Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

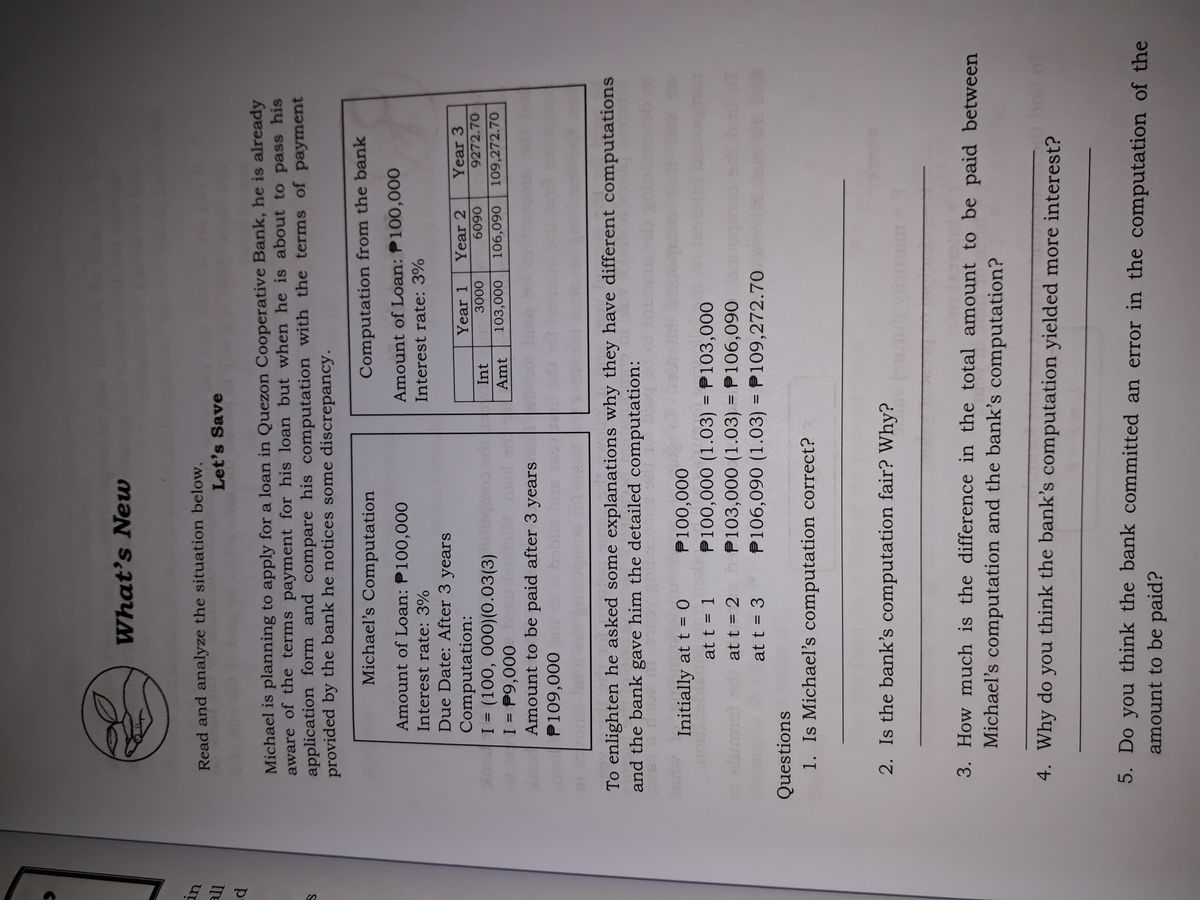

Transcribed Image Text:What's New

ur

Read and analyze the situation below.

Let's Save

Michael is planning to apply for a loan in Quezon Cooperative Bank, he is already

aware of the terms payment for his loan but when he is about to pass his

application form and compare his computation with the terms of payment

provided by the bank he notices some discrepancy.

