FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

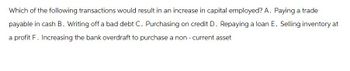

Transcribed Image Text:Which of the following transactions would result in an increase in capital employed? A. Paying a trade

payable in cash B. Writing off a bad debt C. Purchasing on credit D. Repaying a loan E. Selling inventory at

a profit F. Increasing the bank overdraft to purchase a non - current asset

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- When both deposit and loan interest rates increase at the same speed in the market, a bank tends to ( ) to make profit. a. reinvest b. refinance c. keep neutralarrow_forwardWhich of the following statements is most correct? a. When actual inflation exceeds expected inflation, debtors gain at the expense of creditors because they repay their loans with depreciated currency. b. When expected inflation exceeds actual inflation, debtors gain at the expense of creditors because they repay their loans with depreciated currency. c. When actual inflation exceeds expected inflation, creditors gain at the expense of debtors because they repay their loans with devalued currency. d. When actual inflation exceeds expected inflation, debtors and creditors both lose because they repay their loans with depreciated currency.arrow_forward1. Which of the following is not a reason for the issuance of long-term liabilities? a. Debt financing offers an income tax advantage.b. Ownership interest is diluted.c. Debt may be the only available source of funds.d. Debt financing may have a lower cost.arrow_forward

- Which of the following circumstances would result in an increase in cash from operations but not an increase in net income? Select one: a. None of the other choices is correct b. The failure to take advantage of a purchase discount offered by the supplier c. The sale of equipment for an amount greater than its book value d. The reissuance of treasury stock for an amount greater than its cost e. The issuance of bonds at a premiumarrow_forward4. Which of the following transactions causes an increase in working capital? a. Sale of merchandise on credit at a price above cost. b. Sale of marketable securities at a price below cost. c. Collection of an account receivable. d. Return to supplier of defective merchandise purchased on credit. Full credit allowed by supplier.arrow_forwardAs a bank manager, you conclude that the bank has a capital shortfall and should decrease the equity multiplier (i.e., increase the capital ratio) to prevent bank failure. Which of the following is one of things you can do to manage capital adequacy of the bank? a.Acquiring more reserves through borrowing from fed funds loansb.Selling the bank's holding of mortgage-backed securities and using the proceeds to decrease liabilitiesc.Repurchasing shares of the bankd.Increasing dividend payout ratio to reduce retained earnings.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education