FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

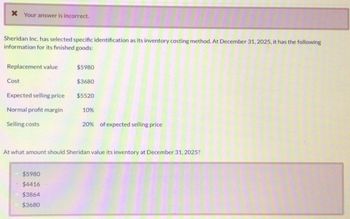

Transcribed Image Text:Your answer is incorrect.

Sheridan Inc. has selected specific identification as its inventory costing method. At December 31, 2025, it has the following

information for its finished goods:

Replacement value

$5980

Cost

$3680

Expected selling price

$5520

Normal profit margin

10%

Selling costs

20% of expected selling price

At what amount should Sheridan value its inventory at December 31, 2025?

$5980

•

$4416

$3864

$3680

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please do not give solution in image format thankuarrow_forwardSheridan Combines, Inc. has $12000 of ending finished goods inventory as of December 31, 2022. If beginning finished goods inventory was $7000 and cost of goods sold was $42000, how much would Sheridan Combines, Inc. report for cost of goods manufactured? O $54000 O $7000 O $47000 O $37000 Save for Later Attempts: 0 of 1 used Submit Answerarrow_forwardDarrow_forward

- Smith Company's inventory cost is $100. The expected sales price is $110, estimated selling costs are $6. The normal gross profit ratio is 20% of selling price. The replacement cost of the inventory is $95. Smith Company uses the LIFO inventory method so must use the lower of cost or market approach and this inventory item should be valued at Correct answer came back as $95, Id love an explanation for this. Thank you!arrow_forwardDo not give solution in imagearrow_forwardes Sparrow Company uses the retail inventory method to estimate ending inventory and cost of goods sold. Data for 2024 are as follows: Beginning inventory Purchases Freight-in Purchase returns. Net markups Net markdowns Normal spoilage ormal spoilage Sales Sales returns Cost $ 97,000 363,000 9,700 7,700 Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold 5,546 Retail $ 187,000 587,000 11,700 16,700 12,700 3,700 8,700 547,000 10,700 The company records sales net of employee discounts. Employee discounts for 2024 totaled $4,700. 2. Estimate Sparrow's ending inventory and cost of goods sold for the year using the retail inventory method and the conventional application. Note: Round Cost-to-retail percentage to 2 decimal places and final answers to the nearest whole dollar amount. Conventional applicationarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education