FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

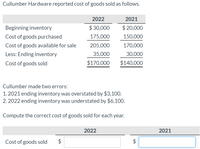

Transcribed Image Text:Cullumber Hardware reported cost of goods sold as follows.

2022

2021

Beginning inventory

$ 30,000

$ 20,000

Cost of goods purchased

175,000

150,000

Cost of goods available for sale

205,000

170,000

Less: Ending inventory

35,000

30,000

Cost of goods sold

$170,000

$140,000

Cullumber made two errors:

1. 2021 ending inventory was overstated by $3,100.

2. 2022 ending inventory was understated by $6,100.

Compute the correct cost of goods sold for each year.

2022

2021

Cost of goods sold

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please don't provide hand written solution.....arrow_forwardCullumber Hardware reported cost of goods sold as follows. Beginning inventory Cost of goods purchased Cost of goods available for sale Less: Ending inventory Cost of goods sold 2027 Cost of goods sold $ $30,000 175,000 205,000 35,000 $170,000 2026 2027 $ 20,000 150,000. 170,000 Cullumber made two errors: 1.2026 ending inventory was overstated by $3,100. 2.2027 ending inventory was understated by $6,100. Compute the correct cost of goods sold for each year. 30,000 $140,000 $ 2026arrow_forwardCrane Ltd. had the following items in inventory as at December 31, 2024: Item No. Quantity Unit Cost NRV དྷྭ སྒྲ སཱུ སྦ 340 $4.00 $4.30 370 3.00 2.90 380 8.00 9.00 400 7.00 6.80 Assume that Crane uses a perpetual inventory system. Fill in the table below for the lower of cost and net realizable value per unit, the inventory dollar amount at the lower of cost and net realizable value, and the dollar amount of the inventory at cost. ntity Unit Cost NRV Unit LC & NRV 340 $4.00 $4.30 S 370 3.00 2.90 Dollar LC & NRV 4.00 $ 2.90 1360 1073 380 8.00 9.00 8.00 3040 400 7.00 6.80 6.80 2720 Dollar Cost 1360 1110 3040 2800 $ 8193 $ 8310 Prepare any necessary adjusting entry at December 31, 2024. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry) Account Titles Debit Creditarrow_forward

- Darrow_forwardgo.4arrow_forwardValuing Inventory at Lower-of-Cost-or-Market Management of Tarry Company takes the position that under the lower-of-cost-or-market rule, the two items below are reported in ending inventory at $119,520 (total). Inventory cost is reported using LIFO. • Edgers: 2,160 in inventory; cost is $22 each; replacement cost is $16 each; estimated sale price is $30 each; estimated distribution cost is $3 each; and normal profit is 10% of sale price. • Hedge clippers: 1,440 in inventory; cost is $50 each; replacement cost is $36 each; estimated sale price is $90 each; estimated distribution cost is $28 each; and normal profit is 20% of sale price. a. Compute your inventory valuation by item and in total for the Tarry Company inventory reported above. Inventory valuation for edgers $ Inventory valuation for hedge clippers Total inventory valuation b. Prepare the entry, if any, to report inventory at the lower-of-cost-or-market. Assume that all adjustments directly impact cost of goods sold and…arrow_forward

- Refer to the photoarrow_forwardPlease do not give solution in image formatarrow_forwardYour answer is incorrect. Inventory data for Shamrock Company are reported as follows: Date Explanation Number of Units Unit Cost Total Cost June 1 Beginning inventory 370 $5 $1,850 CL Purchase 570 6 3,420 23 Purchase 470 7 Assume a sale of 610 units occurred on June 15 for a selling price of $8 and a sale of 530 units on June 27 for $9. On June 30, 270 units remain in inventory. Calculate the cost of ending inventory and cost of goods sold on June 30 under weighted average. (Round the weighted average cost per unit to 3 decimal places, eg. 5.271 and final answers to 2 decimal places, eg. 5,275.75.) Weighted Average Ending inventory $ 1,639.90 Cost of goods sold $ 6,924.80arrow_forward

- Do not give solution in imagearrow_forwardes Sparrow Company uses the retail inventory method to estimate ending inventory and cost of goods sold. Data for 2024 are as follows: Beginning inventory Purchases Freight-in Purchase returns. Net markups Net markdowns Normal spoilage ormal spoilage Sales Sales returns Cost $ 97,000 363,000 9,700 7,700 Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold 5,546 Retail $ 187,000 587,000 11,700 16,700 12,700 3,700 8,700 547,000 10,700 The company records sales net of employee discounts. Employee discounts for 2024 totaled $4,700. 2. Estimate Sparrow's ending inventory and cost of goods sold for the year using the retail inventory method and the conventional application. Note: Round Cost-to-retail percentage to 2 decimal places and final answers to the nearest whole dollar amount. Conventional applicationarrow_forwardHello, I'm not sure how to solve this problemarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education