FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

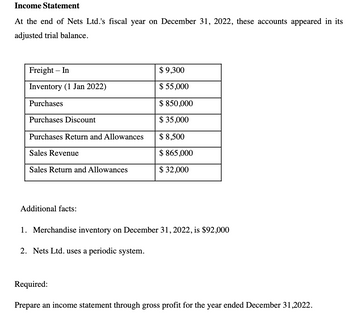

Transcribed Image Text:Income Statement

At the end of Nets Ltd.'s fiscal year on December 31, 2022, these accounts appeared in its

adjusted trial balance.

Freight - In

Inventory (1 Jan 2022)

Purchases

Purchases Discount

Purchases Return and Allowances

Sales Revenue

Sales Return and Allowances

Additional facts:

$ 9,300

$ 55,000

$ 850,000

$ 35,000

$ 8,500

$ 865,000

$ 32,000

1. Merchandise inventory on December 31, 2022, is $92,000

2. Nets Ltd. uses a periodic system.

Required:

Prepare an income statement through gross profit for the year ended December 31,2022.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sunland Company's inventory on January 1, 2025, at cost and retail are $97,500 and $141,000, respectively. Sunland established its base year amounts on January 1, 2025. The current year price index was 1.20. Sunland also had the following information: Purchases Sales Mark-ups Mark-downs Cost $195,000 Retail $282,000 243,000 19,740 (11,280) Determine ending inventory using: (Round ratio to 2 decimal places, e.g. 75.35% and final answer to O decimal places, e.g. 5,275.) (a) LIFO retail. (b) Dollar Value LIFO. (a) Ending inventory under LIFO retail $ tA (b) Ending inventory under Dollar Value LIFO $arrow_forwardMemanarrow_forwardcomplete chartarrow_forward

- Based on our understanding of inventory cost flows, and given the information listed below for the company's fiscal year 2018, determine beginning inventory in 2018. A physical count indicated that there was $30,000 of inventory on hand at December 31, 2018 (i.e., ending inventory). Sales $317,000 Freight In Purchase Returns and Allowances $7,000 $8,000 Sales Returns $9,000 Purchase Discounts $4,000 Purchases $245,000 Gross Profit $75,000 Sales Discounts $1,000 Select one: a. $36,000 b. $29,000 c. $21,000 d. $32,000 e. $22,000arrow_forwardKmuarrow_forwardSubject: accountingarrow_forward

- Pls answerarrow_forwardPurchase-Related Transactions Using Periodic Inventory System The following selected transactions were completed by Niles Co. during March of the current year: Mar. 1. Purchased merchandise from Haas Co., $43,250, terms FOB shipping point, 2/10, n/eom. Prepaid freight of $650 was added to the invoice. 5. Purchased merchandise from Whitman Co., $19,175, terms FOB destination, n/30. 10. Paid Haas Co. for invoice of March 1. 13. Purchased merchandise from Jost Co., $15,550, terms FOB destination, 2/10, n/30. 14. Issued debit memo to Jost Co. for $3,750 of merchandise returned from purchase on March 13. 18. Purchased merchandise from Fairhurst Company, $13,560, terms FOB shipping point, n/eom. 18. Paid freight of $140 on March 18 purchase from Fairhurst Company. 19. Purchased merchandise from Bickle Co., $6,500, terms FOB destination, 2/10, n/30. 23. Paid Jost Co. for invoice of March 13 less debit memo of March 14. 29. Paid Bickle Co. for invoice of March 19. 31.…arrow_forwardA physical inventory count showed ABC Company had inventorycosting $428,000 on hand at December 31, 2025. This amountdid not include the following:1. Inventory costing $39,000 that was shipped to acustomer FOB shipping point on December 30, 2025.The inventory was expected to be received by thecustomer on January 3, 2026.2. Inventory costing $17,000 that was shipped to acustomer FOB destination point on December 29, 2025.The inventory was expected to be received by thecustomer on January 6, 2026.3. Inventory costing $26,000 that ABC Company hadpurchased from one of its suppliers. The goodswere shipped to ABC Company on December 31, 2025.ABC Company expects to receive the inventory onJanuary 4, 2026. The shipping terms were FOBshipping point.Calculate the correct dollar amount of ending inventoryto be reported on ABC Company’s December 31, 2025 balancesheet.arrow_forward

- On January 1, 2024, HGC Camera Store adopted the dollar-value LIFO retail inventory method. Inventory transactions at both cost and retail, and cost indexes for 2024 and 2025 are as follows: Beginning inventory Net purchases Freight-in Net markups Net markdowns Net sales to customers Sales to employees (net of 20% discount) Price Index: January 1, 2024 December 31, 2024 December 31, 2025 Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold 2024 2024 Cost $ 48,000 103,040 3,200 Retail $ 64,000 120,000 2025 16,000 3,200 117,850 3,800 Cost 2025 $ 115,150 3,700 Retail Required: Estimate the 2024 and 2025 ending inventory and cost of goods sold using the dollar-value LIFO retail inventory method. Note: Do not round other intermediate calculations. Round your cost-to-retail percentage calculation to 2 decimal places and final answers to the nearest whole dollar. $ 133,000 10,400 3,400 119,440 5,920 1.00 1.06 1.12arrow_forwardKnowledge Check Crane Works' uses a periodic inventory system. Its accounting records show the following as of December 31, 2025. Inventory, Dec. 31, 2025 Purchase Returns and Allowances Inventory, Jan. 1, 2025 Cost of goods purchased Cost of goods sold $ $4,050 $ 730 5,550 Compute cost of goods purchased and cost of goods sold. Freight-In Purchases Purchase Discounts $1,800 95,100 1,480 Sused Submit Answerarrow_forwardOn January 1, 2024, HGC Camera Store adopted the dollar-value LIFO retail inventory method. Inventory transactions at both cost and retail, and cost indexes for 2024 and 2025 are as follows: Beginning inventory Net purchases Freight-in Net markups Net markdowns Net sales to customers Sales to employees (net of 20 % discount) Price Index: January 1, 2024 December 31, 2024 December 31, 2025 Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold 2024 2024 Cost $ 56,000 104,000 4,000 Retail $ 80,000 128,000 2025 20,000 4,000 129,465 2,700 Cost 2025 $ 109,695 4,500 Required: Estimate the 2024 and 2025 ending inventory and cost of goods sold using the dollar-value LIFO retail inventory method. Note: Do not round other intermediate calculations. Round your cost-to-retail percentage calculation to 2 decimal places and final answers to the nearest whole dollar. Retail $ 134,200 12,000 4,200 121,260 4,400 1.00 1.06 1.12arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education