Personal Finance

13th Edition

ISBN: 9781337669214

Author: GARMAN

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

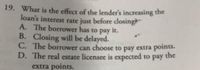

Transcribed Image Text:19. What is the effect of the lender's increasing the

loan's interest rate just before closing

A. The borrower has to pay it.

B. Closing will be delayed.

C. The borrower can choose to pay extra points.

D. The real estate licensee is expected to pay

the

extra points.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Which of these statements is true? A)There is no reason to pay off a loan early B) when shopping for a loan, you need to compare only APRs C) the more you owe, the higher your interest payment will be D) you can save money by making the smallest down payment the lender will allowarrow_forwardQuestions D, E, F, Garrow_forward6. Calculating simple interest and APR on a single-payment loan You are taking out a single-payment loan that uses the simple interest method to compute the finance charge. You need to figure out what your payment will be when the loan comes due. The equation to calculate the finance charge is: FsFs = P r t In the equation, FsFs is the finance charge for the loan. What are the other values? P is the amount of the loan. r is the stated rate of interest. t is the term of the loan in . You’re borrowing $4,000 for a year and a half with a stated annual interest rate of 10%. Complete the following table. (Note: Round your answers to the nearest dollar.)arrow_forward

- What's New ur Read and analyze the situation below. Let's Save Michael is planning to apply for a loan in Quezon Cooperative Bank, he is already aware of the terms payment for his loan but when he is about to pass his application form and compare his computation with the terms of payment provided by the bank he notices some discrepancy. Michael's Computation Computation from the bank Amount of Loan: P100,000 Amount of Loan: P100,000 Interest rate: 3% Interest rate: 3% Due Date: After 3 years Computation: I = (100, 000)(0.03(3) Year 1 Year 2 Year 3 9272.70 000 106,090 0609 109,272.70 Int %3D Amt 103,000 %3D Amount to be paid after 3 years e acq 000ʻ6d = I To enlighten he asked some explanations why they have different computations and the bank gave him the detailed computation: Initially at t = 0 P100,000 P100,000 (1.03) = P103,000 at t = 2 b P103,000 (1.03) = P106,090 P106,090 (1.03) = P109,272.70 at t = 1 %3D slumo %3D at t = 3 %3D Questions 1. Is Michael's computation correct? 2. Is…arrow_forwardWhich of the following refers to the ratio of the interest to the principal repayment on an annual unpaid loan? A. it increases as the loan gets older О в. it decreases as the loan gets older O c. it remains constant over the life of the loan O D. it changes according to the level of market interest rates during the life of the loanarrow_forwardWhat's New ur Read and analyze the situation below. Let's Save Michael is planning to apply for a loan in Quezon Cooperative Bank, he is already aware of the terms payment for his loan but when he is about to pass his application form and compare his computation with the terms of payment provided by the bank he notices some discrepancy. Michael's Computation Computation from the bank Amount of Loan: P100,000 Interest rate: 3% Amount of Loan: P100,000 Interest rate: 3% Due Date: After 3 years Computation: I = (100, 000)(0.03(3) Year 1 Year 2 Year 3 9272.70 eco Amt 0609 109,272.70 060'901 Int 0008 Amount to be paid after 3 years o C ag 000'6d = I 000'60I To enlighten he asked some explanations why they have different computations and the bank gave him the detailed computation: Initially at t = 0 000'00 P100,000 (1.03) = P103,000 P103,000 (1.03) = P106,090 P106,090 (1.03) = P109,272.70 at t = 1 at t = 2 at t = 3 Questions 1. Is Michael's computation correct? 2. Is the bank's computation…arrow_forward

- Borrowers should consider refinancing their existing fixed rate mortgage (FRM) loan only when the market interest rates _____; and they should refinance _____ frequently as the refinance closing costs rise. Group of answer choices increase; less increase; more decrease; less decrease; morearrow_forwardSuppose your bank’s loan officer tells you that if you take out a mortgage (i.e., you borrow money to buy a house), you will be permitted to borrow no more than 80% of the value of the house. Describe this transaction using the terminology of short-sales.arrow_forwardNote: answer it " all " correctly. Justify your answer by showing solution of your choice If not I will rate you unhelpful I dont care about Bartleby rules. Thank you for understanding Asaparrow_forward

- the situation below. Let's Save Michael is planning to apply for a loan in Quezon Cooperative Bank, he is already aware of the terms payment for his loan but when he is about to pass his application form and compare his computation with the terms of payment provided by the bank he notices some discrepancy. Michael's Computation Computation from the bank Amount of Loan: P100,000 Amount of Loan: P100,000 Interest rate: 3% Interest rate: 3% Due Date: After 3 years Computation: I = (100, 000)(0.03(3) I = P9,000 Amount to be paid after 3 years Year 1 Year 2 Year 3 %3D Int 3000 6090 9272.70 Amt 103,000 106,090 109,272.70 %3D P109,000 To enlighten he asked some explanations why they have different computations and the bank gave him the detailed computation: Initially at t = 0 P100,000 P100,000 (1.03) = P103,000 P103,000 (1.03) = P106,090 P106,090 (1.03) = P109,272.70 at t = 1 at t = 2 %3D at t = 3 %3D Questions 1. Is Michael's computation correct? 2. Is the bank's computation fair? Why? 2 How…arrow_forwardQuestion 5.A bank has borrowing needs at timeT >0. Show that by combining an FRAtrade today with a libor loan at timeT, the bank can today lock in its interest cost forthe periodTtoT+α. Does the borrowing bank need to buy or sell the FRA to do this?What is the fixed rate that the bank locks in?arrow_forwardWhat do we know about a loan, which is said to have annuity payments? a. This loan has annual cashflows only. b. This loan has only interest payments before maturity. c. This loan should be a mortgage loan. d. This loan has equal payment cashflows in all periods along its maturity.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning