estate is the designated beneficiary) Insurance policy on Ariana's life, Issued by Crimson Company (Rex is the designated beneficiary, but Ariana can change beneficiaries) Fair Market Value $900,000 40,000 100,000 500,000 300,000 400,000 Assuming that Peter and Rex survive Ariana, how much is included in Ariana's probate estate? Ariana's gross estate? (Refer to text Section 18-3a as needed.) Ariana's probate estate includes $…arrow_forward

- 7arrow_forwardMargaret issues a promissory note payable to the order of Pancho. Pancho indroses the note toAdolfo, then Adolfo to Beatrice, then Beatrice back to Margaret. What happened to the obligationof Margaret?arrow_forwardAt the time of his death on July 9, Aiden held rights in the following real estate: The apartment building was purchased by Chloe, Aiden’s mother, and is owned in a joint tenancy with her. The tree farm and pastureland were gifts from Chloe to Aiden and his two sisters. The tree farm is held in joint tenancy, and the pastureland is owned as tenants in common. Aiden purchased the residence and owns it with his wife as tenants by the entirety. How much is included in Aiden’s gross estate based on the following assumptions? 3. Aiden dies after Chloe and his sisters, but before his wife. 4. Aiden dies last (i.e., he survives Chloe, his sisters, and his wife).arrow_forward

- 4. COMPUTE: Inheritance of brother 5. COMPUTE: Inheritance of girlfriend (mother of child) 6. COMPUTE: Inheritance of sonarrow_forward50. Mr. O, Filipino, married, died on August 1, 2018, three years after his marriage to Mrs. O. He left the following: a. Property inherited by Mr. O from his father who died February 14, 2013 b. Property inherited by Mrs. O from her father who died February 14, 2014 c. Property inherited by Mr. O from his mother who died February 14, 2015 d. Property inherited by Mrs. O from her mother who died February 14, 2016 c. Property acquired thru the labor of P3,000,000 1,200,000 1,800,000 1,400,000 Mr. O Mrs. O Mr. & Mrs. O (family bome) 2,000,000 1,500,000 2,400,000 1,600,000 f. Other personal property Deductions claimed by the estate: a. Funeral expense b. Unpaid mortgages on property in letters: a 500,000 c. Claims against the estate d. Accrued taxes (before the death of Mr.O) 220,000 b. 300,000 c. 180,000 d 200,000 170,000 80,000 Determine the net taxable estate assuming 1. Conjugal partnership of gains 2. Absolute community of propertyarrow_forwardMarie Lincoln is a head of household. She is 37 years old and her address is 4110 N. E. 13 th street, Miami, FL 33127. Additional information about ms Lincoln is as follows:Social security number: 412 34 5670Date of birth : 1 / 14 / 1982W 2 for Marie shows these amounts:Wages ( box 1) = 43.600Federal W / H ( box 2) = 2.488Social security wages ( box 3) = 43.600Social security W / H ( box 4) = 2703.20Medicare wages ( box 5) = 43600Medicare W / H ( box 6 )= 632Form 1099 - INT for Marie shows this amount :Box 1 = $ 500.000 from A & D Bank.Dependent: Son Steven is 10 years old. His date of birth is 5 / 11 / 2009 . His social security number is 412 34 5672. Marie is an administrative assistant.Required.Prepare the tax return for Ms Lincoln using the appropriate form. She is entitled to a 2000 child tax credit. For now, enter the credit on line 13 a, page 2 of the 1040. She wants to contribute to the presidential election campaign. Ms Lincoln had qualifying health care coverage at all…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education