Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

quiz 8-14

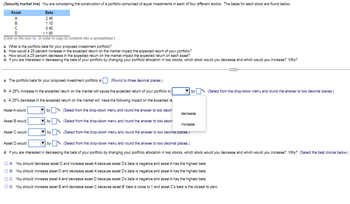

Transcribed Image Text:(Security market line) You are considering the construction of a portfolio comprised of equal investments in each of four different stocks. The betas for each stock are found below:

Beta

Asset

A

B

2.40

1.10

D

0.40

-1.80

(Click on the icon in order to copy its contents into a spreadsheet.)

a. What is the portfolio beta for your proposed investment portfolio?

b. How would a 25 percent increase in the expected return on the market impact the expected return of your portfolio?

c. How would a 25 percent decrease in the expected return on the market impact the expected return on each asset?

d. If you are interested in decreasing the beta of your portfolio by changing your portfolio allocation in two stocks, which stock would you decrease and which would you increase? Why?

a. The portfolio beta for your proposed investment portfolio is

(Round to three decimal places.)

b. A 25% increase in the expected return on the market will cause the expected return of your portfolio to

by

%. (Select from the drop-down menu and round the answer to two decimal places.)

c. A 25% decrease in the expected return on the market will have the following impact on the expected re

Asset A would

by %. (Select from the drop-down menu and round the answer to two decim

decrease

Asset B would

▼ by ☐ %. (Select from the drop-down menu and round the answer to two decin

increase

Asset C would

▼by

(Select from the drop-down menu and round the answer to two decimal places.)

Asset D would

by %. (Select from the drop-down menu and round the answer to two decimal places.)

d. If you are interested in decreasing the beta of your portfolio by changing your portfolio allocation in two stocks, which stock would you decrease and which would you increase? Why? (Select the best choice below.)

O A. You should decrease asset D and increase asset A because asset D's beta is negative and asset A has the highest beta.

OB. You should increase asset D and decrease asset A because asset D's beta is negative and asset A has the highest beta.

OC. You should increase asset A and decrease asset D because asset D's beta is negative and asset A has the highest beta.

OD. You should increase asset B and decrease asset C because asset B' beta is close to 1 and asset C's beta is the closest to zero.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Chapter 6 Homework ctors CPO bofa X - Chapter 6 Homework education.wiley.com/was/ui/v2/assessment-player/index.html?launchid=dfb96462-e0c8-4eb4-bc8f-5f439b0e2a06#/question/0 wiley connect NWP Assessment Player Ul Ap x workjam (ulta) school b bartleby Question 1 of 11 Average unit cost $ Calculate average unit cost. (Round answer to 3 decimal places, e.g. 5.125.) eTextbook and Media List of Accounts + The cost of the ending inventory $ MYOCC In its first month of operations, Sheridan Company made three purchases of merchandise in the following sequence: (1) 500 units at $4, (2) 600 units at $5, and (3) 700 units at $7. eTextbook and Media List of Accounts zoom quizlet google docs google slides Compute the cost of the ending inventory under the average-cost method, assuming there are 400 units on hand at the end of the period. (Round answer to O decimal places, e.g. 125.) B instagram twitter -/1 = : F. ☐ Updat youtubearrow_forwardChapters 10 and 11 HOMEWORK X CengageNOWv2| Online teachin x ô https://v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogres.. Chapters 10 and 11 еBook Show Me How Print Item Bennett Enterprises issues a $396,000, 30-day, 9%, note to Spectrum Industries for merchandise inventory. Assume a 360-day year. If required, round your answers to the nearest dollar.If an amount box does not require an entry, leave it blank. a. Journalize Bennett Enterprises' entries to record: 1. the issuance of the note. 2. the payment of the note at maturity. 1. 2. > b. Journalize Spectrum Industries' entries to record: 1. the receipt of the note. 2. the receipt of the payment of the note at maturity. 1. 2.arrow_forwardF myCampus Portal Login - for Stu X B 09 Operational and Legal Consid x E (24,513 unread) - sharmarohit81 b My Questions | bartleby A fleming.desire2learn.com/d21/le/content/130754/viewContent/1518900/View?ou=130754 Table of Contents > Week 9: Operational and legal Considerations > Lecture Notes > 09 Operational and Legal Considerations 09 Operational and Legal Considerations - > Calculating Capacity • How many machines do you need? • You expect your sales to be 3,000,000 granola bars (20g each) • How large is your plant? per month • How many workers do you need? The machine: • How much is the investment? Capacity: 100 kgs per hour • What are the operating costs? Requires 2 people to operate it Takes 8 ft x 40 ft space • Cost per machine $15,000 Energy and maintenance: $5 per hour • Cost of material and packaging: $0.12 per bar I Group Project.xlsx Show all 12:35 AM O Type here to search A O 4) ENG 2020-12-09arrow_forward

- QHorngre X G horngre X End of Chapter: Accounting and the Business Environment d:course:7710589/products/79c3fa4c-a84f-42ba-b87a-e36a400bca00/pages/urn:pearson Problems Group A P-F:1-41A. Using the accounting equation for transaction analysis (Learning Objective 4) ASSETS Meg McKinney opened a public relations firm called Solid Gold on August 1, 2024. The following amounts summarize her business on August 31, 2024: TutorM X | G horngre Cash + Accounts + Office + Land Receivable Supplies $0 Bal. $1,900 + $3.200 + transactions: +$15,000 LIABILITIES + Contributed Capital + Accounts + Common Stock Payable $5,000 $11.900 - EQUITY During September 2024, the business completed the following Retained Earnings Dividends & Service Rent - Advertising Revenue Expense Expense + $3,200 a. Received contribution of $17,000 cash from Meg McKinney in exchange for common stock. b. Performed service for a client and received cash of $800. c. Paid off the beginning balance of accounts payable. d. Purchased…arrow_forwardRequired information [The following information applies to the questions displayed below.] Cardinal Company is considering a five-year project that would require a $2,975,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate income in each of five years as follows: $ 2,735,000 1,000,000 Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out- of-pocket costs Depreciation Total fixed expenses 1,735,000 $ 735,000 595,000 1,330,000 Net operating income $ 405,000 Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using table. 14. Assume a postaudit showed that all estimates including total sales) were exactly correct except for the variable expense ratio, which actually turned out to be 45%. What was the project's actual payback period? (Round your answer to 2 decimal places.) Payback period yearsarrow_forwardM Question 6- QUIZ- CH 18-C X Project 6 x .mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.tulsacc.edu%252Fw... 18 es Saved Help Save Exercises 18-41 (Algo) Allocation of Central Costs; Profit Centers [LO 18-3] Woodland Hotels Incorporated operates four resorts in the heavily wooded areas of northern California. The resorts are named after the predominant trees at the resort: Pine Valley, Oak Glen, Mimosa, and Birch Glen. Woodland allocates its central office costs to each of the four resorts according to the annual revenue the resort generates. For the current year, the central office costs (000s omitted) were as follows: Front office personnel (desk, clerks, etc.) Administrative and executive salaries Interest on resort purchase Advertising Housekeeping Depreciation on reservations computer Room maintenance Carpet-cleaning contract Contract to repaint rooms $ 12,100 5,700 4,700 600 3,700 80 1,210 50 570 $ 28,710 Revenue (000s) Square…arrow_forward

- Please help with 4a and 4barrow_forward101: QU X in 2022SU1-MATH-1005-A01: QU X Google My Questions | bartleby × + le.esc.edu/mod/lti/view.php?id=3172946 e ▼ Library MyESC Faculty & Staff ▼ Policies & Resources Help 1-MATH-1005-A01) Contemporary Mathematics (2022SU1-MATH-1005-A01) Contemporary Mathematics / Module 2: General Problem Solving / Quiz: Module 2 General Problem Solving - PITU on You're planning on making 7 meatloafs for a party. You go to the store to buy breadcrumbs, and see they are sold by the canister. How many canisters do you need to buy? info (along with other info). First, determine what information you need to answer this question, then click here to display that • How much breadcrumbs does the recipe call for? It calls for 1 1/2 cups of breadcrumbs. • How many meatloafs does the recipe make? It makes 1 meatloaf. • How many servings does that recipe make? It says it serves 10. • How big is the canister? It is cylindrical, 3.5 inches across and 7 inches tall. • What is the net weight of the contents of 1…arrow_forwardQuestion on attachement BTN 13-6arrow_forward

- J X ersity X Quiz List - Su22 RELS 308- X Question 24 - Chapter 6 Prc X * Course Hero ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewcom ge... W3Schools Online... Ally Auto Online Se... M Gmail Your report has bee... Best Buy Credit Car... i: Hono Saved oter 6 Problem Set 24 Problem 6-26 Calculating Annuity Present Values [LO1] Beginning three months from now, you want to be able to withdraw $2,400 each quarter from your bank account to cover college expenses over the next three years. If the account pays 46 percent interest per quarter, how much do you need to have in your. bank account today to meet your expense needs over the next three years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Present value 21 O P F8 F9 F10 5467 & 7 03:06:31 pped Book Hint rences re to search 2 F2 F3 3 WE S D F4 4 C O At FS R F % 5 V F6 T J G 6 F7 525 370 Y B H U N 00. 8 J ( 9 F11 K Marrow_forwardDivuarrow_forwardard Collaborate x G wileyplus - Google Sear x Ch10 Homework F21 O #SummerFridays At W x O NWP Assessment Play x A Player i education.wiley.com/was/ui/v2/assessment-player/index.html?launchld-22d696ac-86f1-41c7-99c8-d40d5ddc6467#/question/12 Ch10 Homework F21 - /1 三 Question 13 of 20 View Policies Current Attempt in Progress A factory machine was purchased for $380000 on January 1, 2021.It was estimated that it would have a $70000 salvage value at the end of its 5-year useful life. It was also estimated that the machine would be run 37000 hours in the 5 years. The company ran the machine for 3700 actual hours in 2021. If the company uses the units-of-activity method of depreciation, the amount of depreciation expense for 2021 would be O $70000. O $38000. O $31000. O $62000. eTextbook and Media Attempts: 0 of 2 used Submit Answer Save for Later & 3 4. 7 8 t d farrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education