FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

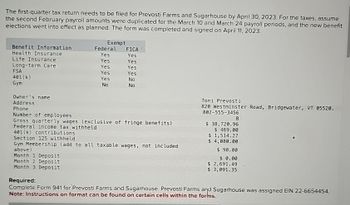

Transcribed Image Text:The first-quarter tax retum needs to be filed for Prevosti Farms and Sugarhouse by April 30, 2023 For the taxes, assume

the second February payroll amounts were duplicated for the March 10 and March 24 payrol periods, and the new benefit

elections went into effect as planned. The form was completed and signed on April 11, 2023

Exempt

Benefit Information

Federal FICA

Health Insurance

Yes

Yes

Life Insurance

Yes

Yes

Long-term Care

Yes

Yes

FSA

Yes

Yes

401(k)

Yes

No

бул

No

No

Owner's name

Address

Phone

Number of employees

Gross quarterly wages lexclusive of fringe benefits)

Federal income tax withheld

401(k) contributions

Section 125 withheld

Gym Membership (add to all taxable wages, not included

above)

Manth 1 Deposit

Month 2 Deposit

Month 3 Deposit

Toni Prevosti

828 Westminster Road, Bridgewater, VT 05520.

882-555-3456

$ 38.720.96

$469.00

$ 1,514.27

$ 4,850.00

$ 90.00

50.00

$ 2,691.49

$3,091.35

Required:

Complete Form 941 for Prevosti Farms and Sugarhouse. Prevosti Farms and Sugarhouse was assigned EIN 22-6654454

Note: Instructions on format can be found on certain cells within the forms

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- For each employee listed, use the percentage method to calculate federal income tax withholding, assuming that each has submitted a pre-2020 Form W-4. Then calculate both the state income tax withholding (assuming a state tax rate of 5.0% of taxable pay, with taxable pay being the same for federal and state income tax withholding), and the local income tax withholding. Refer to the Federal Tax Tables in Appendix A of your textbook.NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. Armand Giroux (single; 0 federal withholding allowances) earned weekly gross pay of $1,490. For each period, he makes a 401(k) retirement plan contribution of 7% of gross pay. The city in which he works (he lives elsewhere) levies a tax of 1.1% of an employee's taxable pay (which is the same for federal and local income tax withholding) on residents and 0.70% of an employee's taxable pay on…arrow_forwardBlossom Home Inc., a real estate developing company, was accounting for its long-term contracts using the completed contract method prior to 2024. In 2024, it changed to the percentage-of-completion method. The company decided to use the same for income tax purposes. The tax rate enacted is 20%. Income before taxes under both the methods for the past three years appears below. Completed contract Percentage-of-completion 2022 2023 $385000 $261000 685000 323000 2024 A credit to Retained Earnings for $219280 O A debit to Retained Earnings $289600 A credit to Retained Earnings for $289600 A debit to Retained Earnings for $219280 $137000 205000 Which of the following will be included in the journal entry made by Blossom Home to record the income effect after taxes?arrow_forwardUse (a) the percentage method and (b) the wage-bracket method to compute the federal income taxes to withhold from the wages or salaries of each employee. Enter all amounts as positive numbers. Round your calculations and final answers to the nearest cent. As we go to press, the federal income tax rates for 2022 are being determined by budget talks in Washington and not available for publication. For this edition, the 2021 federal income tax tables for Manual Systems with Forms W-4 from 2020 or later with Standard Withholding and 2021 FICA rates have been used. Click here to access the Percentage Method Tables. Click here to access the Wage-Bracket Method Tables. Employee Lennon, A. Starr, P. McNeil, S. Harrison, W. Smythe, M. Feedback Filing Status S S MFJ MFJ MFJ No. of Withholding Allowances N/A N/A N/A N/A N/A Gross Wage or Salary $675 weekly 1,365 weekly 1,775 biweekly 2,480 semimonthly 5,380 monthly Amount to Be Withheld Percentage Method X X X X X Wage-Bracket Method X X X X X…arrow_forward

