Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:culator

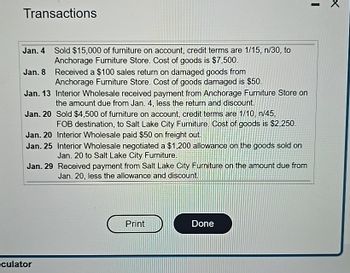

Transactions

Jan. 4 Sold $15,000 of furniture on account, credit terms are 1/15, n/30, to

Anchorage Furniture Store. Cost of goods is $7,500.

Jan. 8 Received a $100 sales return on damaged goods from

Anchorage Furniture Store. Cost of goods damaged is $50.

Jan. 13 Interior Wholesale received payment from Anchorage Furniture Store on

the amount due from Jan. 4, less the return and discount.

Jan. 20 Sold $4,500 of furniture on account, credit terms are 1/10, n/45,

FOB destination, to Salt Lake City Furniture. Cost of goods is $2,250.

Jan. 20 Interior Wholesale paid $50 on freight out.

Jan. 25 Interior Wholesale negotiated a $1,200 allowance on the goods sold on

Jan. 20 to Salt Lake City Furniture.

Jan. 29 Received payment from Salt Lake City Furniture on the amount due from

Jan. 20, less the allowance and discount.

Print

Done

-

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Record journal entries for the following transactions of Furniture Warehouse. A. July 5: Purchased 30 couches at a cost of $150 each from a manufacturer. Credit terms are 2/15, n/30, invoice date July 5. B. July 10: Furniture Warehouse returned 5 couches for a full refund. C. July 15: Furniture Warehouse found 6 defective couches, but kept the merchandise for an allowance of $500. D. July 20: Furniture Warehouse paid their account in full with cash.arrow_forwardRecord journal entries for the following transactions of Mason Suppliers. A. Sep. 8: Purchased 50 deluxe hammers at a cost of $95 each from a manufacturer. Credit terms are 5/20, n/60, invoice date September 8. B. Sep. 12: Mason Suppliers returned 8 hammers for a full refund. C. Sep. 16: Mason Suppliers found 4 defective hammers, but kept the merchandise for an allowance of $250. D. Sep. 28: Mason Suppliers paid their account in full with cash.arrow_forwardRecord journal entries for the following transactions of Barrera Suppliers. A. May 12: Sold 32 deluxe hammers at $195 each to a customer, credit terms 10/10, n/45, invoice date May 12; the deluxe hammers cost Barrera Suppliers $88 each. B. May 15: Customer returned 6 hammers for a full refund. The merchandise was in sellable condition at the original cost. C. May 20: Customer found 2 defective hammers but kept the merchandise for an allowance of $200. D. May 22: Customer paid their account in full with cash.arrow_forward

- A customer discovers 60% of the total merchandise delivered from a retailer is damaged. The original purchase for all merchandise was $3,600. The customer decides to return 35% of the damaged merchandise for a full refund and keep the remaining 65%. What is the value of the merchandise returned?arrow_forwardBlue Barns sold 136 gallons of paint at $31 per gallon on July 6 to a customer with a cost of $19 per gallon to Blue Barns. Terms of the sale are 2/15, n/45, invoice dated July 6. The customer pays their account in full on July 24. On July 28, the customer discovers 17 gallons are the wrong color and returns the paint for a full cash refund. Blue Barns returns the gallons to their inventory at the original cost per gallon. Record the journal entries to recognize these transactions for Blue Barns.arrow_forward10 Record journal entries for the following transactions of Furniture Warehouse. A. Aug. 3: Sold 15 couches at $500 each to a customer, credit terms 2/15, n/30, invoice date August 3; the couches cost Furniture Warehouse $150 each. B. Aug. 8: Customer returned 2 couches.for a full refund. The merchandise was in sellable condition at the original cost. C. Aug. 15: Customer found 4 defective couches but kept the merchandise for an allowance of $1,000. D. Aug. 18: Customer paid their account in full with cash. Solution Debit Credit Date Accounts and Explanationarrow_forward

- Do not use Aiarrow_forwardRecord journal entries for the following transactions of Furniture Warehouse. Aug. 3: Sold 15 couches at $500 each to a customer, credit terms 2/15, n/30, invoice date August 3; the couches cost Furniture Warehouse $150 each. Aug. 8: Customer returned 2 couches for a full refund. The merchandise was in sellable condition at the original cost. Aug. 15: Customer found 4 defective couches but kept the merchandise for an allowance of $1,000. Aug. 18: Customer paid their account in full with cash. Solution Date Accounts and Explanation Debit Creditarrow_forwardJournalize the following sales transactions for Paul Sportswear. Explanations are not required. Aug. 1 Paul sold $67,000 of women's sportswear on account, credit terms of 2/10, n/60. Cost of goods is $34,000. 5 Paul received a $3,500 sales return on damaged goods from the customer. Cost of goods damaged is $1,750. 10 Paul receives payment from the customer on the amount due, less the return and discount. Journalize the sales transactions. Explanations are not required. (Assume the company uses a perpetual inventory system. Record debits first, then credits. Exclude explanations from journal entries.) Aug. 1: Paul sold $67,000 of women's sportswear on account, credit terms of 2/10, n/60. Cost of goods is $34,000. Begin by preparing the entry to journalize the sale portion of the transaction. Do not record the expense related to the sale. We will do that in the following step. Date Accounts Debit Credit Aug. 1arrow_forward

- Vintage World uses a perpetual inventory system. Journalize the following sales transactions for Vintage World. Explanations are not required. The company estimates sales returns at the end of each month. (Record debits first, then credits. Exclude explanations from journal entries. Assume the company records sales at the net amount. Round all numbers to the nearest whole dollar.) (Click the icon to view the transactions.) Jan. 4: Sold $10,000 of antiques on account, credit terms are n/30, to Conch Designs. Cost of goods is $5,000. Begin by preparing the entry to journalize the sale portion of the transaction. Do not record the expense related to the sale. We will do that in the following step. Accounts Credit Date Jan. 4 Now journalize the expense related to the January 4 sale-Cost of goods, $5,000. Debit Date Jan. 4 Debit Accounts ... Creditarrow_forwardJournalize the following transactions for Iron Sports Corp.: March 1 Iron Sports Corp. sold $64,200 of merchandise on account with credit terms of 2/10, n/30. Cost of merchandise sold was $29,900. March 8 Iron Sports Corp. received $5,000 sales return on damaged goods from the customer. The cost of merchandise returned was $2,400. March 15 Iron Sports Corp. received payment from the customer on the amount due, less the return and discount. Date March 1 March 1 March 8 March 8 March 15 Description + + + ◆ + M + Debit Creditarrow_forwardInformation related to Splish Brothers Inc. is presented below. rch On April 5, purchased merchandise on account from Sheffield Company for $26,400, terms 4/10, net/30, FOB shipping point. On April 6, paid freight costs of $930 on merchandise purchased from Sheffield. On April 7, purchased equipment on account for $41,900. On April 8, returned damaged merchandise to Sheffield Company and was granted a $4,100 credit for returned merchandise. 5. On April 15, paid the amount due to Sheffield Company in full. 1. 2. 3. 4. Prepare the journal entries to record these transactions on the books of Splish Brothers Inc. under a perpetual inventory system. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) No. 1. 2. Date Account Titles and Explanation norcal_archives_20....zip O i Ei W QCA 5.docx C ((( W response essay.docx Debit < 76°F_^ Creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College