FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

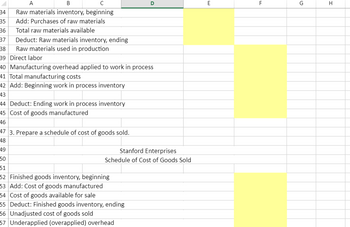

Transcribed Image Text:A

B

с

34

Raw materials inventory, beginning

35 Add: Purchases of raw materials

36 Total raw materials available

37

Deduct: Raw materials inventory, ending

Raw materials used in production

38

39 Direct labor

40 Manufacturing overhead applied to work in process

41 Total manufacturing costs

42 Add: Beginning work in process inventory

43

44 Deduct: Ending work in process inventory

45 Cost of goods manufactured

46

47 3. Prepare a schedule of cost of goods sold.

48

49

50

51

52 Finished goods inventory, beginning

53 Add: Cost of goods manufactured

D

Stanford Enterprises

Schedule of Cost of Goods Sold

54 Cost of goods available for sale

55 Deduct: Finished goods inventory, ending

56 Unadjusted cost of goods sold

57 Underapplied (overapplied) overhead

E

LL

F

G

H

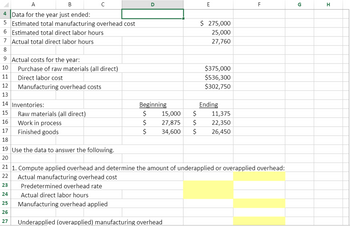

Transcribed Image Text:A

B

4

Data for the year just ended:

5 Estimated total manufacturing overhead cost

6 Estimated total direct labor hours

7

Actual total direct labor hours

8

9 Actual costs for the year:

10

11

12

13

14 Inventories:

15

16

17

18

19 Use the data to answer the following.

20

Purchase of raw materials (all direct)

Direct labor cost

Manufacturing overhead costs

Raw materials (all direct)

Work in process

Finished goods

D

E

$ 275,000

25,000

27,760

$375,000

$536,300

$302,750

Beginning

$

15,000 $

11,375

$

27,875 $

22,350

$ 34,600 $ 26,450

Ending

F

21 1. Compute applied overhead and determine the amount of underapplied or overapplied overhead:

22

Actual manufacturing overhead cost

23

Predetermined overhead rate

24

Actual direct labor hours

25

Manufacturing overhead applied

26

27

Underapplied (overapplied) manufacturing overhead

G

H

Expert Solution

arrow_forward

Step 1 Introduction

The statement of cost of goods manufactured represents the cost of goods that are finished during the period.

The statement of cost of goods sold represents the cost of goods that are sold during the period.

The overhead is applied to the production on the basis of a predetermined overhead rate. The pre-determined overhead rate is calculated as the estimated overhead cost divided by the estimated base activity.

Step by stepSolved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

By chance, do you have the formulas that you used for each answer so i can study it more?

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

By chance, do you have the formulas that you used for each answer so i can study it more?

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Mason Company provided the following data for this year: Sales Direct labor cost Raw material purchases Selling expenses Administrative expenses Manufacturing overhead applied to work in process Actual manufacturing overhead costs Inventories Raw materials Work in process Finished goods Beginning $ 8,600 $ 5,800 $ 71,000 Ending $ 10,800 $ 20,000 $ 25,400 $ 653,000 $ 82,000 $ 133,000 $ 106,000 $ 45,000 $ 223,000 $ 201,000 Required: 1. Prepare a schedule of cost of goods manufactured. Assume all raw materials used in production were direct materials. 2. Prepare a schedule of cost of goods sold. Assume the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. 3. Prepare an income statement.arrow_forwardHemlock Company developed the following data for the current year: Beginning work in process inventory $275,000 Direct materials used 160,000 Actual overhead 340,000 Overhead applied 225,000 Cost of goods manufactured 265,000 Total manufacturing costs 860,000 Hemlock Company's direct labor cost for the year is?arrow_forwardEquivalent Units of Production and Related Costs The charges to Work in Process—Assembly Department for a period, together with information concerning production, are as follows. All direct materials are placed in process at the beginning of production. Work in Process-Assembly Department Bal., 8,000 units, 65% completed 31,880 To Finished Goods, 184,000 units ? Direct materials, 188,000 units @ $2.10 394,800 Direct labor 404,400 Factory overhead 157,320 Bal., ? units, 20% completed ? Determine the following: a. The number of units in work in process inventory at the end of the period. units b. Equivalent units of production for direct materials and conversion. If an amount is zero or a blank, enter in "0". Work in Process-Assembly Department Equivalent Units of Production for Direct Materials and Conversion Costs WholeUnits Equivalent UnitsDirect Materials Equivalent UnitsConversion Inventory in process, beginning…arrow_forward

- Department G had 1,920 units 25% completed at the beginning of the period, 13,800 units were completed during the period, 1,600 units were 20% completed at the end of the period, and the following manufacturing costs debited to the departmental work in process account during the period: Work in process, beginning of period $29,200 Costs added during period: Direct materials (13,480 units at $8) 107,840 Direct labor Factory overhead 73,200 24,400 All direct materials are placed in process at the beginning of production and the first-in, first-out method of inventory costing is used. The total cost of 1,920 units of beginning inventory which were completed during the period is (do not round unit cost calculations) O $39,504 O $29,200 $37,443 $41,104arrow_forwardConsider the following information for June: Work-in- Raw Process Finished Material (WIP) Goods Beginning inventory $ 60,000 $ 24,000 $ 60,000 Ending inventory $ 90,000 $ 45,000 $ 80,000 Other information: Net income (after adjustment) $ 779,000 Purchases $ 600,000 Cost of goods sold (before adjustment) $ 1,420,000 Sales $ 2,800,000 Direct labor $ 95,000 Compute APPLIED manufacturing overhead.arrow_forwardDepartment G had 1,920 units 25% completed at the beginning of the period, 13,600 units were completed during the period, 1,600 units were 20% completed at the end of the period, and the following manufacturing costs were debited to the departmental work in process account during the period: Work in process, beginning of period Costs added during period: Direct materials (13,280 units at $9) Direct labor Factory overhead $27,200 119,520 76,200 25,400 All direct materials are placed in process at the beginning of production, and the first-in, first-out method of inventory costing is used. What is the total cost of the units started and completed during the period (do not round unit cost calculation)? a. $175,756 b. $211,074 c. $105,120 d. $193,415arrow_forward

- Cost data for Disksan Manufacturing Company for the month ended January 31 are as follows: Inventories January 1 January 31 Materials $180,000 $145,500 Work in process 334,600 290,700 Finished goods 675,000 715,000 Direct labor $2,260,000 Materials purchased during January 1,375,000 Factory overhead incurred during January: Indirect labor 115,000 Machinery depreciation 90,000 Heat, light, and power 55,000 Supplies 18,500 Property taxes 10,000 Miscellaneous costs 33,100 a. Prepare a cost of goods manufactured statement for January.arrow_forwardDirect Material, Beginning $7,000 WIP, Beginning 7,500 Finished goods, Beginning 10,000 Raw Material purchased 46,800 Selling & general expenses 6,700 Direct Material, Ending 9,000 WIP, Ending 3,500 Finished goods, Ending 12,000 Direct Labor 8,000 Factory overhead is applied at the rate of 80% of direct labor cost. You are required to calculate: i) Cost of goods manufactured ii) Cost of goods soldarrow_forwardDepartment G had 2,280 units 25% completed at the beginning of the period, 12,700 units were completed during the period, 1,900 units were 20% completed at the end of the period, and the following manufacturing costs debited to the departmental work in process account during the period: Work in process, beginning of period $33,800 Costs added during period: Direct materials (12,320 units at $8) 98,560 Direct labor 81,600 Factory overhead 27,200 All direct materials are placed in process at the beginning of production and the first-in, first-out method of inventory costing is used. The total cost of 2,280 units of beginning inventory which were completed during the period is (do not round unit cost calculations) $33,800 $50,572 $45,698 $48,672arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education