Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

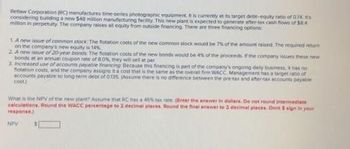

Transcribed Image Text:Retlaw Corporation (RC) manufactures time-series photographic equipment. It is currently at ts target debt-equity ratio of 074 its

considering building a new 548 million manufacturing facility. This new plant is expected to generate sher-tax cash flows of $4

milion in perpetuity. The company raises all equity from outside financing. There are three financing options

1 A new issue of common stock: The flotation costs of the new common stock would be 7% of the amount raised. The required retur

on the company's new equity is 14%

2 A new issue of 20-year bonds The flotation costs of the new bonds would be 4% of the proceeds. If the company issues these new

bonds at an annual coupon rate of 80%, they will sell at par

3 Increased use of accounts payable financing Because this financing is part of the company's ongoing daily business, it has no

fotation costs, and the company assigns it a cost that is the same as the overall frm WACC Management has a target ratio of

accounts payable to long-term debt of 0135 (Assume there is no difference between the pre-tax and after-tax accounts payable

cost)

What is the NPV of the new plant? Assume that RC has a 46% tax rate (Enter the answer in deitars. De not round Intermediate

calculations, Round the WACC percentage to 2 decimal pieces. Bound the final answer to 2 decimat pisces. Ons s sign in your

response)

NOV

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Calculate the missing information. Round dollars to the nearest cent and percents to the nearest tenth of a percent. Item PercentMarkupBased onCost PercentMarkupBased onSelling Price Flashlight ____ % 55%arrow_forwardCalculate the standard deviation of the following returns. Year Return 1 0.01 2 0.27 3 0.02 4 0.02 5 0.22 Enter the answer with 4 decimals, e.g. 0.1234.arrow_forwardView Policies Current Attempt in Progress Dorothy Thomas sells gourmet chocolate chip cookies. The results of her last month of operations are as follows: Sales revenue $48,000 Cost of goods sold (all variable) 20,000 Gross margin 28,000 8,000 Selling expenses (70% variable) 12,000 Administrative expenses (20% variable) $8,000 Operating income (a) What is Dorothy's degree of operating leverage? (Round answer to 2 decimal places, e.g. 52.75.) Hide Ston sharingarrow_forward

- Its npv vs discount rate graph please help with conceptarrow_forwardThe lowest rate of return possible is:a. 0%b. -∞c. -100%d. the company’s MARRarrow_forwardWaiting periods. Fill in the number of periods for the following table,, using one of the three methods below: In (FV/PV) In (1 + r) a. Use the waiting period formula, n = b. Use the TVM keys from a calculator. c. Use the TVM function in a spreadsheet. Present Value 760.13 Future Value $ 1,585.01 Interest Rate 3% Number of Periods years (Round to the nearest whole number.)arrow_forward

- Assume X = $100 and So = $95. With T on the X-axis and $ on the Y-axis, plot the time value (price minus intrinsic value) implied for each of the following long call prices. Pa(So,T1,X) = $6.00; Pa(So,T2,X) = $7.00; Pa(So,T3,X) = $8.20; Pa(So,T4,X) = $12.50arrow_forwardNo chatgpt used i will give 5 upvotes typing please both answers plsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education