FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

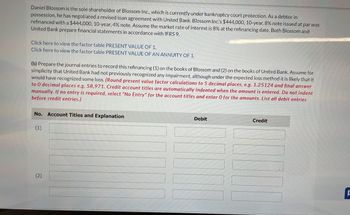

Transcribed Image Text:Daniel Blossom is the sole shareholder of Blossom Inc., which is currently under bankruptcy court protection. As a debtor in

possession, he has negotiated a revised loan agreement with United Bank. Blossom Inc.'s $444,000, 10-year, 8% note issued at par was

refinanced with a $444,000, 10-year, 4% note. Assume the market rate of interest is 8% at the refinancing date. Both Blossom and

United Bank prepare financial statements in accordance with IFRS 9.

Click here to view the factor table PRESENT VALUE OF 1.

Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1.

(b) Prepare the journal entries to record this refinancing (1) on the books of Blossom and (2) on the books of United Bank. Assume for

simplicity that United Bank had not previously recognized any impairment, although under the expected loss method it is likely that it

would have recognized some loss. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answer

to 0 decimal places e.g. 58,971. Credit account titles are automatically indented when the amount is entered. Do not indent

manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries

before credit entries.)

No. Account Titles and Explanation

(1)

(2)

Debit

Credit

E

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Markel Inc. has bonds outstanding during a year in which the general (risk-free) rate of interest has not changed. Markel elected the fair value option for the bonds upon issuance. What will the company report for the bonds in its income statement for the year?arrow_forwardStewart Enterprises has the following investments, all purchased prior to 2021: Stewart does not intend to sell any of these investments and does not believe it is more likely than not that it will have to sell any of the bond investments before fair value recovers. Required: For each investment, Prepare the appropriate adjusting journal entries to account for each investment for 2021 and 2022. 1. Bee Company 5% bonds, purchased at face value, with an amortized cost of $4,160,000, and classified as held to maturity. At December 31, 2021, the Bee investment had a fair value of $3,540,000, and Stewart calculated that $320,000 of the fair value decline is a credit loss and $300,000 is a noncredit loss. At December 31, 2022, the Bee investment had a fair value of $3,740,000, and Stewart calculated that $180,000 of the difference between fair value and amortized cost was a credit loss and $240,000 was a noncredit loss. 2. Oliver Corporation 4% bonds, purchased at face value, with an…arrow_forward12. Seco Corp. was forced into bankruptcy and is in the process of liquidating assets and paying claims. Unsecured claims will be paid at the rate of forty cents on the dollar. Hale holds a $30,000 noninterest- bearing note receivable from Seco collateralized by an asset with a book value of $35,000 and a liquidation value of $5,000. The amount to be realized by Hale on this note is a. $5,000 b. $12,000 c. $15,000 d. $17,000arrow_forward

- rrarrow_forwardSienna Company developed a specialized banking application software program that it licenses to various financial institutions through multiple-year agreements. On January 1, 2021, these licensing agreements have a fair value of $905,000 and represent Sienna's sole asset. Although Sienna currently has no liabilities, the company has a $188,000 net operating loss (NOL) carry-forward because of recent operating losses. On January 1, 2021, Paoli, Inc., acquired all of Sienna's voting stock for $1,130,000. Paoli expects to extract operating synergies by integrating Sienna's software into its own products. Paoli also hopes that Sienna will be able to receive a future tax reduction from its NOL. Assume an applicable federal income tax rate of 21 percent. a. If there is a greater than 50 percent chance that the subsidiary will be able to utilize the NOL carry-forward, how much goodwill should Paoli recognize from the acquisition? b. If there is a less than 50 percent chance that the…arrow_forwardBefore any debt cancellation, the insolvent KuhnCo holds business equipment, its only asset, with a fair market value of $1 million and related liabilities of $1.25 million. The lender agrees to cancel $400,000 of the liabilities. KuhnCo has no other liabilities. a. How much gross income does KuhnCo report as a result of the debt cancellation? b. How would your answer change, if at all, had the lender cancelled $200,000 of the debt?arrow_forward

- Sonny and Cher equally own Song Corporation, an 5 corporation. Each has a $50,000 stock basis at the beginning of the year. Song Corporation has a $100,000 mortgage on its balance sheet, as well as a note payable to Cher for $25,000. During the current year, Song Corporation reports an ordinary loss of $105,000. 1. What is Sonny's stock basis at the end of the year? 2. What is Sonny's debt basis at the end of the year? 3. What loss will Sonny report on his tax return for the year? 4. What is Cher's stock basis at the end of the year? 5. What is Cher's debt basis at the end of the year? 6. What loss will Cher report on her tax return for the year?arrow_forwardFranklin Corp. has a debt investment that it has held for several years. When it purchased the debt investment, Franklin classified and accounted for it as available-for-sale. Can Franklin use the fair value option for this investment? Explain.arrow_forwardNYK, Inc.retires a $45 million bond issue when the carrying value of the bonds is $47 million, but the market value of the bonds is $45 million. The entry to record the retirement will include: Select one: a. A credit of $4 million to Gain on Bond Retirement. b. A debit of $4 million to Loss on Bond Retirement. c. No gain or loss on retirement d. A debit of $2 million to Loss on Bond Retirement e. A credit of $2 million to Gain on Bond Retirement.arrow_forward

- Aa.47.arrow_forwardNYK, Inc.retires a $45 million bond issue when the carrying value of the bonds is $43 million, but the market value of the bonds is $46 million. The entry to record the retirement will include: Select one: a. A debit of $3 million to Loss on Bond Retirement. b. A credit of $1 million to Gain on Bond Retirement. c. A debit of $1 million to Loss on Bond Retirement d. No gain or loss on retirement e. A credit of $2 million to Gain on Bond Retirement.arrow_forwardThree years ago American Insulation Corporation issued 10%, $800,000, 10-year bonds for $770,000. American Insulation exercised its call privilege and retired the bonds for $790,000. The corporation uses the straight-line method to determine interest. Required: Prepare the journal entry to record the call of the bonds. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education