Michael's Computation

Computation from the bank

Amount of Loan: P100,000

Interest rate: 3%

Amount of Loan: P100,000

Interest rate: 3%

Due Date: After 3 years

Computation:

I = (100, 000)(0.03(3)

Year 1

Year 2

Year 3

9272.70

eco

Amt

0609

109,272.70

060'901

Int

0008

Amount to be paid after 3 years

o C ag 000'6d = I

000'60I

To enlighten he asked some explanations why they have different computations

and the bank gave him the detailed computation:

Initially at t = 0

000'00

P100,000 (1.03) = P103,000

P103,000 (1.03) = P106,090

P106,090 (1.03) = P109,272.70

at t = 1

at t = 2

at t = 3

Questions

1. Is Michael's computation correct?

2. Is the bank's computation fair? Why?

3. How much is the difference in the total amount to be paid between

Michael's computation and the bank's computation?

4. Why do you think the bank's computation yielded more interest?

5. Do you think the bank committed an error in the computation of the

amount to be paid?

Transcribed Image Text:6. If the term of payment will be longer what do you think will happen

between the difference of the amount to be paid in Michael's computation

and the bank's computation?

7. If vou are Michael and you follow the computation made by the bank do

Ou think there is a way to lessen the amount to be paid at the end of 3

years? How?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Subject:arrow_forwardYou are the loan department supervisor for a bank. This installment loan is being paid off early, and it’s your task to calculate the rebate fraction, the finance charge rebate (in $), and the payoff for the loan (in $). (Round to the nearest cent)arrow_forwardJason and Matthew borrowed $38.400 on a 7-month, 5% note from Gem State Bank to open their business, Blossom's Coffee House The money was borrowed on June 1, 2025, and the note matures January 1, 2026. (a) ✓ Your answer is correct. Prepare the entry to record the receipt of the funds from the loan. (List all debit entries before credit entries, Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts) Date ne 1, 2025 Account Titles and Explanation (b) Question 5 of 12 Cash Date Notes Payable eTextbook and Medial Prepare the entry to accrue the interest on June 30, (List all debit entries before credit entries. Credit account titles are automatically Indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter O for the amounts) Account Titles and Explanation Debit 38400 Credit Debit…arrow_forward

- Matty deposits $1,300.00 into a Savings Account at their bank. The annual compound interest rate 2%. How much interest did they earn after after 10 years? Enter answer in format: $ 00.00 Question 2 Suzy deposits $2,400.00 into a Savings Account at their bank. The annual compound interest rate 2.5%. How much interest did she earn after after 15 years? Enter answer in format: $ 00.00arrow_forwardI can purchase a 1-year Certificate of Deposit at a bank. The bank uses that deposit money to fund a 30-year mortgage loan. This is an example of (2 words)arrow_forwardA borrower has two alternatives for a loan: (1) issue a $570,000, 90-day, 7% note or (2) issue a $570,000, 90-day note that the creditor discounts at 7%. Assume a 360-day year. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. X Open spreadsheet a. Compute the amount of the interest expense for each option. Round your answer to the nearest dollar. for each alternative. b. Determine the proceeds received by the borrower in each situation. Round your answers to the nearest dollar. (1) $570,000, 90-day, 7% interest-bearing note: $ (2) $570,000, 90-day note discounted at 7%: $ c. Alternative is more favorable to the borrower because the borrowerarrow_forward

- Travis Thompson uses his credit card to obtain a cash advance of $600 to pay for his textbooks in medical school. The interest rate charged for the loan is 0.04386% per day. Travis repays the money plus the interest after 30 days. a) Determine the interest charged for the cash advance. b) When he repaid the loan, how much did he pay the credit card company?arrow_forwardLaura borrowed a total of $18000 from two different banks. one bank charged 6% simple interest and the other 7.5% simple interest. If the total interest after 2 years was $2,220 determine the amount borrowed by both banks. let x represent the principal of the loan business loan 6% then what is the remaining amount borrowed at 7.5%?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education