FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Current Attempt in Progress

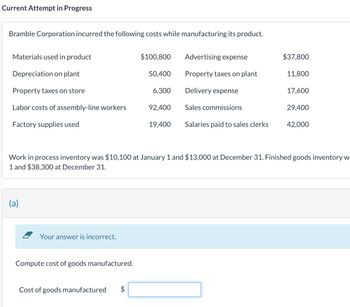

Bramble Corporation incurred the following costs while manufacturing its product.

Materials used in product

Depreciation on plant

Property taxes on store

Labor costs of assembly-line workers

Factory supplies used

(a)

Your answer is incorrect.

Compute cost of goods manufactured.

Cost of goods manufactured

LA

$100,800

$

50,400

6,300

92,400

19,400

Advertising expense

Property taxes on plant

Delivery expense

Sales commissions

Salaries paid to sales clerks

Work in process inventory was $10,100 at January 1 and $13,000 at December 31. Finished goods inventory w

1 and $38,300 at December 31.

$37,800

11,800

17,600

29,400

42,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Gell Corporation manufactures computers. Assume that Gell: • allocates manufacturing overhead based on machine hours • estimated 12,000 machine hours and $93,000 of manufacturing overhead costs • actually used 16,000 machine hours and incurred the following actual costs: What is Gell’s actual manufacturing overhead cost? a. $158,000 b. $83,000 c. $145,000 d. $220,000arrow_forwardplease explain in stepsarrow_forwardNeed Answer in text Formate. Photo not Allowedarrow_forward

- Please do not give solution in image format thankuarrow_forwardLost of accounts Accounts Payable Accounts Receivable Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Cash Cost of Completed Service Contracts Cost of Goods Sold Depreciation Expense Employer Fringe Benefits Payable Employer Payroll Taxes Payable Factory Labor Factory Wages Payable Finished Goods Inventory Manufacturing Overhead Operating Overhead Prepaid Property Taxes Raw Materials Inventory Salaries and Wages Payable Sales Revenue Service Contracts in Process Service Salaries and Wages Supplies Utilities Payable Work in Process Inventoryarrow_forwardPlease do not give solution in image format thankuarrow_forward

- please answer if you know , give correct answerarrow_forwardI need all parts of this questions answered Marquess Corporation has provided the following partial listing of costs incurred during May: Marketing salaries $ 39,000 Property taxes, factory $ 8,000 Administrative travel $ 102,000 Sales commissions $ 73,000 Indirect labor $ 31,000 Direct materials $ 197,000 Advertising $ 145,000 Depreciation of production equipment $ 39,000 Direct labor $ 78,000 Required:a. What is the total amount of product cost listed above?b. What is the total amount of period cost listed above?arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Please help me with correct answer thankuarrow_forwardvd subject-Accountingarrow_forwardAssume that a manufacturing company incurred the following costs: $ 90,000 $ 40,000 $ 35,000 $ 15,000 $ 4,000 $ 5,000 $ 20,000 $ 1,000 $ 2,500 $ 105,000 $ 6,000 $ 7,000 Direct labor Advertising Factory supervision Sales commissions Depreciation, office equipment Indirect materials Depreciation, factory building Administrative office salaries Utilities, factory Direct materials Insurance, factory Property taxes, factory What is the total amount of conversion costs?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education