FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

please answer in text form and in proper format answer with must explanation , calculation for each part and steps clearly

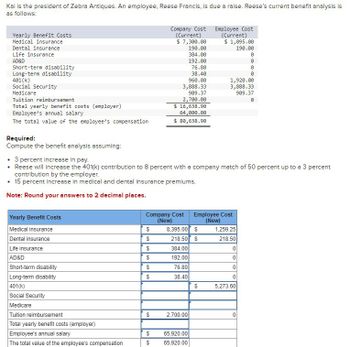

Transcribed Image Text:Kai is the president of Zebra Antiques. An employee, Reese Francis, is due a raise. Reese's current benefit analysis is

as follows:

Yearly Benefit Costs

Medical insurance

Dental insurance

Life insurance

AD&D

Short-term disability

Long-term disability

401(k)

Social Security

Medicare

Tuition reimbursement

Total yearly benefit costs (employer)

Employee's annual salary

The total value of the employee's compensation

Required:

Compute the benefit analysis assuming:

3 percent increase in pay.

Company Cost

(Current)

$ 7,300.00

Employee Cost

(Current)

$ 1,095.00

190.00

190.00

384.00

0

192.00

0

76.80

0

38.40

960.00

1,920.00

3,888.33

909.37

°

3,888.33

909.37

2,700.00

$ 16,638.90

64,000.00

$ 80,638.90

• Reese will increase the 401(k) contribution to 8 percent with a company match of 50 percent up to a 3 percent

contribution by the employer.

• 15 percent increase in medical and dental insurance premiums.

Note: Round your answers to 2 decimal places.

Yearly Benefit Costs

Company Cost

(New)

Employee Cost

(New)

Medical insurance

$

8,395.00 $

1,259.25

Dental insurance

$

218.50 $

218.50

Life insurance

$

384.00

0

AD&D

$

192.00

0

Short-term disability

$

76.80

0

Long-term disability

$

38.40

0

401(k)

$

5,273.60

Social Security

Medicare

Tuition reimbursement

$

2,700.00

0

Total yearly benefit costs (employer)

Employee's annual salary

$

65,920.00

The total value of the employee's compensation

$

65,920.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What information is provided by this statement? Describe the steps to create the statement - choose either the direct or indirect method in your response.arrow_forwardCan i have the steps in formula form pleasearrow_forwardshow journal entry (for part b) assuming estimate is considered to be accurate. and show a journal entry (from part b) assuming the amount is large enough to intentionally impact decision of users.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education