FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Prepare the

Transcribed Image Text:Culver has already made an entry that established the incorrect December 31, 2020, inventory amount.

3.

4.

At December 31, 2020, Culver decided to change the depreciation method on its office equipment from double-declining-

balance to straight-line. The equipment had an original cost of $108,000 when purchased on January 1, 2018. It has a 10-year

useful life and no salvage value. Depreciation expense recorded prior to 2020 under the double-declining-balance method

was $37,200. Culver has already recorded 2020 depreciation expense of $13,400 using the double-declining-balance

method.

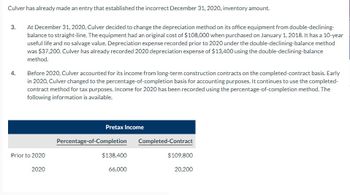

Before 2020, Culver accounted for its income from long-term construction contracts on the completed-contract basis. Early

in 2020, Culver changed to the percentage-of-completion basis for accounting purposes. It continues to use the completed-

contract method for tax purposes. Income for 2020 has been recorded using the percentage-of-completion method. The

following information is available.

Prior to 2020

2020

Pretax Income

Percentage-of-Completion

$138,400

66,000

Completed-Contract

$109,800

20,200

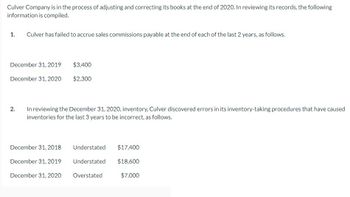

Transcribed Image Text:Culver Company is in the process of adjusting and correcting its books at the end of 2020. In reviewing its records, the following

information is compiled.

1. Culver has failed to accrue sales commissions payable at the end of each of the last 2 years, as follows.

December 31, 2019

December 31, 2020

2.

$3,400

$2,300

In reviewing the December 31, 2020, inventory, Culver discovered errors in its inventory-taking procedures that have caused

inventories for the last 3 years to be incorrect, as follows.

December 31, 2018

December 31, 2019

December 31, 2020

Understated

$17,400

Understated $18,600

Overstated

$7,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Glennelle's Boutique Incorporated operates in a city in which real estate tax bills for one year are issued in May of the subsequent year. Thus, tax bills for 2022 are issued in May 2023 and are payable in July 2023. Required: 1. How the amount of tax expense for calendar 2022 and the amount of taxes payable (if any) at December 31, 2022, can be determined? a. The amount is estimated based on prior year taxes. b. The amount is estimated based on future year taxes. 2. Use the horizontal model to show the effect of accruing 2022 taxes of $6,900 at December 31, 2022. Indicate the financial statement effect.arrow_forwardI'm having the same problem here with required # 2. I can't figure out where I went wrong, but it keeps saying my calculations are wrong. Please help! Described below are six independent and unrelated situations involving accounting changes. Each change occurs during 2021 before any adjusting entries or closing entries were prepared. Assume the tax rate for each company is 25% in all years. Any tax effects should be adjusted through the deferred tax liability account. Fleming Home Products introduced a new line of commercial awnings in 2020 that carry a one-year warranty against manufacturer’s defects. Based on industry experience, warranty costs were expected to approximate 4% of sales. Sales of the awnings in 2020 were $4,000,000. Accordingly, warranty expense and a warranty liability of $160,000 were recorded in 2020. In late 2021, the company’s claims experience was evaluated, and it was determined that claims were far fewer than expected: 3% of sales rather than 4%. Sales of…arrow_forwardAt December 31, 2020 Sunland Corporation reported a deferred tax liability of $210000 which was attributable to a taxable temporary difference of $740000. The temporary difference is scheduled to reverse in 2024. During 2021, a new tax law increased the corporate tax rate from 20% to 30%. Sunland should record this change by debitingarrow_forward

- Described below are six independent and unrelated situations involving accounting changes. Each change occurs during 2021 before any adjusting entries or closing entries were prepared. Assume the tax rate for each company is 25% in all years. Any tax effects should be adjusted through the deferred tax liability account. Fleming Home Product introduced a new line of commercial awnings in 2020 that carry a one year warranty against manufacturer’s defects. Based on industry experience, warranty costs were expected to approximate 3% of sales. Sales of the awnings in 2020 were $2,700,000. Accordingly, warranty expense and a warranty liability of $81,000 were recorded in 2020, in late 2021, the company’s claims experience was evaluated, and it was determined that claims were far fewer than expected: 2% of sales rather than 3%. Sales of the awnings in 2021 were $3,200,000, and warranty expenditures in 2021 totaled $72,800. On December30, 2017, Rival Industries acquired its office building at…arrow_forwardA C corporation has a fiscal year-end of August 30. In tax year 2022, it requests an automatic extension of time to file its income tax return. It must file its return no later than the 15th day of: Multiple Choice March. June. April. May.arrow_forward2: Michael Kolk (single; 3 federal withholding allowances) earned biweekly gross pay of $935. He participates in a flexible spending account, to which he contributes $100 during the period. Federal income tax withholding = $ 3: Anita McLachlan (single; 0 federal withholding allowances) earned monthly gross pay of $2,510. For each period, she makes a 401(k) contribution of 9% of gross pay. Federal income tax withholding = $ 4: Stacey Williamson (married; 3 federal withholding allowances) earned semimonthly gross pay of $1,250. She participates in a cafeteria plan, to which she contributes $150 during the period. Federal income tax withholding = $arrow_forward

- Please do not give solution in image format ?arrow_forwardAt December 31, 2020, Sheridan Corporation has a deferred tax asset of $180,000. After a careful review of all available evidence, it is determined that it is more likely than not that $54,000 of this deferred tax asset will not be realized.Prepare the necessary journal entry. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Creditarrow_forwardAt the beginning of 2021, Pitman Co. had pretax financial income of $1,200,000. Additionally, there was a timing difference of $300,000 due to an accounts receivable that will not be collected until the following year. The tax rate us 30%. A. Calculate the total taxable income for 2021. B. Calculate Income tax expense, income tax payable, and the deferred amount for 2021, and create the journal entry.arrow_forward

- IMPORTANT, PLEASE SEE IMAGE, ANSWER CORRECTLY AND I'LL LIKE YOUR ANSWER. THANK YOU! Exercise 19-03 (Part Level Submission) Marigold Corporation began 2020 with a $39,560 balance in the Deferred Tax Liability account. At the end of 2020, the related cumulative temporary difference amounts to $301,000, and it will reverse evenly over the next 2 years. Pretax accounting income for 2020 is $451,500, the tax rate for all years is 20%, and taxable income for 2020 is $348,300.arrow_forwardIn December 2022, J-Matt, Inc. collected rent in advance from tenants who will begin occupying the rental space in January 2023. For financial reporting purposes, J-Matt recorded the rent as deferred revenue when received in 2022 and will record the rent as revenue in January 2023 when the tenants occupy the rental space. For tax reporting, the rent is taxable in 2022 when collected. The deferred portion of the rent collected in 2022 was $122 million. Taxable income is $540 million in 2022. No temporary differences existed at the beginning of the year, and the tax rate is 25%. Prepare the appropriate journal entry to record J-Matt's provision for income taxes in 2022.arrow_forwardPearl Inc. incurred a net operating loss of $455,000 in 2020. The tax rate for all years is 20%. Assume that it is more likely than not that the entire net operating loss carryforward will not be realized in future years. Prepare all the journal entries necessary at the end of 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education