- Your pay also includes a deduction for Medicare. The 2022 rate is 1.45% of your annual salary as listed in question three. Do not use your taxable income as done in previous questions. If 1.45% of your earnings are deducted for Medicare, how much is deducted from your salary within one year? (Note: There is not a maximum contribution for Medicare; all earned wages are taxed. Your employer is required to match this amount too.) Question 3 Base Salary= 24.94 Week=1066 Month=4125 Year=58261arrow_forwardDetermine from the tax table or the tax rate schedule, whichever is appropriate, the amount of the income tax for each of the following taxpayers for 2020. Please show all work and calculations where appropriate. Taxpayer(s) Filing Status Taxable Income Income Tax Macintosh Single $35,700 Hindmarsh MFS $62,000 Kinney MFJ $143,000 Rosenthal H of H $91,500 Wilk Single $21,400arrow_forwardn 2020, Juergen made after-tax contributions of $24,300 to his employer's qualified plan. In August 2021, he requested a nonperiodic distribution. At that time, his account balance was $78,000 and he received a one-time distribution of $13,000. How much of the distribution is tax-free? $0 $4,050 $11,300 $13,000arrow_forward

- Since the SUTA rates change at the end of each year, the available 2023 rates were used for FUTA and SUTA. Note: For this textbook edition the rate 0.6% was used for the net FUTA tax rate for employers. Example 5-6 Park Company has a $70,000 federal and state taxable payroll and has earned a reduced state tax rate timely, the FUTA tax calculation is as follows: Gross FUTA tax ($70,000 x 0.060) Less 90% credit for state taxes paid late ($70,000 x 0.04 x 90%) $2,520 Less additional credit for state tax if rate were 5.4% [$70,000 x (0.054 - 0.04)] 980 Total credit Net FUTA tax If Park Company had made its SUTA payments before the due date of Form 940, the credit for the paym would have provided a total credit of $3,780 and a FUTA tax savings of $280. Peroni Company paid wages of $170,900 this year. Of this amount, $114,000 was taxable for net FUTA and SUTA purposes. The state's contribution tax rate is 3.1% for Peroni Company. Due to cash flow problems, the company did not make any SUTA…arrow_forwardGlennelle's Boutique Incorporated operates in a city in which real estate tax bills for one year are issued in May of the subsequent year. Thus, tax bills for 2022 are issued in May 2023 and are payable in July 2023. Required: 1. How the amount of tax expense for calendar 2022 and the amount of taxes payable (if any) at December 31, 2022, can be determined? a. The amount is estimated based on prior year taxes. b. The amount is estimated based on future year taxes. 2. Use the horizontal model to show the effect of accruing 2022 taxes of $6,900 at December 31, 2022. Indicate the financial statement effect.arrow_forwardGallagher Company has gathered the information needed to complete its Form 941 for the quarter ended September 30, 2019. Using the information presented below, complete Part 1 of Form 941, reproduced on the next page. # of employees for pay period that included September 12—15 employees Wages paid third quarter—$89,352.18 Federal income tax withheld in the third quarter—$10,195.00 Taxable social security and Medicare wages—$89,352.18 Total tax deposits for the quarter—$23,865.92arrow_forward

- Don't give answer in image formatarrow_forwardA C corporation has a fiscal year-end of August 30. In tax year 2022, it requests an automatic extension of time to file its income tax return. It must file its return no later than the 15th day of: Multiple Choice March. June. April. May.arrow_forward2: Michael Kolk (single; 3 federal withholding allowances) earned biweekly gross pay of $935. He participates in a flexible spending account, to which he contributes $100 during the period. Federal income tax withholding = $ 3: Anita McLachlan (single; 0 federal withholding allowances) earned monthly gross pay of $2,510. For each period, she makes a 401(k) contribution of 9% of gross pay. Federal income tax withholding = $ 4: Stacey Williamson (married; 3 federal withholding allowances) earned semimonthly gross pay of $1,250. She participates in a cafeteria plan, to which she contributes $150 during the period. Federal income tax withholding = $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education