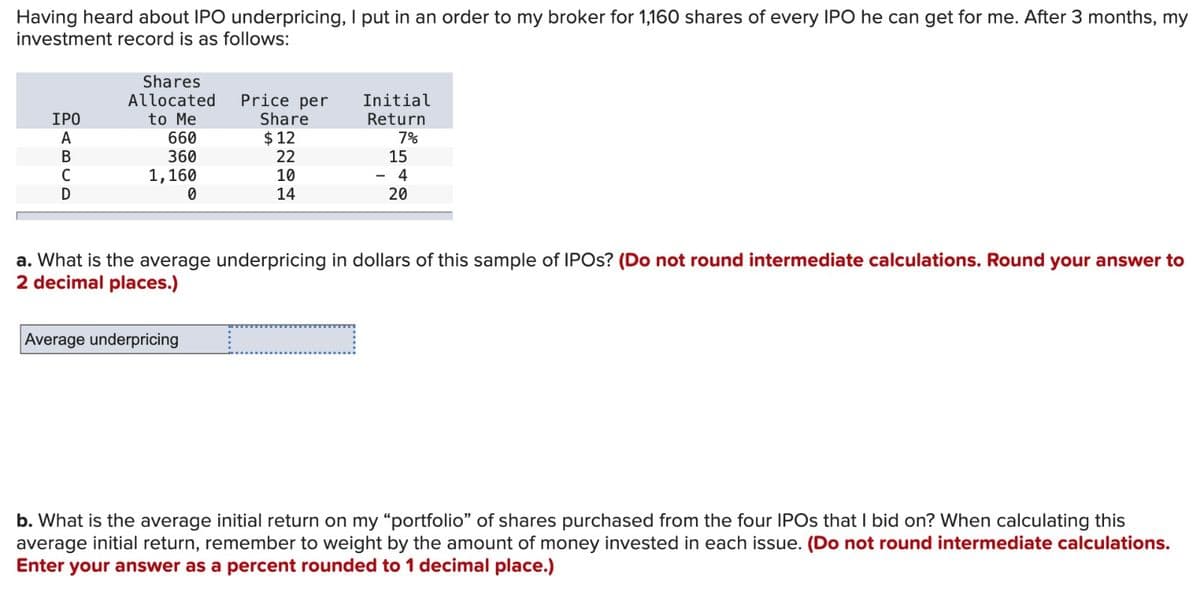

Having heard about IPO underpricing, I put in an order to my broker for 1,160 shares of every IPO he can get for me. After 3 months, my investment record is as follows: Shares Allocated ΙΡΟ to Me Price per Share Initial Return A 660 $12 B 360 22 7% 15 C 1,160 10 - 4 D 0 14 20 a. What is the average underpricing in dollars of this sample of IPOs? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Average underpricing b. What is the average initial return on my "portfolio" of shares purchased from the four IPOs that I bid on? When calculating this average initial return, remember to weight by the amount of money invested in each issue. (Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place.)

Having heard about IPO underpricing, I put in an order to my broker for 1,160 shares of every IPO he can get for me. After 3 months, my investment record is as follows: Shares Allocated ΙΡΟ to Me Price per Share Initial Return A 660 $12 B 360 22 7% 15 C 1,160 10 - 4 D 0 14 20 a. What is the average underpricing in dollars of this sample of IPOs? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Average underpricing b. What is the average initial return on my "portfolio" of shares purchased from the four IPOs that I bid on? When calculating this average initial return, remember to weight by the amount of money invested in each issue. (Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place.)

Chapter14: Corporation Accounting

Section: Chapter Questions

Problem 4TP: On November 7, 2013, Twitter released its initial public offering (IPO) priced at $26 per share....

Related questions

Question

Baghiben

Transcribed Image Text:Having heard about IPO underpricing, I put in an order to my broker for 1,160 shares of every IPO he can get for me. After 3 months, my

investment record is as follows:

Shares

Allocated

IPO

to Me

Price per

Share

Initial

Return

A

660

$12

7%

B

с

360

1,160

22

15

10

D

0

14

- 4

20

a. What is the average underpricing in dollars of this sample of IPOS? (Do not round intermediate calculations. Round your answer to

2 decimal places.)

Average underpricing

b. What is the average initial return on my "portfolio" of shares purchased from the four IPOs that I bid on? When calculating this

average initial return, remember to weight by the amount of money invested in each issue. (Do not round intermediate calculations.

Enter your answer as a percent rounded to 1 decimal place.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning