FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Current Attempt in Progress

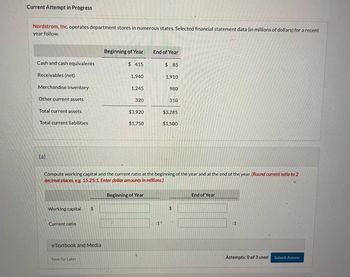

Nordstrom, Inc. operates department stores in numerous states. Selected financial statement data (in millions of dollars) for a recent

year follow.

Cash and cash equivalents

Receivables (net)

Merchandise inventory

Other current assets

Total current assets

Total current liabilities

(a)

Working capital $

Current ratio

eTextbook and Media

Beginning of Year

Save for Later

$415

1,940

HA

1,245

320

$3,920

$1,750

Beginning of Year

End of Year

Compute working capital and the current ratio at the beginning of the year and at the end of the year. (Round current ratio to 2

decimal places, e.g. 15.25:1. Enter dollar amounts in millions.)

$85

:1

1,910

980

310

$3,285

$1,500

$

End of Year

Attempts: 0 of 3 used

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Selected data from the financial statements of Rags to Riches are provided below: Current Year Prior Year Accounts Receivable $120,000 $ 76,000 Inventory 24,000 32,000 Total Assets 900,000 760,000 Net Sales 760,000 540,000 Cost of Goods Sold 320,000 420,000 Which of the following would result from vertical analysis of the company's income statement? a. The accounts receivable turnover ratio is 7.76 in the current year. b. Gross profit is 57.9% of net sales for the current year. c. Net sales are 84.4% of total assets for the current year. d. Cost of goods sold decreased by $50,000 or 23.8% duringarrow_forwardNumber 5arrow_forwardSuppose the 2022 financial statements of 3M Company report net sales of $23.1 billion. Accounts receivable (net) are $3.2 billion at the beginning of the year and $3.25 billion at the end of the year. Compute 3M’s accounts receivable turnover. - Accounts Recievable turnover ratio=? (times) Compute 3M’s average collection period for accounts receivable in days - Average collection period =? (days)arrow_forward

- How can this be worked out ?arrow_forwardComplete the balance sheet and sales information using the following financial data Total assets turnover: 1.5 X Days sales outstanding: 36.5 days (Calculation is based on a 365-day year) Inventory turnover ratio: 5 X Fixed assets turnover: 3.0 X Current ratio: 2.0 X Gross profit margin on sales: (Sales - Cost of goods sold) ∕ Sales = 25% Cash ------------ Current Liabilities -------- Accounts Receivables ------------ Long Term Liabilities 60000 Inventories ------------ Common Stock -------- Fixed Assets ------------ Retained Earnings 97500 Total Assets 300000 Total Liabilities and Equity --------- Sales Cost of goods sold --------- Interpret the current ratio, total assets turnover ratio, inventory turnover ratio and profit margin on sales.arrow_forwardCompute the following ratios and measurement for 2020 a. cash flow from operations to current liabilities b. inventory turnover c. rate of gross profit on salesarrow_forward

- Forecasted Statements and Ratios Upton Computers makes bulk purchases of small computers, stocks them in conveniently located warehouses, ships them to its chain of retail stores, and has a staff to advise customers and help them set up their new computers. Upton's balance sheet as of December 31, 2019, is shown here (millions of dollars): Cash $ 3.5 Accounts payable $ 9.0 Receivables 26.0 Notes payable 18.0 Inventories 58.0 Line of credit 0 Total current assets $ 87.5 Accruals 8.5 Net fixed assets 35.0 Total current liabilities $ 35.5 Mortgage loan 6.0 Common stock 15.0 Retained earnings 66.0 Total assets $122.5 Total liabilities and equity $122.5 Sales for 2019 were $425 million and net income for the year was $12.75 million, so the firm's profit margin was 3.0%. Upton paid dividends of $5.1 million to common stockholders, so its payout ratio was 40%. Its tax rate was 25%, and it operated at full capacity. Assume that all…arrow_forwardNordstrom, Inc. operates department stores in numerous states. Selected hypothetical financial statement data (in millions) for 2025 are presented below. Cash and cash equivalents Accounts receivable (net) Inventory Other current assets Total current assets Total current liabilities Current ratio. Current ratio End of Year Accounts receivable turnover Average collection period Inventory turnover $740 Days in inventory 1,980 eTextbook and Media 900 Save for Later 310 $3,930 For the year, net credit sales were $8,258 million, cost of goods sold was $5,328 million, and net cash provided by operating activities was $1,251 million. $1.990 Compute the current ratio, accounts receivable turnover, average collection period, inventory turnover, and days in inventory for the current year. (Round current ratio to 2 decimal places, e.g. 1.83 and all other answers to 1 decimal place, e.g. 1.8. Use 365 days for calculation.) Beginning of Year $77 1,830 For the year, net credit sales were $8,258…arrow_forwardplease anwer all the questions i have mentioned below : - A company has the following items for the fiscal year 2020: Cash = 2 million Marketable securities = 3 million Account receivables (A/R) = 1.5 million Inventories = 8.5 million Total current liabilities = 8 million Calculate the company’s current ratio and quick ratio 2. Write the formula for the following ratios and what each ratio measures: Asset turnover Inventory Turnover and Days Inventory Receivable Collection Period 3. Write down the DuPont framework. How would you explain to your non-MBA non-Finance friend about the DuPont framework and why it is important?arrow_forward

- A condensed balance sheet for Simultech Corporation and a partially completed vertical analysis are presented below. Complete the vertical analysis by computing each missing line item as a percentage of total assets. (Round your answers to the nearest whole percent.) SIMULTECH CORPORATION Balance Sheet (summarized) January 31 (in millions of U.S. dollars) Cash $433 29 % Current Liabilities $409 27 % Accounts Receivable 294 19 Long-term Liabilities 495 33 Inventory 206 14 Total Liabilities 904 Other Current Assets 109 Common Stock 118 Property and Equipment 27 2 Retained Earnings 492 32 Other Assets 445 29 Total Stockholders’ Equity 610 Total Assets $1,514 100 % Total Liabilities & Stockholders’ Equity $1,514 100 % 2A. What percentage of Simultech’s total assets relate to inventory? (Round your answer to the nearest whole percent.) 2B. What percentage of Simultech’s total assets relate to property…arrow_forwardNordstrom, Inc. operates department stores in numerous states. Selected hypothetical financial statement data (in millions) for 2022 are presented below. End of Year Beginning of Year Cash and cash equivalents $ 1,289 $ 126 Accounts receivable (net) 3,600 3,400 Inventory 1,600 1,600 Other current assets 571 531 Total current assets $7,060 $5,657 Total current liabilities $3,530 $2,802 For the year, net credit sales were $14,350 million, cost of goods sold was $9,280 million, and net cash provided by operating activities was $1,256 million.Compute the current ratio, accounts receivable turnover, average collection period, inventory turnover, and days in inventory for the current year. (Round Current ratio to 2 decimal places, e.g. 1.62 and all other answers to 1 decimal place, e.g. 1.6.) Current ratio enter the ratio rounded to 2 decimal places :1 Accounts…arrow_forwardPlease help mearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education