Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

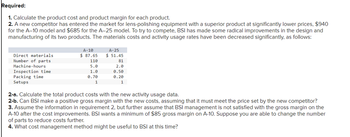

Transcribed Image Text:Required:

1. Calculate the product cost and product margin for each product.

2. A new competitor has entered the market for lens-polishing equipment with a superior product at significantly lower prices, $940

for the A-10 model and $685 for the A-25 model. To try to compete, BSI has made some radical improvements in the design and

manufacturing of its two products. The materials costs and activity usage rates have been decreased significantly, as follows:

A-25

$ 51.45

Direct materials

Number of parts

Machine-hours

Inspection time

Packing time

Setups

A-10

$ 87.65

110

81

5.0

2.0

1.0

0.50

0.70

1

0.20

1

2-a. Calculate the total product costs with the new activity usage data.

2-b. Can BSI make a positive gross margin with the new costs, assuming that it must meet the price set by the new competitor?

3. Assume the information in requirement 2, but further assume that BSI management is not satisfied with the gross margin on the

A-10 after the cost improvements. BSI wants a minimum of $85 gross margin on A-10. Suppose you are able to change the number

of parts to reduce costs further.

4. What cost management method might be useful to BSI at this time?

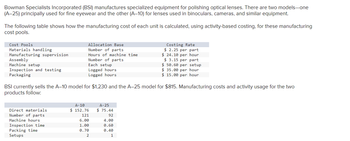

Transcribed Image Text:Bowman Specialists Incorporated (BSI) manufactures specialized equipment for polishing optical lenses. There are two models-one

(A-25) principally used for fine eyewear and the other (A-10) for lenses used in binoculars, cameras, and similar equipment.

The following table shows how the manufacturing cost of each unit is calculated, using activity-based costing, for these manufacturing

cost pools.

Cost Pools

Materials handling

Manufacturing supervision

Assembly

Machine setup

Allocation Base

Number of parts

Hours of machine time

Number of parts

Each setup

Costing Rate

$2.25 per part

Inspection and testing

Packaging

Logged hours

Logged hours

$ 24.10 per hour

$ 3.15 per part

$ 50.60 per setup

$ 35.00 per hour

$ 15.00 per hour

BSI currently sells the A-10 model for $1,230 and the A-25 model for $815. Manufacturing costs and activity usage for the two

products follow:

Direct materials

Number of parts

Machine hours

Inspection time

Packing time

Setups

A-10

$ 152.76

A-25

$ 75.44

121

92

6.00

4.00

1.00

0.60

0.70

0.40

2

1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Reducir, Inc., produces two different types of hydraulic cylinders. Reducir produces a major subassembly for the cylinders in the Cutting and Welding Department. Other parts and the subassembly are then assembled in the Assembly Department. The activities, expected costs, and drivers associated with these two manufacturing processes are given below. Note: In the assembly process, the materials-handling activity is a function of product characteristics rather than batch activity. Other overhead activities, their costs, and drivers are listed below. Other production information concerning the two hydraulic cylinders is also provided: Required: 1. Using a plantwide rate based on machine hours, calculate the total overhead cost assigned to each product and the unit overhead cost. 2. Using activity rates, calculate the total overhead cost assigned to each product and the unit overhead cost. Comment on the accuracy of the plantwide rate. 3. Calculate the global consumption ratios. 4. Calculate the consumption ratios for welding and materials handling (Assembly) and show that two drivers, welding hours and number of parts, can be used to achieve the same ABC product costs calculated in Requirement 2. Explain the value of this simplification. 5. Calculate the consumption ratios for inspection and engineering, and show that the drivers for these two activities also duplicate the ABC product costs calculated in Requirement 2.arrow_forwardLarsen, Inc., produces two types of electronic parts and has provided the following data: There are four activities: machining, setting up, testing, and purchasing. Required: 1. Calculate the activity consumption ratios for each product. 2. Calculate the consumption ratios for the plantwide rate (direct labor hours). When compared with the activity ratios, what can you say about the relative accuracy of a plantwide rate? Which product is undercosted? 3. What if the machine hours were used for the plantwide rate? Would this remove the cost distortion of a plantwide rate?arrow_forwardElectan Company produces two types of printers. The company uses ABC, and all activity drivers are duration drivers. Electan Company is considering using DBC and has gathered the following data to help with its decision. A. Activities with duration drivers: B. Activities with consumption ratios and costs: C. Products with cycle time and practical capacity: Required: 1. Using cycle time and practical capacity for each product, calculate the total time for all primary activities. Comment on the relationship to ABC. 2. Calculate the overhead rate that DBC uses to assign costs. Comment on the relationship to a unit-based plantwide overhead rate. 3. Use the overhead rate calculated in Requirement 2 to calculate (a) the overhead cost per unit for each product, and (b) the total overhead assigned to each product. How does this compare to the ABC assignments shown in Part B of the Information set? 4. What if the units actually produced were 10,000 for Printer A and 18,000 for Printer B. Using DBC, calculate the cost of unused capacity.arrow_forward

- Roberts Company produces two weed eaters: basic and advanced. The company has four activities: machining, engineering, receiving, and inspection. Information on these activities and their drivers is given below. Overhead costs: Required: 1. Calculate the four activity rates. 2. Calculate the unit costs using activity rates. Also, calculate the overhead cost per unit. 3. What if consumption ratios instead of activity rates were used to assign costs instead of activity rates? Show the cost assignment for the inspection activity.arrow_forwardHercules Inc. manufactures elliptical exercise machines and treadmills. The products are produced in its Fabrication and Assembly production departments. In addition to production activities, several other activities are required to produce the two products. These activities and their associated activity rates are as follows: The activity-base usage quantities and units produced for each product were as follows: Use the activity rate and usage information to determine the total activity cost and activity cost per unit for each product.arrow_forwardVishnuarrow_forward

