Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

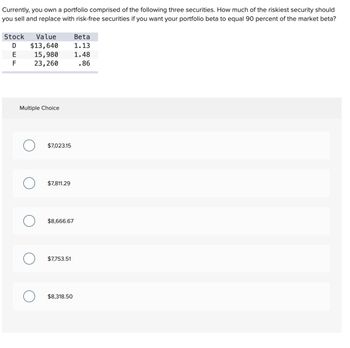

Transcribed Image Text:Currently, you own a portfolio comprised of the following three securities. How much of the riskiest security should

you sell and replace with risk-free securities if you want your portfolio beta to equal 90 percent of the market beta?

Stock Value

$13,640

15,980

23,260

E

F

Multiple Choice

O $7,023.15

$7,811.29

O $8,666.67

O $7,753.51

Beta

1.13

1.48

.86

$8,318.50

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Give me three steps solution and explanationarrow_forwardYou have a portfolio with the following: Stock Number of Shares Price Expected Return W 875 $ 52 14% X 775 29 18 Y 525 65 16 Z 750 50 17 What is the expected return of your portfolio?arrow_forwardportfolio.. - Word **** References Mailings Review View Help RCM Acrobat Foxit Reader PDF Foxit PDF 5. The risk-free rate and the expected market rate of return are 0.04 and 0.14, respectively. According to the capital asset pricing model (CAPM), the expected rate of return on security X with a beta of 1.25 is equal to: a. 0.004 b. 0.165 C. 0.121 d. 0.132arrow_forward

- An investor plans to invest funds in the following stocks: Stock Beta Amount Invested A 1.39 $1,939.00 B 1.21 $2,818.00 C 0.75 $1,378.00 The risk-free rate is currently 3.00%, while the market risk premium is 6.00%. What is the beta of this portfolio?arrow_forwardProblem 1: You invest in a portfolio of 5 stocks with an equal investment in each one. The betas of the 5 stocks are as follows: .75, -1.2, .90, 1.3, 1.5. The risk free return is 4% and the market return is 9%. A. Compute the beta of the portfolio B. Compute the required return of the portfolioarrow_forwardV1arrow_forward

- An investor's portfolio consists of the following stocks: B. C. Required: A. Stock NCB BNS JBG GRACE LASD HBN % of Portfolio Beta 35 1.05 15 0.45 10 0.9 10 0.95 23 d 1.6 7 $0.7 Expected Return 21% * 10% 15% 18% 25% 9% d The current risk free rate of return is 6.5% and the expected return on the market portfolio is f 16%. to sastava 128 hodan) ditane H puo abuso gurILA be HOME D q now to Compute the expected return of the portfolio and the portfolio beta. Tynaquros ort vd bomenstem of dou Compute the required rate of return for the NCB stock using the Capital Asset Pricing Model (CAPM). bell (0 simo 15710 zib sh Explain the difference between diversifiable and non-diversifiable risks using examples.arrow_forwardQuestion 4 A stock has an expected return of 13.6 percent, the risk - free rate is 3.7 percent, and the market risk premium is 7.1 percent. What must the beta of this stock be?arrow_forwardPick the best answer to the following portfolio? (Round off all numbers to 2 decimal places) Stock Amount Invested Beta A $6,700 1.16 B 3,000 1.23 C 8,500 0.79 Group of answer choices The portfolio has more systematic risk than the market. The portfolio has more total risk than the market. The portfolio has no systematic risk. The portfolio has same systematic risk as the market. The portfolio has less systematic risk than the market.arrow_forward

- Please help correctly all or skip plsarrow_forward16. Assume the betas for securities A, B, and C are as shown here. (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Security A B C .673 Beta If you have a portfolio with $30,000 invested in each of Investment A, B, and C, what is your portfolio beta? Using the portfolio beta and assuming a risk-free rate of 5%, what would you expect the return of your portfolio to be if the market earned 20.8% next year? Declined 19.6%? The beta of your portfolio is (Round to three decimal places.) The return of your portfolio to be if the market earned 20.8% is If the market earned 20.8%, the value of your portfolio is $ The return of your portfolio to be if the market declined 19.6% is If the market declined 19.6%, the value of your portfolio is $ 1.62 0.63 - 0.23 (Round to the nearest dollar.) %. (Round to two decimal places and enter as a negative number if the return decreased.) %. (Round to two decimal places and enter…arrow_forwardVijayarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education