PART 1

Cucina Corp. signed a new installment note on January 1, 2018, and deposited the proceeds of $70,000 in its bank account. The note has a 3-year term, compounds 5 percent interest annually, and requires an annual installment payment on December 31. Cucina Corp. has a December 31 year-end and adjusts its accounts only at year-end.

Required:

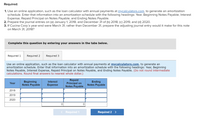

- Use an online application, such as the loan calculator with annual payments at mycalculators.com, to generate an amortization schedule. Enter that information into an amortization schedule with the following headings: Year, Beginning Notes Payable, Interest Expense, Repaid Principal on Notes Payable, and Ending Notes Payable.

- Prepare the journal entries on (a) January 1, 2018, and December 31 of (b) 2018, (c) 2019, and (d) 2020.

- If Cucina Corp.'s year-end were March 31, rather than December 31, prepare the

adjusting journal entry would it make for this note on March 31, 2018?

PART 1 REQUIRED 1 IN ATTACHED IMAGE

Required 2

Prepare the journal entries on (a) January 1, 2018, and December 31 of (b) 2018, (c) 2019, and (d) 2020. (Do not round intermediate calculations. Round final answers to nearest whole dollar. If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

- Record the signing of the installment note on January 1, 2018. (Note: Enter debits before credits.)

Date General Journal Debit Credit

Jan 01, 2018 [ ] [ ] [ ]

- Record the installment payment on December 31, 2018. (Note: Enter debits before credits.)

Date General Journal Debit Credit

Dec 31, 2018 [ ] [ ] [ ]

- Record the installment payment on December 31, 2019. (Note: Enter debits before credits.)

Date General Journal Debit Credit

Dec 31, 2019 [ ] [ ] [ ]

- Record the installment payment on December 31, 2020. (Note: Enter debits before credits.)

Date General Journal Debit Credit

Dec 31, 2020 [ ] [ ] [ ]

Required 3

If Cucina Corp.'s year-end were March 31, rather than December 31, prepare the adjusting journal entry would it make for this note on March 31, 2018? (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

- Record the adjusting journal entry for this note on March 31, 2018. (Note: Enter debits before credits.)

Date General Journal Debit Credit

March 31, 2018 [ ] [ ] [ ]

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

- Base Line Co. receives $250,000 when it issues a $250,000, 8%, mortgage note payable to finance the construction of a building at December 31, 2016. The terms provide for annual installment payments of $40,000 on December 31. Instructions Prepare the mortgage payment schedule and journal entries to record the mortgage loan and the first two installment payments. In this order Date | Particulars | Debit $ | Credit $ and in a text filearrow_forwardSunland Company borrowed $760,000 on December 31, 2019, by issuing an $760,000, 9% mortgage note payable. The terms call for annual installment payments of $118,423 on December 31. (a) Your answer is correct. Prepare the journal entries to record the mortgage loan and the first two installment payments. (Round answers to 0 decimal places, e.g. 15,250. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Date Dec. 31, 2019 ec. 31, 2020 Account Titles and Explanation Cash Mortgage Payable Interest Expense Mortgage Payable Cash Debit 760,000 68400 50023 Credit 760,000 118423arrow_forwardHardevarrow_forward

- On January 1, 2021, Tropical Paradise borrows $33,000 by agreeing to a 6%, four-year note with the bank. The funds will be used to purchase a new BMW convertible for use in promoting resort properties to potential customers. Loan payments of $775.01 are due at the end of each month with the first installment due on January 31, 2021. Record the issuance of the installment note payable and the first two monthly payments. (Do not round intermediate calculations. Round your final answers to 2 decimal places. If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardLl.102.arrow_forwardCrane Company issues a 12%, 5-year mortgage note on January 1, 2025, to obtain financing for new equipment. Land is used as collateral for the note. The terms provide for semiannual installment payments of $47,300. Click here to view the factor table What are the cash proceeds received from the issuance of the note? (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer to 2 decimal places, e.g. 25.25.) Crane Company should receive $arrow_forward

- Date Transaction description Obtained a loan of $41,000 from Earth Bank at a simple interest rate of 6% per year. The first interest payment is due at the end of August 2021 and the principal of the loan is to be repaid on June 1, 2024. Paid the full amount owing to Sport Borders, Check No. 603. Payment fell within discount period. Paid the full amount owing to J. J. Spud, Check No. 604. Payment fell within discount period. Made cash sales of $4,184 during the first 3 days of the month. 2 3 Purchased 6 Downhill Snowboards from Good Sports for $180 each, terms 2/10, n/30. Sold 6 Tony Eagle Mark 3 Freestyle Skateboards to Balls 'n All for $204 each, Invoice No. 501. Purchased 5 Freestyle Snowboards with cash for $170 each, Check No. 605. Purchased 5 Pipe Dream surfboards from Sports 'R Us for $150 each, terms net 30. 4 4. 7 After completing this practice set page, you should know how to record basic transactions in the journals provided below and understand the posting process in the…arrow_forwardDogarrow_forwardUrmilabenarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education