FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:3-a. Refer to the move time, process time, and so forth, given for month 4. Assume that in month 5 the move time, process time, and so

forth, are the same as in month 4, except that through the use of Lean Production the company is able to completely eliminate the

queue time during production. Compute the new throughput time and MCE.

3-b. Refer to the move time, process time, and so forth, given for month 4. Assume in month 6 that the move time, process time, and so

forth, are again the same as in month 4, except that the company is able to completely eliminate both the queue time during

production and the inspection time. Compute the new throughput time and MCE.

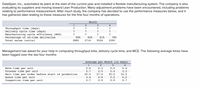

Transcribed Image Text:DataSpan, Inc., automated its plant at the start of the current year and installed a flexible manufacturing system. The company is also

evaluating its suppliers and moving toward Lean Production. Many adjustment problems have been encountered, including problems

relating to performance measurement. After much study, the company has decided to use the performance measures below, and it

has gathered data relating to these measures for the first four months of operations.

Month

1

2

4

Throughput time (days)

Delivery cycle time (days)

Manufacturing cycle efficiency (MCE)

Percentage of on-time deliveries

Total sales (units)

?

?

?

89%

84%

81%

78%

3880

3714

3524

3390

Management has asked for your help in computing throughput time, delivery cycle time, and MCE. The following average times have

been logged over the last four months:

Average per Month (in days)

2

3

4

Move time per unit

Process time per unit

Wait time per order before start of production

Queue time per unit

Inspection time per unit

0.6

0.3

0.4

0.4

2.7

2.5

2.4

2.2

25.0

27.4

30.0

32.5

4.4

4.9

5.5

6.2

0.7

0.9

0.9

0.7

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Example1: A company is comparing between two equipment for quality inspection as per data in below table: DATA MACHINE 1 MACHINE 2 INITIAL COST 12,000 8,000 1,000 (YEARS 1-5) 3,000 (YEARS 6-14) ANNUAL NET 3,000 INCOME MAXIMUM LIFE 14 The company used rate of return 15% to take the decision by: 1. Payback period analysis. 2. NPV analysis.arrow_forwardRequired information (The following information applies to the questions displayed below.] Jonas Materials Science (JMS) purchases its materials from several countries. As part of its cost-control program, JMS uses a standard cost system for all aspects of its operations, including purchases of direct materials. The company establishes standard costs for direct materials at the beginning of each fiscal year. Pat Butch, the purchasing manager, is happy with the result of the year just ended. He believes that the purchase price variance for direct materials for the year will be favorable and is very confident that his department has at least met the standard prices. The preliminary report from the controller's office confirms his jubilation. Following is a portion of the preliminary report: Total quantity purchased Average price per kilogran Standard price per kilogran 40,000 kilograms $50.00 $ 60.00 Budgeted quantity per quarter 5,000 kilograns In the fourth quarter, the purchasing…arrow_forwardAs an analyst at Delta Air Lines, you are asked to help the operations staff. Operations has identified a new method of loading baggage that is expected to result in a 35 percent reduction in labor time but no changes in any other costs. The current labor cost to load bags is $3 per bag. Other costs are $2 per bag. Required: a-1. What differential costs should the operations staff consider for the decision to use the new method next year? a-2. What would be the cost savings per bag using it? b. How would management use the information in requirement (a) and any other appropriate information to proceed with the contemplated use of the new baggage loading method? What would be the cost savings per bag using it? Note: Round your answer to 2 decimal places. Cost savings per bagarrow_forward

- High Country, Inc., produces and sells many recreational products. The company has just opened a new plant to produce a folding camp cot that will be marketed throughout the United States. The following cost and revenue data relate to May, the first month of the plant's operation: Beginning inventory Units produced Units sold Selling price per unit Selling and administrative expenses: Variable per unit Fixed (per month) Manufacturing costs: Direct materials cost per unit Direct labor cost per unit Variable manufacturing overhead cost per unit Fixed manufacturing overhead cost (per month) 2. Assume that the company uses variable costing. a. Determine the unit product cost. b. Prepare a contribution format income statement for May. Req 1A Management is anxious to assess the profitability of the new camp cot during the month of May. Required: 1. Assume that the company uses absorption costing. a. Determine the unit product cost. b. Prepare an income statement for May. Req 1B Req ZA…arrow_forwardPlease do not give solution in image format ? And Fast answering please ? And Explain Proper Step by Step.arrow_forwardElmo Security Consultants (ESC) offer a standardized review of data security for small business owners. The following data apply to the provision of these reviews: Sales price per unit (1 unit = 1 review with recommendations) Fixed costs (per month): Selling and administration Production overhead (e.g., rent of facilities) Variable costs (per review): Labor for oversight and feedback Outsourced security analysis Materials used in reviews Review overhead Selling and administration (e.g., scheduling and billing) Number of reviews per month Required: a. Variable review (production) cost per unit b. Variable total cost per unit c. Full cost per unit d. Full absorption cost per unit e. Prime cost per unit f. Conversion cost per unit Calculate the amount for each of the following (one unit = one review) if the number of reviews is 2,500 per month. Also calculate if the number of reviews decreases to 2,000 per month. g. Contribution margin per unit h. Gross margin per unit 2,500 Reviews $ 500…arrow_forward

- Could you please answer all the reuired fields correctly.arrow_forwardHigh Country, Incorporated, produces and sells many recreational products. The company just opened a new plant to produce a folding camp cot that will be marketed throughout the United States. The following cost and revenue data relate to May, the first month of the plant's operation: Beginning inventory Units produced Units sold Selling price per unit Selling and administrative expenses: Variable per unit Fixed (per month) Manufacturing costs: Direct materials cost per unit Direct labor cost per unit Variable manufacturing overhead cost per unit Fixed manufacturing overhead cost (per month) Required: 1. Assume the company uses absorption costing. a. Calculate the camp cot's unit product cost. b. Prepare an income statement for May. 2. Assume the company uses variable costing. a. Calculate the camp cot's unit product cost. b. Prepare a contribution format income statement for May. 0 46,000 41,000 $83 $4 $ 565,000 $ 16 $ 8 $1 $ 782,000 Complete this question by entering your answers in…arrow_forwardplease do not provide solution in image format thank you!arrow_forward

- Required information [The following information applies to the questions displayed below] Nation's Capital Fitness, Inc., operates a chain of fitness centers in the Washington, D.C., area. The firm's controller is accumulating data to be used in preparing its annual profit plan for the coming year. The cost behavior pattern of the firm's equipment maintenance costs must be determined. The accounting staff has suggested the use of the high-low method to develop an equation, in the form of Y=a+bX, for maintenance costs. Data regarding the maintenance hours and costs for last year are as follows: Month January February March April May June July August September October November December Total Average "Rounded Hours of Maintenance Service 530 470 260 470 360 450 330 450 470 380 360 360 4,890 408- Maintenance Costs $ 5,068 4,220 2,800 4,330 2,970 4,140 3,100 3,510 4,010 3,200 3,250 3,040 $43,638 $ 3,637 Required: 1. Using the high-low method of cost estimation, estimate the behavior of the…arrow_forward7arrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education