- Lens Care Inc. (LCI) manufactures specialized equipment for polishing optical lenses. There are two models - one mainly used for fine eyewear (F-32) and another for lenses used in binoculars, cameras, and similar equipment (B-13).The manufacturing cost of each unit is calculated using activity-based costing, using the following manufacturing cost pools: Cost Pools Allocation Base Costing Rate Materials handling Number of parts $ 3.80 per part Manufacturing supervision Hours of machine time $ 14.94 per hour Assembly Number of parts $ 4.00 per part Machine setup Each setup $ 57.20 per setup Inspection and testing Logged hours $ 46.20 per hour Packaging Logged hours $ 20.20 per hour LCI currently sells the B-13 model for $4,925 and the F-32 model for $5,140. Manufacturing costs and activity usage for the two products are as follows: B-13 F-32 Direct materials $ 165.20 $ 76.16 Number of parts 174.00 134 Machine hours 8.60…arrow_forwardLens Care Inc. (LCI) manufactures specialized equipment for polishing optical lenses. There are two models - one mainly used for fine eyewear (F-32) and another for lenses used in binoculars, cameras, and similar equipment (B-13).The manufacturing cost of each unit is calculated using activity-based costing, using the following manufacturing cost pools: Cost Pools Allocation Base Costing Rate Materials handling Number of parts $ 3.90 per part Manufacturing supervision Hours of machine time $ 14.95 per hour Assembly Number of parts $ 4.05 per part Machine setup Each setup $ 57.25 per setup Inspection and testing Logged hours $ 46.25 per hour Packaging Logged hours $ 20.25 per hour LCI currently sells the B-13 model for $5,150 and the F-32 model for $5,420. Manufacturing costs and activity usage for the two products are as follows: B-13 F-32 Direct materials $ 165.25 $ 76.20 Number of parts 175 135 Machine hours 8.65 4.35…arrow_forwardLens Care Inc. (LCI) manufactures specialized equipment for polishing optical lenses. There are two models - one mainly used for fine eyewear (F-32) and another for lenses used in binoculars, cameras, and similar equipment (B-13).The manufacturing cost of each unit is calculated using activity-based costing, using the following manufacturing cost pools: Cost Pools Allocation Base Costing Rate Materials handling Number of parts $ 3.20 per part Manufacturing supervision Hours of machine time $ 14.88 per hour Assembly Number of parts $ 3.70 per part Machine setup Each setup $ 56.90 per setup Inspection and testing Logged hours $ 45.90 per hour Packaging Logged hours $ 19.90 per hour LCI currently sells the B-13 model for $3,575 and the F-32 model for $3,460. Manufacturing costs and activity usage for the two products are as follows: B-13 F-32 Direct materials $ 164.90 $ 75.92 Number of parts 168 128 Machine hours 8.30 4.28…arrow_forward

- Lens Care Inc. (LCI) manufactures specialized equipment for polishing optical lenses. There are two models - one mainly used for fine eyewear (F-32) and another for lenses used in binoculars, cameras, and similar equipment (B-13).The manufacturing cost of each unit is calculated using activity-based costing, using the following manufacturing cost pools: Cost Pools Allocation Base Costing Rate Materials handling Number of parts $ 2.40 per part Manufacturing supervision Hours of machine time $ 14.80 per hour Assembly Number of parts $ 3.30 per part Machine setup Each setup $ 56.50 per setup Inspection and testing Logged hours $ 45.50 per hour Packaging Logged hours $ 19.50 per hour LCI currently sells the B-13 model for $1,775 and the F-32 model for $1,220. Manufacturing costs and activity usage for the two products are as follows: B-13 F-32 Direct materials $ 164.50 $ 75.60 Number of parts 160 120 Machine hours 7.90 4.20…arrow_forwardLens Care Inc. (LCI) manufactures specialized equipment for polishing optical lenses. There are two models - one mainly used for fine eyewear (F-32) and another for lenses used in binoculars, cameras, and similar equipment (B-13).The manufacturing cost of each unit is calculated using activity-based costing, using the following manufacturing cost pools: Cost Pools Allocation Base Costing Rate Materials handling Number of parts $ 2.50 per part Manufacturing supervision Hours of machine time $ 14.81 per hour Assembly Number of parts $ 3.35 per part Machine setup Each setup $ 56.55 per setup Inspection and testing Logged hours $ 45.55 per hour Packaging Logged hours $ 19.55 per hour LCI currently sells the B-13 model for $2,000 and the F-32 model for $1,500. Manufacturing costs and activity usage for the two products are as follows: B-13 F-32 Direct materials $ 164.55 $ 75.64 Number of parts 161 121 Machine hours 7.95 4.21…arrow_forwardProduct-Costing Accuracy, Consumption Ratios, Activity Rates, ActivityCostingTristar Manufacturing produces two types of battery-operated toysoldiers: infantry and special forces. The soldiers are produced by usingone continuous process. Four activities have been identified: machining, setups, receiving, and packing. Resource drivers have been used toassign costs to each activity. The overhead activities, their costs, and theother related data are as follows: Required: 1. Calculate the total overhead assigned to each product by usingonly machine hours to calculate a plantwide rate.2. Calculate consumption ratios for each activity. (Round to twodecimal places.3. Calculate a rate for each activity by using the associated driver.(Round to two decimal places. 4. Assign the overhead costs to each product by using the activityrates computed in Requirement 3.5. CONCEPTUAL CONNECTION Comment on the differencebetween the assignment in Requirement 1 and the activity-basedassignment.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub