FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

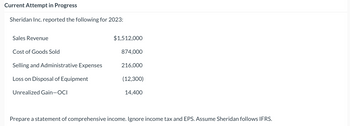

Transcribed Image Text:Current Attempt in Progress

Sheridan Inc. reported the following for 2023:

Sales Revenue

Cost of Goods Sold

Selling and Administrative Expenses

Loss on Disposal of Equipment

Unrealized Gain-OCI

$1,512,000

874,000

216,000

(12,300)

14,400

Prepare a statement of comprehensive income. Ignore income tax and EPS. Assume Sheridan follows IFRS.

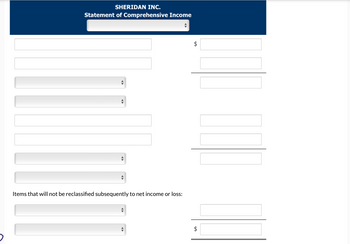

Transcribed Image Text:SHERIDAN INC.

Statement of Comprehensive Income

Items that will not be reclassified subsequently to net income or loss:

LA

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- QUESTION How much shall be presented as profit/loss on the face of the income statement? USE NEGATIVE SIGN IF LOSSarrow_forwardPlease proper solution please without plagiarism pleasearrow_forwardPresented below is information related to Novak Corporation at December 31, 2025, the end of its first year of operations. Sales revenue Cost of goods sold Interest expense Selling and administrative expenses Dividends declared and paid Loss on sale of investments Unrealized gain on available-for-sale financial assets Gain on discontinued operations Compute the following: Ignore tax effects. (a) Income from operations $532,000 360,000 29,500 109,400 9,900 5,500 16,200 17,600 $ GAarrow_forward

- Tisdale Incorporated reports the following amounts in its December 31, 2024, income statement. Income tax expense Cost of goods sold Administrative expenses $28,000 188,000 38,000 Sales revenue Nonoperating revenue Selling expenses General expenses $290,000 108,000 58,000 48,000 Required: 1. Prepare a multiple-step income statement. 2. Indicate whether the statement "Tisdale Incorporated does not appear to have much profit-generating potential." is true or false. Required 1 Required 2 Complete this question by entering your answers in the tabs below. Prepare a multiple-step income statement. (Losses should be indicated by a minus sign.) TISDALE INCORPORATED Multiple-Step Income Statement For the Year Ended December 31, 2024arrow_forwardFill in the missing numbers for the following income statement. (Do not round intermediate calculations.) Sales Costs Depreciation EBIT Taxes (23%) Net income $ 659,000 420,100 98,900 a. Calculate the OCF. (Do not round intermediate calculations.) b. What is the depreciation tax shield? (Do not round intermediate calculations.) a. OCF $ 206,580 b. Depreciation tax shieldarrow_forwardThe following information is from Lacy's Inc. $ millions Prior Fiscal Year Current Fiscal Year Net Year-End Assets Revenue Income $21,330 14,403 $18,955 $1,070 a. Compute the asset turnover ratio for the current fiscal year. b. Compute the return on assets ratio for the current fiscal year. Numerator a. Asset Turnover Ratio $ Check b. Return on Assets Ratio $ Numerator Denominator / $ Denominator / $ || Result Resultarrow_forward

- Please show all workarrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardCurrent Attempt in Progress In its income statement for the year ended December 31, 2027, Ivanhoe Inc. reported the following condensed data. Operating expenses $623,500 Interest revenue $28,380 Cost of goods sold 1,080,160 Loss on disposal of plant assets 14,620 Interest expense 60,200 Net sales 1,892,000 Income tax expense 40,420 Prepare an income statement. (List other revenues before other expenses.) IVANHOE INC. Income Statement > > +Aarrow_forward

- In its income statement for the year ended December 31, 2020, Cheyenne Corp. reported the following condensed data. Operating expenses Cost of goods sold Interest expense (a) $753,390 1,293,700 72,600 V V > M Interest revenue eTextbook and Media Loss on disposal of plant assets Net sales Other comprehensive income Prepare a multiple-step income statement. (List other revenues before other expenses. If there is a net loss then enter the amount using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Cheyenne Corp. Income Statement For the Year Ended December 31, 2020 $ 30,920 $ 16,420 2.404.800 6.970 $arrow_forwardPlease help me with show all Calculation thankuarrow_forwardPlease help me with show all calculation thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education