FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Compute the quality-control overhead cost to be assigned to the low-calorie breakfast product line for the month of June (1)

using the traditional product costing system (direct labor cost is the cost driver), and (2) using activity-based costing.

Quality control overhead cost to be assigned

eTextbook and Media

$

By what amount does the traditional product costing system undercost or overcost the low-calorie breakfast line?

eTextbook and Media

Question 3 of 4

e Textbook and Media

Classify each of the activities as value-added or non-value-added.

Activites

Inspections of material received

In-process inspections

FDA certification

Traditional product costing

eTextbook and Media

Save for Later

Activity-based costing

-/3.75 E

Attempts: 0 of 5 used Submit Answer

Transcribed Image Text:Question 3 of 4

View Policies

Current Attempt in Progress

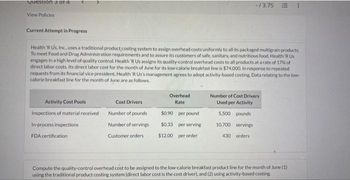

Health 'R Us, Inc., uses a traditional product costing system to assign overhead costs uniformly to all its packaged multigrain products.

To meet Food and Drug Administration requirements and to assure its customers of safe, sanitary, and nutritious food, Health R Us

engages in a high level of quality control. Health 'R Us assigns its quality-control overhead costs to all products at a rate of 17% of

direct labor costs. Its direct labor cost for the month of June for its low-calorie breakfast line is $74,000. In response to repeated

requests from its financial vice president, Health 'R Us's management agrees to adopt activity-based costing. Data relating to the low-

calorie breakfast line for the month of June are as follows.

Activity Cost Pools

Inspections of material received

In-process inspections

FDA certification

Cost Drivers

Number of pounds

Number of servings

Customer orders

-/3.75

Overhead

Rate

$0.90 per pound

$0.33 per serving

$12.00 per order

Number of Cost Drivers

Used per Activity

5,500 pounds

10,700 servings

430 orders

Compute the quality-control overhead cost to be assigned to the low-calorie breakfast product line for the month of June (1)

using the traditional product costing system (direct labor cost is the cost driver), and (2) using activity-based costing.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Drippin' in Heat manufactures the finest formal wear west of the Mississippi. The company produces two main products: Suit Jackets and Sport Coats. Currently the company uses a traditional overhead rate in which Manufacturing Overhead is allocated to products based on direct labor hours logged. The projected production levels for the period are 1,200 Suit Jackets and 400 Sport Coats. Due to profitability concerns, management is considering switching to Activity-Based Costing (ABC). Management has divided manufacturing overhead costs into three activities and cost pools: Assembly $30,000; Machine Setup $20,000; and Product Movement $102,400. Management has identified the following cost drivers for each overhead activity: direct labor hours for assembly, number of setups for machine setup, and number of moves for product movement. The following information has been compiled for each product line: Direct Labor Requirements Machine Setup Requirements Product Movement Requirements Suit…arrow_forwardE4-11 Health 'R Us, Inc., uses a traditional product costing system to assign overhead costs uniformly to all its packaged multigrain products. To meet Food and Drug Administration requirements and to assure its customers of safe, sanitary, and nutritious food, Health 'R Us engages in a high level of quality control. Health 'R Us assigns its quality-control overhead costs to all products at a rate of 17% of direct labor costs. Its direct labor cost for the month of June for its low-calorie breakfast line is $70,000. In response to repeated requests from its financial vice president, Health 'R Us’s management agrees to adopt activity-based costing. Data relating to the low-calorie breakfast line for the month of June are as follows. Activity Cost Pools Inspections of material received In-process inspections FDA certification Cost Drivers Number of pounds Number of servings Customer orders Overhead Rate $0.90 per pound $0.33 per serving $12.00 per order Number of Cost Drivers Used per…arrow_forwardDecorative Doors Ltd produces two types of doors: interior and exterior. The company’s costing system has two direct-cost categories (materials and labour) and one indirect-cost pool. The costing system allocates indirect costs on the basis of machine-hours. Recently, the owners of Decorative Doors have been concerned about a decline in the market share for their interior doors, usually their biggest seller. Information related to Decorative Doors production for the most recent year is as follows: Particulars Interior Exterior Units sold 3200 1800 Selling price $125 $200 Direct material cost per unit $30 $45 Direct production labour cost per hour5 $16 $16 Direct production labour-hours per unit 1.50 2.25 Production runs 40 85 Material moves 72 168 Machine set-ups 45 155 Machine-hours 5500 4500 Number of inspections 250 150 The owners have heard of other companies in the industry that are now…arrow_forward

- Product Costing and Decision Analysis for a Service Company Pleasant Stay Medical Inc. wishes to determine its product costs. Pleasant Stay offers a variety of medical procedures (operations) that are considered its “products.” The overhead has been separated into three major activities. The annual estimated activity costs and activity bases follow: Activity Budgeted Activity Cost Activity Base Scheduling and admitting $432,000 Number of patients Housekeeping 4,212,000 Number of patient days Nursing 5,376,000 Weighted care unit Total costs $10,020,000 Total “patient days” are determined by multiplying the number of patients by the average length of stay in the hospital. A weighted care unit (wcu) is a measure of nursing effort used to care for patients. There were 192,000 weighted care units estimated for the year. In addition, Pleasant Stay estimated 6,000 patients and 27,000 patient days for the year. (The…arrow_forwardI submitted this question earlier but failed to attach the beginning part of the question. I am not sure how to figure this outarrow_forwardWaterways Corporation uses very stringent standard costs in evaluating its manufacturing efficiency. These standards are not "ideal" at this point, but the management is working toward that as a goal. At present, the company uses the following standards. Materials Item Per unit Cost Metal 1 lb. 63¢ per lb Plastic 12 oz. $1.00 per Ib. Rubber 4 oz. 88¢ per Ib. Direct labor Item Per unit Cost Labor 15 min. $9.00 per hr. Predetermined overhead rate based on direct labor hours = $424 The January figures for purchasing, production, and labor are: The company purchased 228,200 pounds of raw materials in January at a cost of 79¢ a pound. Production used 228,200 pounds of raw materials to make 115,000 units in January. Direct labor spent 18 minutes on each product at a cost of $8.80 per hour. Overhead costs for January totaled $54,597 variable and $72,000 fixed. Answer the following questions about standard costs. Your answer is partially correct. What is the materials price variance? (Round…arrow_forward

- Campbell Electronics produces video games in three market categories: commercial, home, and miniature. Campbell has traditionally allocated overhead costs to the three products using the companywide allocation base of direct labor hours. The company recently implemented an ABC system when it installed computer-controlled assembly stations that rendered the traditional costing system ineffective. In implementing the ABC system, the company identified the following activity cost pools and cost drivers: Category Unit Batch Product Facility Additional data for each of the product lines follow: Direct materials cost Direct labor cost Number of labor hours Number of machine hours Number of production orders Research and development time Number of units. Square footage Required Total Pooled Cost $ 376,000 206,400 109,600 304,000 Type of Product a. Commercial a. Home a. Miniature Combined total b. Commercial b. Home b. Miniature Combined total Types of Costs Indirect labor wages, supplies,…arrow_forwardGive me answerarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education