Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:abour 000

Jou ob saigrao0

(4.2) Assume the base-case forecasts and no taxes for the project. Compute the cash break-evenb

point.

(4.3) Assume the base-case forecasts and no taxes for the project. Compute the financial break-

even point.

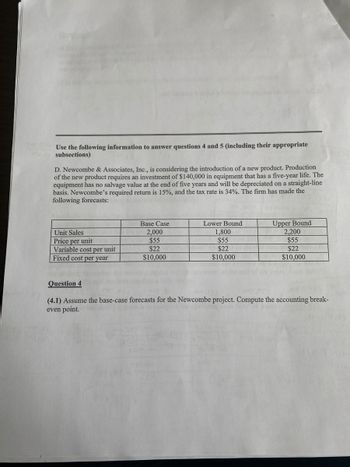

Transcribed Image Text:Use the following information to answer questions 4 and 5 (including their appropriate

subsections)

D. Newcombe & Associates, Inc., is considering the introduction of a new product. Production

of the new product requires an investment of $140,000 in equipment that has a five-year life. The

equipment has no salvage value at the end of five years and will be depreciated on a straight-line

basis. Newcombe's required return is 15%, and the tax rate is 34%. The firm has made the

following forecasts:

Unit Sales

Price per unit

Variable cost per unit

Fixed cost per year

Base Case

2,000

$55

$22

$10,000

Lower Bound

1,800

$55

$22

$10,000

Upper Bound

2,200

$55

$22

$10,000

Question 4

(4.1) Assume the base-case forecasts for the Newcombe project. Compute the accounting break-

even point.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- We are evaluating a project that costs $735, 200, has an eight year life, and has no salvage value. Assume that depreciation is straight - line to zero over the life of the project. Sales are projected at 80, 000 units per year. Price per unit is $48, variable cost per unit is $33, and fixed costs are $730, 000 per year. The tax rate is 22 percent, and we require a return of 12 percent on this project. Suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within \pm 15 percent. Calculate the best - case and worst case NPV figures. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e. g., 32.16.)arrow_forwardWe are evaluating a project that costs $604,000, has an 8-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 55,000 units per year. Price per unit is $36, variable cost per unit is $17, and fixed costs are $685,000 per year. The tax rate is 21 percent and we require a return of 15 percent on this project. Suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within ±10 percent. Calculate the best-case and worst-case NPV figures. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forwardUnited Pigpen is considering a proposal to manufacture high-protein hog feed. The project would make use of an existing warehouse, which is currently rented out to a neighboring firm. The next year's rental charge on the warehouse is $195,000, and thereafter, the rent is expected to grow in line with inflation at 4% a year. In addition to using the warehouse, the proposal envisages an investment in plant and equipment of $1.77 million. This could be depreciated for tax purposes straight-line over 10 years. However, Pigpen expects to terminate the project at the end of 8 years and to resell the plant and equipment in year 8 for $590,000. Finally, the project requires an immediate investment in working capital of $445,000. Thereafter, working capital is forecasted to be 10% of sales in each of years 1 through 7. Year 1 sales of hog feed are expected to be $6.10 million, and thereafter, sales are forecasted to grow by 5% a year, slightly faster than the inflation rate. Manufacturing costs…arrow_forward

- Kimoto Ltd has designed a new product and conducted a market survey costing $30,000 to assess its viability. The survey has determined that the new product will generate sales of $1,200,000 per year. Fixed costs associated with the product will be $50,000 a year and variable costs will amount to 35% of sales. The equipment necessary for production will cost $1,500,000 and is to be depreciated evenly over the project’s life of 5 years (straight-line method). In addition, $45,000 in net working capital is required to fund the project. The tax rate is 30%. The company believes the risk of the new project is the same as the risk of the company’s existing assets. Kimoto’s capital consists of the following : Ordinary Shares: The company has 2 million ordinary shares outstanding, currently selling for $150 per share and a beta of 1.2. The market risk premium (rm-rf) is 8% and the risk-free rate is 3%. Preference Shares: The company has 1 million preference shares, currently selling for $85…arrow_forwardRapp Hardware is adding a new product line that will require an investment of $1,418,000. Managers estimate that this investment will have a 10-year life and generate net cash inflows of $320,000 the first year, $270,000 the second year, and. $240,000 each year thereafter for eight years. Assume the project has no residual value. Compute the ARR for the investment. Round to two places. Select the formula, then enter the amounts to calculate the ARR (accounting rate of return) for the new product line. (Round ARR to the nearest hundredth percent [two decimal places], X.XX%.) Average annual operating income +Average amount invested = ARR = %arrow_forwardWe are evaluating a project that costs $1,100,000, has a ten-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 42,000 units per year. Price per unit is $50, variable cost per unit is $25, and fixed costs are $820,000 per year. The tax rate is 35 percent, and we require a 10 percent return on this project. Suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within ±10 percent. Calculate the best-case and worst-case NPV figures. (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations and round your final answers to 2 decimal places. (e.g., 32.16)) Best-case Worst-case NPV $ LA LAarrow_forward

- XYZ is considering an investment which will cost $259,000. The investment produces no cash flows for the first year. In the second year, the cash inflow is $58,000. This inflow will increase to $150,000 and then $200,000 for the following two years before ceasing permanently. The firm requires a 14 percent rate of return and has a required discounted payback period of three years. What is the discounted payback of this project and should the company accept this project?arrow_forwardAgate Marketing Inc. intends to distribute a new product. It is expected to produce net returns of $13,000 per year for the first four years and $11,000 per year for the following three years. The facilities required to distribute the product will cost $36,000, with a disposal value of $9,600 after seven years. The facilities will require a major facelift costing $10,000 each after three years and after five years. If Agate requires a return on investment of 15%, should the company distribute the new product? If NPV is negative your answer must include the negative sign. Net Present Value (NPV) = Should the decision be Accept or Reject? Firarrow_forwardEvergreen Company is investigating the feasibility of buying a new production line producing a new product. They project unit sales as in the below table, and they project price per unit to be $120 per unit at the beginning. And when competition catches up after 3 years (in the 4th year), they anticipate that the price would drop to $110. This project requires $20,000 in net working capital at the beginning. Subsequently, total net working capital at the end of each year would be about 15% of total sales for that year. The variable cost per unit is $60, and total fixed costs are $25,000 per year. It costs about $900,000 to buy the equipment necessary to begin the production. This investment is primarily in industrial equipment and falls in Class 8 with a CCA rate of 20%. The equipment will actually be worth about $150,000 in eight years. The relevant tax rate is 40% and the required return is 15%. Years Unit Sales 1 3000 2 5000 3 6000 4…arrow_forward

- You are evaluating a new project that costs $15 million over its 5-year life. Depreciation is straight-line to zero over the life of the project and the salvage value is zero. The project is expected to have the following base case estimates: Unit sales/year: 250,000; Price/unit: $40; VC/unit: $15; FC/year: $900,000. The required return is 14 % and the corporate tax rate is 30%. The firm has no debt. The base case NPV is $946,661.1003. Calculate the sensitivity of the NPV to changes to changes in variable costs/unitarrow_forwardHoffman company is considering a project that would have a five-year life and require a $3,200,000 investment in equipment. At the end of the five years, the project would terminate and the equipment would have no salvage value. The project would provide the following expected forecasts: Sales $ 5,000,000 Variable expenses $3,000,000 Fixed expenses (including depreciation) $1,600,000 The company’s tax rate is 20% and the WACC is 12% REQUIRED Compute the project’s NPV, IRR, payback period, discounted payback period, and profitability indexarrow_forwardNikularrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education