FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Lost of accounts

Accounts Payable

Accounts Receivable

Accumulated Depreciation -Buildings

Accumulated Depreciation-Equipment

Cash

Cost of Completed Service Contracts

Cost of Goods Sold

Depreciation Expense

Employer Fringe Benefits Payable

Employer Payroll Taxes Payable

Factory Labor

Factory Wages Payable

Finished Goods Inventory

Manufacturing Overhead

Operating Overhead

Prepaid Property Taxes

Raw Materials Inventory

Salaries and Wages Payable

Sales Revenue

Service Contracts in Process

Service Salaries and Wages

Supplies

Utilities Payable

Work in Process Inventory

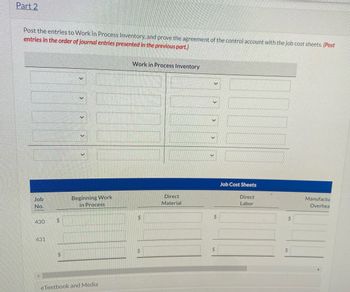

Transcribed Image Text:Part 2

Post the entries to Work in Process Inventory, and prove the agreement of the control account with the job cost sheets. (Post

entries in the order of journal entries presented in the previous part.)

Job

No.

430

431

$

$

Beginning Work

in Process

eTextbook and Media

Work in Process Inventory

$

Direct

Material

V

V

$

$

Job Cost Sheets

Direct

Labor

$

Manufactu

Overhea

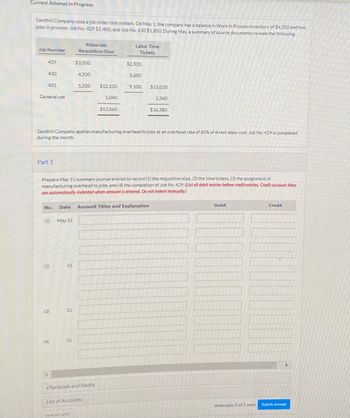

Transcribed Image Text:Current Attempt in Progress

Sandhill Company uses a job order cost system. On May 1, the company has a balance in Work in Process Inventory of $4,200 and two

jobs in process: Job No. 429 $2,400, and Job No. 430 $1,800. During May, a summary of source documents reveals the following.

Job Number

429

430

431

General use

Part 1

(1)

(2)

(3)

May 31

4

31

Materials

Requisition Slips

31

(4) 31

$3,000

4,200

Sandhill Company applies manufacturing overhead to jobs at an overhead rate of 60% of direct labor cost. Job No. 429 is completed

during the month.

No. Date Account Titles and Explanation

5,320

Prepare May 31 summary journal entries to record (1) the requisition slips, (2) the time tickets, (3) the assignment of

manufacturing overhead to jobs, and (4) the completion of Job No. 429. (List all debit entries before credit entries. Credit account titles

are automatically indented when amount is entered. Do not indent manually.)

Save for Later

$12,520

eTextbook and Media

1,040

List of Accounts

$13,560

Labor Time

Tickets

$2,320

3,600

9,100

$15,020

1,360

$16,380

Debit

Attempts: 0 of 2 used

Credit

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following would probably properly classified as a step cost with respect to the volume of production ? Depreciation computed on an annual basis Total salaries paid to quality -control inspectors Real estate taxes President of the company's salaryarrow_forwardFlounder Corporation incurred the following costs while manufacturing its product. Materials used in product Depreciation on plant Property taxes on store Labor costs of assembly-line workers Factory supplies used (a) Compute cost of goods manufactured. $108,000 Cost of goods manufactured $ 54,000 6,750 99,000 20,900 Advertising expense Property taxes on plant Delivery expense Sales commissions Salaries paid to sales clerks $40,500 12,700 18,800 Work in process inventory was $10,850 at January 1 and $13,900 at December 31. Finished goods inventory was $54,000 at January 1 and $41,000 at December 31. 31,500 45,000arrow_forwardA-Compute cost of goods manufactured. B- Compute cost of goods Sold. Complete both A and Barrow_forward

- 5arrow_forwardWhat affect would closing an OVERAPPLIED Manufacturing Overhead account to Cost of Goods Sold have on the accounting records? Group of answer choices A. Cost of Goods Sold would increase B. Net Income would decrease C. Cost of Goods Sold would decrease Both A & Barrow_forwardIndirect materials used Depreciation on delivery equipment Dispatcher's salary Property taxes on office building CEO's salary Gas and oil for delivery trucks Delivery service (product) costs $ Period costs $6,940 LA 12,040 5,400 980 12,960 2,320 Drivers' salaries Advertising Delivery equipment repairs Office supplies Determine the total amount of (a) delivery service (product) costs and (b) period costs. Office utilities Repairs on office equipment $17,280 5,080 324 702 1,080 206arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education