FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Langley Company is considering two capital investments. Both investments have an initial cost of $10,000,000 and total net

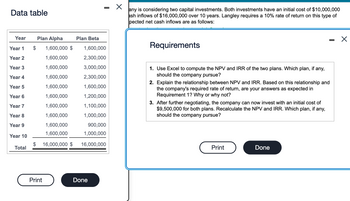

Transcribed Image Text:Data table

Year

Year 1

Year 2

Year 3

Year 4

Year 5

Year 6

Year 7

Year 8

Year 9

Year 10

Total

Plan Alpha Plan Beta

1,600,000 $

1,600,000

1,600,000

2,300,000

1,600,000

3,000,000

1,600,000

2,300,000

1,600,000

1,600,000

1,600,000

1,200,000

1,600,000

1,100,000

1,600,000

1,000,000

1,600,000

900,000

1,600,000

1,000,000

$ 16,000,000 $ 16,000,000

Print

I

Done

X

any is considering two capital investments. Both investments have an initial cost of $10,000,000

ash inflows of $16,000,000 over 10 years. Langley requires a 10% rate of return on this type of

pected net cash inflows are as follows:

Requirements

1. Use Excel to compute the NPV and IRR of the two plans. Which plan, if any,

should the company pursue?

2. Explain the relationship between NPV and IRR. Based on this relationship and

the company's required rate of return, are your answers as expected in

Requirement 1? Why or why not?

3. After further negotiating, the company can now invest with an initial cost of

$9,500,000 for both plans. Recalculate the NPV and IRR. Which plan, if any,

should the company pursue?

Print

-

Done

X

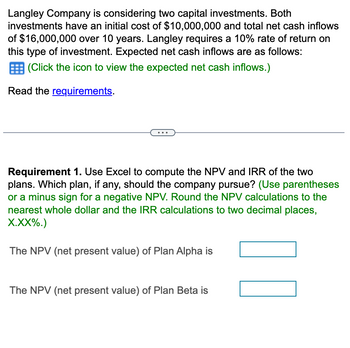

Transcribed Image Text:Langley Company is considering two capital investments. Both

investments have an initial cost of $10,000,000 and total net cash inflows

of $16,000,000 over 10 years. Langley requires a 10% rate of return on

this type of investment. Expected net cash inflows are as follows:

(Click the icon to view the expected net cash inflows.)

Read the requirements.

Requirement 1. Use Excel to compute the NPV and IRR of the two

plans. Which plan, if any, should the company pursue? (Use parentheses

or a minus sign for a negative NPV. Round the NPV calculations to the

nearest whole dollar and the IRR calculations to two decimal places,

X.XX%.)

The NPV (net present value) of Plan Alpha is

The NPV (net present value) of Plan Beta is

00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Perez Company is considering an investment of $26,945 that provides net cash flows of $8,500 annually for four years.(a) What is the internal rate of return of this investment? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.)(b) The hurdle rate is 7%. Should the company invest in this project on the basis of internal rate of return?arrow_forwardTurner Hardware is adding a new product line that will require an investment of $1,530,000. Managers estimate that this investment will have a 10-year life and generate net cash inflows of $320,000 the first year, $265,000 the second year, and $230,000 each year thereafter for eight years. The investment has no residual value. Compute the payback period. First enter the formula, then calculate the payback period. (Round your answer to two decimal places.) Full years Amount to complete recovery in next year Projected cash inflow in next year )= Payback )= yearsarrow_forwardFB Company is considering investing in two construction projects, and he developed the following estimates of the cash flows. His required return is 10% and views these projects as equally risky. Year Project 1 cash flow project 2 cash flow 0 -550000 -700000 1 150000 200000 2 200000 150000 3 150000 250000 4 150000 150000 5 100000 150000 Required: a) Calculate the net present value (NPV) of each project, assess its acceptability, and indicate which project is best using NPV. b) Calculate the profitability index (PI) of each project, assess its acceptability, and indicate which project is best using PI. c) If both the projects have recorded a positive NPV value and the projects are mutually exclusive, which projects would you recommend for FB Company to undertake? Why?arrow_forward

- Salsa Company is considering an investment in technology to improve its operations. The investment costs $250,000 and will yield the following net cash flows. Management requires a 7% return on Investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Year Net cash Flow 1 $ 48,400 2 52,500 3 76,200 4 94,700 5 125,100 Required: 1. Determine the payback period for this Investment. 2. Determine the break-even time for this Investment. 3. Determine the net present value for this Investment. 4. Should management invest in this project based on net present value? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Determine the break-even time for this investment. (Enter cash outflows with a minus sign. Round your break-even time answer to 1 decimal place.) 1 at 7% Year Net Cash Flows Present Value of Present Value of Net Cash Flows per Year Initial investment $ (250,000) Year 1…arrow_forwardUse the information below to answer Question#40: GIVEN: The XYZ Company is considering the following project with its corresponding financial data. The Company requires a 9% return from its investments. $ 500,000 $ 200,000 $ 225,000 $ 245,000 Initial investment: Expected Cash in-flow Year 1: Expected Cash in-flow Year 2: Expected Cash in-flow Year 3: Present Value Factor of 1 at 9%: n=1: 0.91743 n=2: 0.84168 n=3: 0.77218 40) Choose from one of the following that accurately depicts this decision: A) This investment should not be considered because NPV is a negative $62,048 B) This învestment should be considered because NPV equals positive $62,048 C) This investment should be considered because the IRR for this investment is obviously less than its Required Rate of Return D) B and Care both correctarrow_forwardPerez Company is considering an investment of $20,957 that provides net cash flows of $6,900 annually for four years. (a) What is the internal rate of return of this investment? (PV of $1, FV of $1, PVA of $1, and FVA of $1) Note: Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals. (b) The hurdle rate is 9%. Should the company invest in this project on the basis of internal rate of return? Complete this question by entering your answers in the tabs below. Required A Required B What is the internal rate of return of this investment? Present value factor Internal rate of return % Required A Required Barrow_forward

- aaarrow_forwardWavy Inc is examining a project that requires an initial investment of -10 million today. This will be followed by several years of positive incremental after-tax cash flows. However, during the last year of the project's life Wavy expects that the incremental cash flow will again be negative. By which method should Wavy determine whether or not to invest? A) Both NPV or IRR are fine, as they must arrive at same investment decision B) IRR, because there will be no NPV solution in this case C) Neither NPV or IRR are useful in this situation D) NPV, since this project will have two IRRsarrow_forwardVijayarrow_forward

- Please answer fast without plagiarism and introduction pleasearrow_forwardSalsa Company is considering an investment in technology to improve its operations. The investment costs $241,000 and will yield the following net cash flows. Management requires a 10% return on investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) Note: Use appropriate factor(s) from the tables provided. Year Net cash Flow 1 $ 48, 200 2 53,900 3 76, 400 4 95,500 5 126,500 Required: Determine the payback period for this investment. Determine the break - even time for this investment. Determine the net present value for this investment. Should management invest in this project based on net present value?arrow_forwardPlease provide correct solution for correct answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education