Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

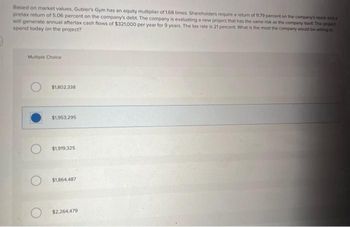

Transcribed Image Text:Based on market values, Gubler's Gym has an equity multiplier of 168 times. Shareholders require a return of 1179 percent on the company's stock and a

pretax return of 5.06 percent on the company's debt. The company is evaluating a new project that has the same risk as the company itself. The project

will generate annual aftertax cash flows of $321,000 per year for 9 years. The tax rate is 21 percent. What is the most the company would be willing to

spend today on the project?

Multiple Choice

$1,802,338

$1,953,295

$1,919,325

$1,864,487

$2,264,479

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Based on market values, Gubler's Gym has an equity multiplier of 1.52 times. Shareholders require a return of 11.15 percent on the company's stock and a pretax return of 4.90 percent on the company's debt. The company is evaluating a new project that has the same risk as the company itself. The project will generate annual aftertax cash flows of $289,000 per year for 9 years. The tax rate is 39 percent. What is the most the company would be willing to spend today on the project? Multiple Choice $1,731,793 $1,778,775 $1,626,236 $2,050,380 $1,682,313arrow_forwardPuckett Products is planning for $3 million in capital expenditures next year. Puckett's target capital structure consists of 60% debt and 40% equity. If net income next year is $2 million and Puckett follows a residual distribution policy with all distributions as dividends, what will be its dividend payout ratio? Round your answer to two decimal places.arrow_forwardMarble Construction estimates that its WACC is 10% if equitycomes from retained earnings. However, if the company issues new stock to raise newequity, it estimates that its WACC will rise to 10.8%. The company believes that it willexhaust its retained earnings at $2,500,000 of capital due to the number of highly profitable projects available to the firm and its limited earnings. The company is considering the following7 investment projects: Assume that each of these projects is independent and that each is just as risky as the firm’sexisting assets. Which set of projects should be accepted, and what is the firm’s optimalcapital budget?arrow_forward

- Dyrdek Enterprises has equity with a market value of $10.4 million and the market value of debt is $3.35 million. The company is evaluating a new project that has more risk than the firm. As a result, the company will apply a risk adjustment factor of 1.2 percent. The new project will cost $2.12 million today and provide annual cash flows of $556,000 for the next 6 years. The company's cost of equity is 10.91 percent and the pretax cost of debt is 4.84 percent. The tax rate is 39 percent. What is the project's NPV?arrow_forwardQuigley Inc. is considering two financial plans for the coming year. Management expects sales to be $300,000, operating costs to be $265,000, assets (which is equal to its total invested capital) to be $200,000, and its tax rate to be 25%. Under Plan A it would finance the firm using 25% debt and 75% common equity. The interest rate on the debt would be 8.8%, but under a contract with existing bondholders the TIE ratio would have to be maintained at or above 3.6. Under Plan B, the maximum debt that met the TIE constraint would be employed. Assuming that sales, operating costs, assets, total invested capital, the interest rate, and the tax rate would all remain constant, by how much would the ROE change in response to the change in the capital structure? Do not round your intermediate calculations. a. 7.92% O b. 7.36 %1 O c. 8.00% O d. 7.84% O e. 7.76%arrow_forwardRDJ Corp. has expected earnings before interest and taxes (EBIT) of $5,000 (assumed to continue forever). Its unlevered cost of capital is 13.0% and its corporate tax rate is 35%. The company would like to borrow debt that amounts to $2,000 and use the proceeds to buy back shares. This debt has a 7.0% annual interest rate and pays interests annually. What is the firm's cost of equity, after this capital conversion? O A. O B. O C. O E. 10.05% 13.33% 15.14% OD. 13.82% 12.65% B 10 19 28 37 46 Finisarrow_forward

- Kielly Machines Inc. is planning an expansion program estimated to cost $100 million. Kielly is going to raise funds according to its target capital structure shown below. Debt 0.30 Preferred stock 0.24 Equity 0.46 Kielly had net income available to common shareholders of $184 million last year of which 75% was paid out in dividends. The company has a marginal tax rate of 40%. Additional data: The before-tax cost of debt is estimated to be 11%. The market yield of preferred stock is estimated to be 12%. The after-tax cost of common stock is estimated to be 16% What is Kielly's weighted average cost of capital? Select one: a. 14.00% b. 12.22% c. 13.54% d. 13.00%arrow_forwardXYZ anticipates earning $1,000,000 and paying $200,000 in dividends this year. XYZ's capital structure is 20% debt and 80% equity and its tax rate is 35%. Compute the equity breakpoint to the nearest dollar. Your Answer:arrow_forwardDyrdek Enterprises has equity with a market value of $10.9 million and the market value of debt is $3.60 million. The company is evaluating a new project that has more risk than the firm. As a result, the company will apply a risk adjustment factor of 1.7 percent. The new project will cost $2.22 million today and provide annual cash flows of $581,000 for the next 6 years. The company's cost of equity is 11.11 percent and the pretax cost of debt is 4.89 percent. The tax rate is 21 percent. What is the project's NPV? Multiple Choice $230,173 $375,414 $237,180 $219,241 $512,072arrow_forward

- ABC Corp is expected to earn $6.00 per share over the next year. The company plows back 35% of its earnings into projects yielding 18%. Investors require a rate of return of 14%. What price will they pay for the stock?arrow_forwardXYZ anticipates earning $1,500,000 and paying $300,000 in dividends this year. XYZ's capital structure is 20% debt and 80% equity and its tax rate is 35%. Compute the equity breakpoint to the nearest dollar. Your Answer:arrow_forwardBeach & Company reported EBIT of $40 million for last year. Depreciation expense totaled $18 million and capital expenditures came to $8 million. Free cash flow is expected to grow at a rate of 5 rate for the foreseeable future. Beach faces a 21 percent tax rate and has a 50 debt to equity ratio with $200 million (market value) in debt outstanding. Beach's equity beta is 1.25, the risk-free rate is currently 4.5 percent and the market risk premium is estimated to be 8 percent. What is the current total value of Beach & Company (in millions)? Multiple Choice $919.46 O $787.29 $655.02 $1,025.95 $840.95arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education