FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Hi there,

I'm having trouble solving this question

Thanks

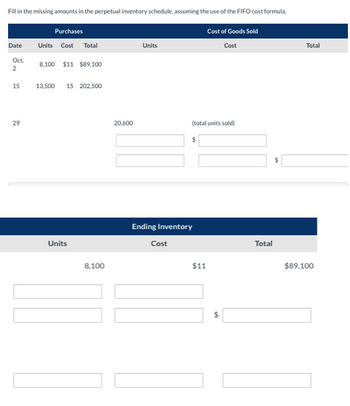

Transcribed Image Text:Fill in the missing amounts in the perpetual inventory schedule, assuming the use of the FIFO cost formula.

Date

Oct.

2

15

29

Purchases

Units Cost Total

8,100 $11 $89.100

13,500 15 202,500

Units

8,100

20,600

Units

Cost

(total units sold)

$

Ending Inventory

Cost of Goods Sold

Cost

$11

$

549

Total

$

Total

$89,100

![Pina Inc. is trying to determine whether to use the FIFO or average cost formula. The accounting records show the following selected

inventory information:

Date

Oct. 2

15

29

Purchases

Units Cost

8,100 $11

13,500

15

Sales

Cost of goods sold

Gross profit

Net income

Operating expenses

Income before income tax

Income tax expense (30%)

Total

$89,100

202,500

FIFO

$563,000

Cost of Goods Sold

182,000

Units

20,600

[6]

[8]

Average

$563,000

Cost Total

182,000

Units

8,100

[1]

[3]

The company accountant has prepared the following partial statement of income to help management understand the financial

statement impact of each cost determination cost formula.

[7]

[9] [10] [11]

Ending Inventory

Cost Total

$11

$89,100

[2]

[4]

[12]

[5]

[13]](https://content.bartleby.com/qna-images/question/f0a8a8b2-22c4-42fd-96b3-e86c4fe33385/72ccbb75-852f-439e-996d-0871c97772bd/gp165tg_thumbnail.png)

Transcribed Image Text:Pina Inc. is trying to determine whether to use the FIFO or average cost formula. The accounting records show the following selected

inventory information:

Date

Oct. 2

15

29

Purchases

Units Cost

8,100 $11

13,500

15

Sales

Cost of goods sold

Gross profit

Net income

Operating expenses

Income before income tax

Income tax expense (30%)

Total

$89,100

202,500

FIFO

$563,000

Cost of Goods Sold

182,000

Units

20,600

[6]

[8]

Average

$563,000

Cost Total

182,000

Units

8,100

[1]

[3]

The company accountant has prepared the following partial statement of income to help management understand the financial

statement impact of each cost determination cost formula.

[7]

[9] [10] [11]

Ending Inventory

Cost Total

$11

$89,100

[2]

[4]

[12]

[5]

[13]

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Im having an issue with this problem. Thank you!arrow_forwardYou guys provided me an expert answer? Cuz the table for the part 1 of the p missing as well on volum PR what do i enter? and the part 2 has a table but c utilized.arrow_forwardPlease do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!Please do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!arrow_forward

- Please do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!Please do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!arrow_forwardHi, Could you please show me how to solve this with formulas? not excel, I should have clarified. Thanksarrow_forwardIt says they answers are wrong from your example.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education